Maryland Odometer Statement For Florida

Description

How to fill out Maryland Bill Of Sale Of Automobile And Odometer Statement?

It’s widely recognized that you cannot transform into a legal authority instantly, nor can you swiftly learn how to effectively assemble a Maryland Odometer Statement For Florida without possessing a specialized expertise.

Crafting legal documents is an extensive endeavor that demands specific training and proficiency. Therefore, why not entrust the generation of the Maryland Odometer Statement For Florida to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from judicial paperwork to templates for internal communication.

If you need any other template, begin your search anew.

Establish a free account and select a subscription plan to purchase the form.

- We understand the significance of compliance and adherence to federal and state regulations.

- That’s why, on our platform, all forms are location-specific and updated regularly.

- Here’s how you can initiate your experience with our site and obtain the document you need in just a few minutes.

- Locate the document you’re looking for using the search bar situated at the top of the page.

- Preview it (if this choice is available) and read the accompanying description to confirm whether the Maryland Odometer Statement For Florida is what you require.

Form popularity

FAQ

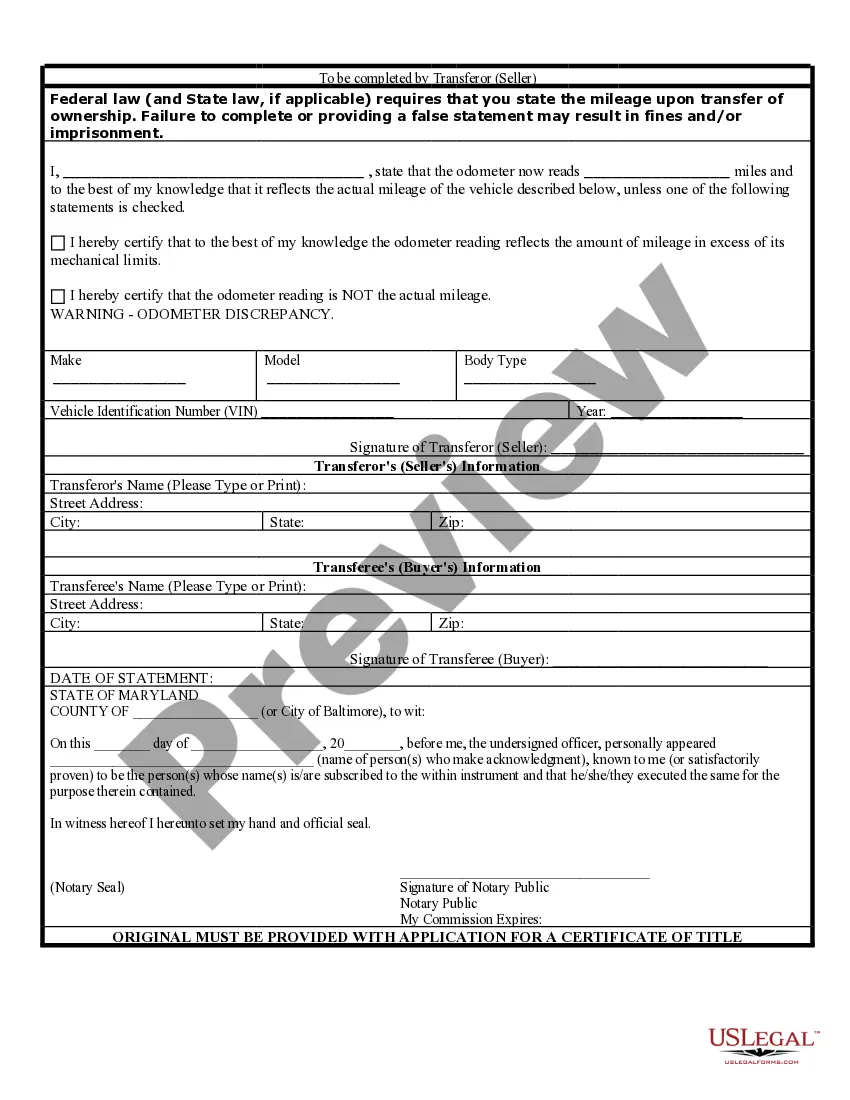

(1) Every certificate of title issued by the department must contain the following statement on its reverse side: ?Federal and state law require the completion of the odometer statement set out below. Failure to complete or providing false information may result in fines, imprisonment, or both.?

A motor vehicle with a model year of 2011 or newer is exempt after twenty (20) years and a motor vehicle with a model year of 2010 or older is exempt after ten (10) years. EXEMPT VEHICLES - A vehicle should not be automatically exempted if an odometer reading is available.

An odometer disclosure statement is a legal document that states the accurate mileage on a vehicle's odometer at the time of transfer from the seller to the buyer. If the seller knows that the car's mileage is incorrect, the document must contain that information.

Because odometer readings are relied upon so heavily, both Florida and federal law make tampering with odometers illegal. Disconnecting or turning back an odometer, and even owning a vehicle with a disconnected or nonfunctional odometer, are against the law.

WARNING: Federal and State law requires that you state the mileage in connection with an application for a Certificate of Title. Failure to complete or providing a false statement may result in fines and/or imprisonment. .