Bank Account Form For New Employee

Description

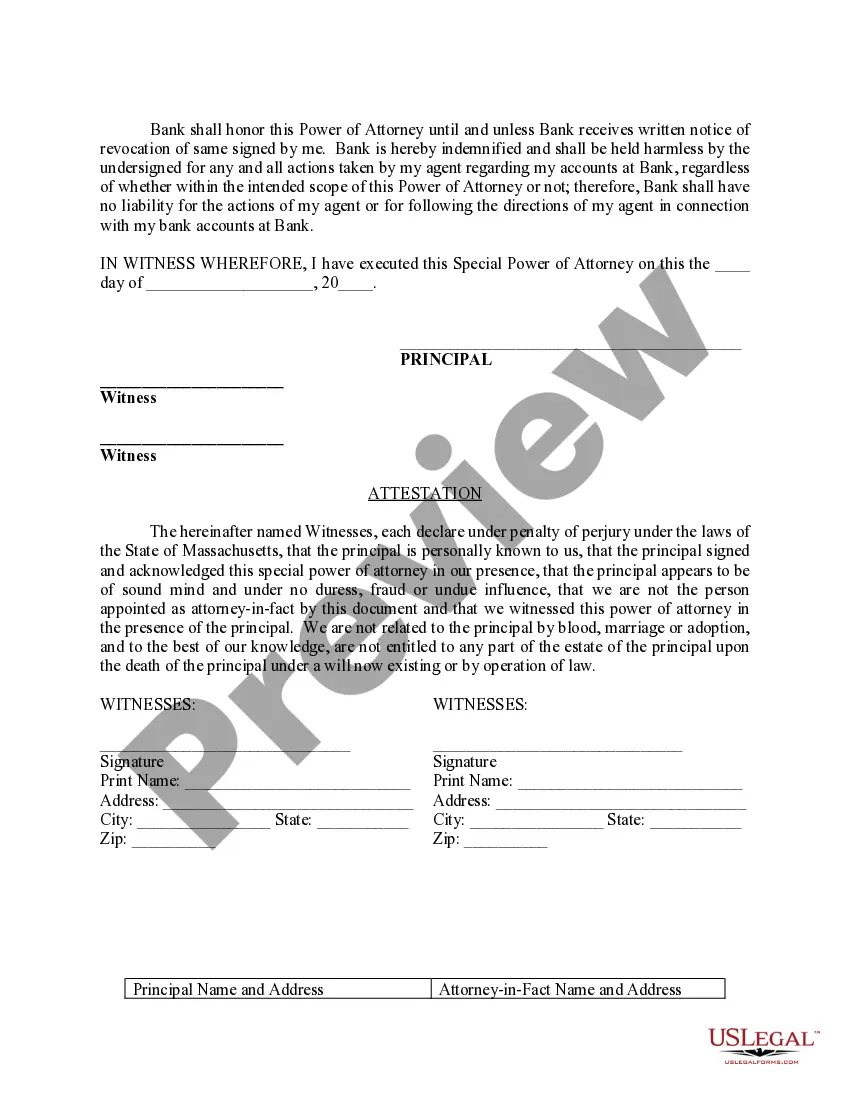

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning US Legal Forms user, log in to your account and download the bank account form for new employee directly from your dashboard.

- For first-time users, browse the extensive collection of forms. Start by checking the Preview mode and reading the form description to confirm it fits your needs.

- If you need a different template, utilize the Search tab to find the appropriate form that meets your local jurisdiction requirements.

- Purchase the selected document by clicking the Buy Now button. Choose your desired subscription plan and create an account to access the library.

- Complete your purchase by entering your credit card information or using PayPal for a quick transaction.

- Finally, download your form to your device and access it anytime from the My Forms section in your profile.

By following these simple steps, you can secure the bank account form for new employee and ensure that your onboarding process is hole-free and efficient.

Consider taking advantage of the comprehensive resource offered by US Legal Forms, which not only provides an extensive library of over 85,000 forms but also allows access to premium experts for help, ensuring your documents are accurate and legally compliant.

Form popularity

FAQ

You should provide your bank account number, the bank's routing number, and specify if it is a checking or savings account. Confirm your full name and any other details your employer requires for verification. Using a bank account form for new employee streamlines this process and helps ensure that you provide all necessary information clearly.

For payroll, your employer requires your bank account number, routing number, and the type of account you hold. This information allows your employer to deposit your wages directly into your account. Completing a bank account form for new employee helps gather this information efficiently, ensuring smooth payroll processing.

Proof of direct deposit generally includes a bank statement showing deposits into your account, or a voided check that displays your account number and bank's routing number. Some employers may accept a confirmation from your bank, verifying your account details. Using a bank account form for new employee can make this proof more straightforward.

To give your employer your bank information, you typically need to fill out a direct deposit or bank account form for new employee. This form should be submitted securely, ensuring your information remains private. For added security, consider confirming with your employer how they prefer to receive sensitive data.

When completing your direct deposit form, include your bank account number, routing number, and the type of account, whether it's a checking or savings account. Additionally, you should provide your employer with your legal name and any other relevant identification to ensure accurate processing. Remember, using the bank account form for new employee simplifies this step and helps avoid errors.

To put someone on payroll, you need their legal name, Social Security number, and address. You will also require their tax withholding information, which is often collected through a W-4 form. Additionally, providing a completed bank account form for new employee ensures that you can set up direct deposit for their wages.

If your employer does not provide direct deposit options, you can open a personal bank account that supports direct deposits. Obtain a bank account form for new employees, complete it, and give your banking information to any source that will deposit funds into your account. Consider using services or apps that allow you to receive funds electronically, ensuring convenience.

To facilitate direct deposit for someone, request a bank account form for new employees from them. Make sure they fill it out accurately, providing their banking details. Next, submit this information through your payroll system or contact your financial institution to ensure the direct deposit is set up correctly.

To set up direct deposit for your employees, first, gather a bank account form for new employees. You will need their banking information, such as account number and routing number. Then, contact your bank to initiate the direct deposit process, or utilize payroll software that integrates this feature smoothly.

To obtain a bank deposit form for new employees, visit your bank's website or branch office. Most banks offer downloadable forms online, allowing you to complete them easily. Make sure to provide the necessary details, such as account numbers and employee information, to ensure a smooth setup.