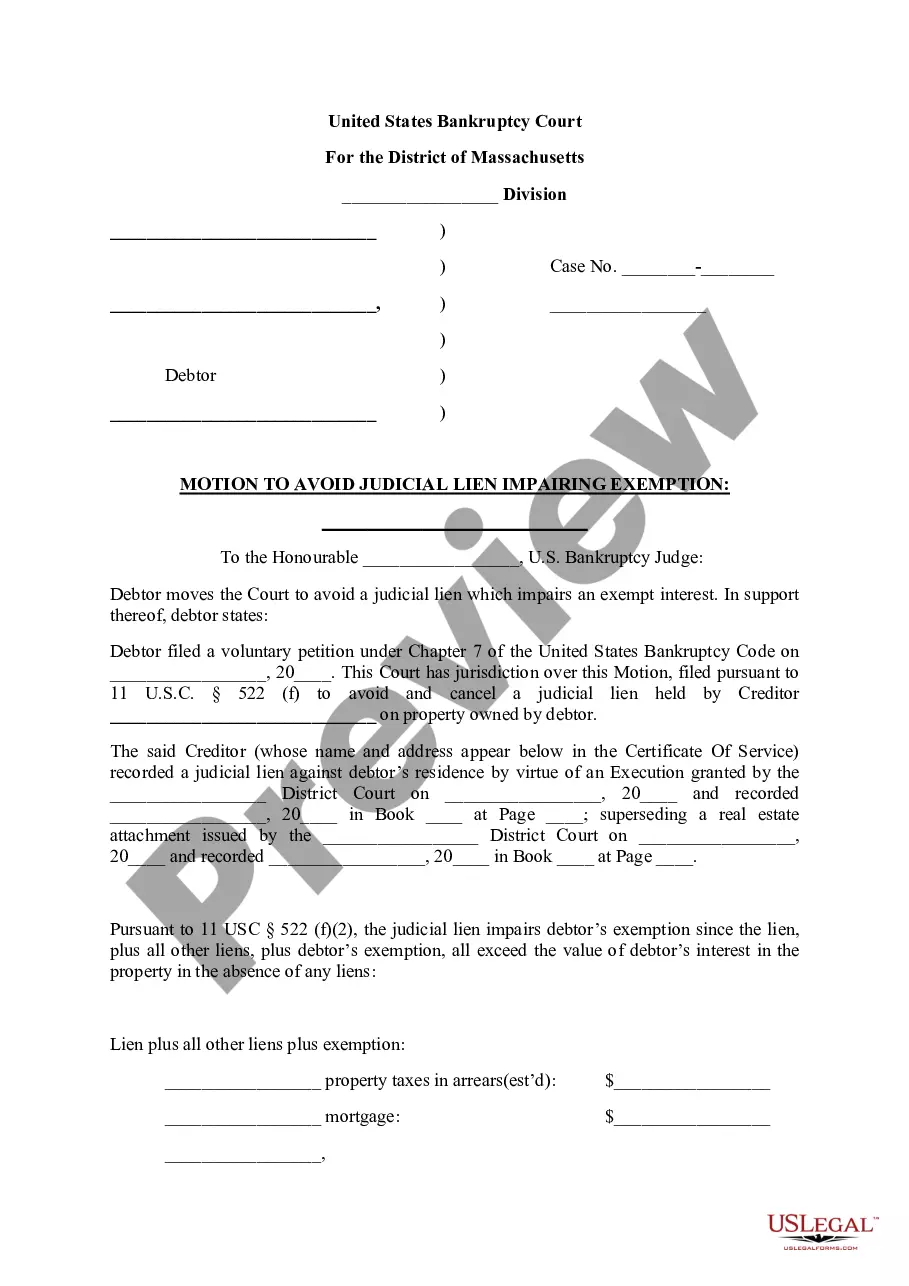

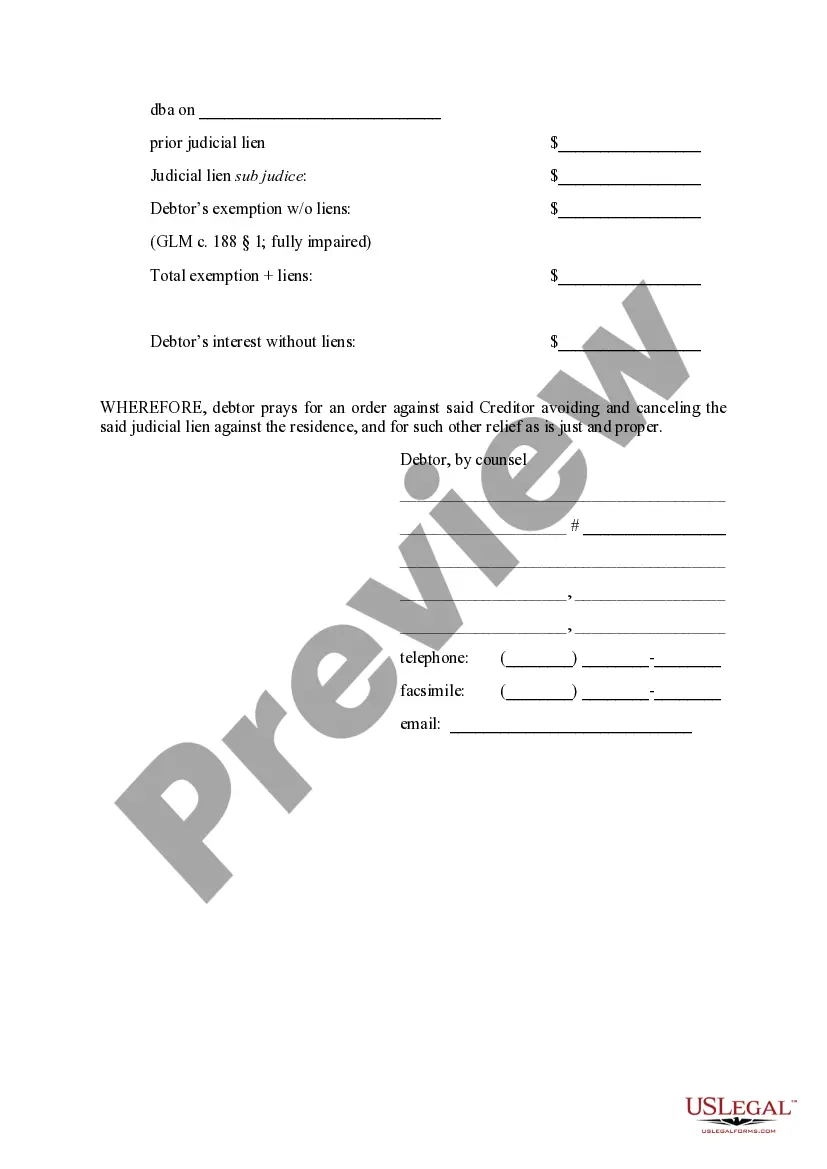

Motion To Avoid Lien Form

Description

Form popularity

FAQ

Another word for lien is 'claim.' This term reflects the creditor's legal right to hold your property until the debt is resolved. Engaging with tools like a Motion to avoid lien form can empower you to challenge claims against your property and secure your financial future.

A lien in a bank account is a legal right that a creditor holds over the funds in your account, often due to unpaid debts. This action allows the creditor to freeze the account or withdraw funds to cover the outstanding balance. If you are facing such a situation, utilizing a Motion to avoid lien form may help you regain access to your funds and limit the creditor's claims.

The full meaning of lien refers to a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. It ensures that the lender receives payment, allowing them to seize the property if necessary. Using a Motion to avoid lien form can help you contest or eliminate unwanted liens, providing you with financial relief and peace of mind.

A lien is a legal claim against someone’s property or assets, typically used as security for a debt. When someone holds a lien against your property, they can potentially take ownership if you fail to repay the debt. In the context of managing your debts, understanding how to use a Motion to avoid lien form can be crucial for protecting your assets from unjust claims.