Loan Modification Agreement Form With Notary

Description

How to fill out Loan Modification Agreement Form With Notary?

What is the most trustworthy service to obtain the Loan Modification Agreement Form With Notary and other up-to-date variations of legal paperwork? US Legal Forms is the answer!

It boasts the largest assortment of legal documents for any purpose. Every template is well-prepared and verified for adherence to federal and local laws and regulations. They are categorized by area and state of use, making it easy to find what you need.

US Legal Forms is a superb solution for anyone who needs to handle legal paperwork. Premium users can achieve even more as they can complete and authorize previously saved documents electronically at any time using the built-in PDF editing tool. Give it a shot now!

- Seasoned users of the site only need to Log In to the system, confirm if their subscription is active, and click the Download button next to the Loan Modification Agreement Form With Notary to retrieve it.

- Once saved, the document remains accessible for additional use within the My documents tab of your account.

- If you have yet to create an account with us, here are the steps you need to follow to set one up.

- Template compliance review. Before obtaining any document, you must verify whether it meets your use case criteria and the laws of your state or county. Review the form description and utilize the Preview if available.

Form popularity

FAQ

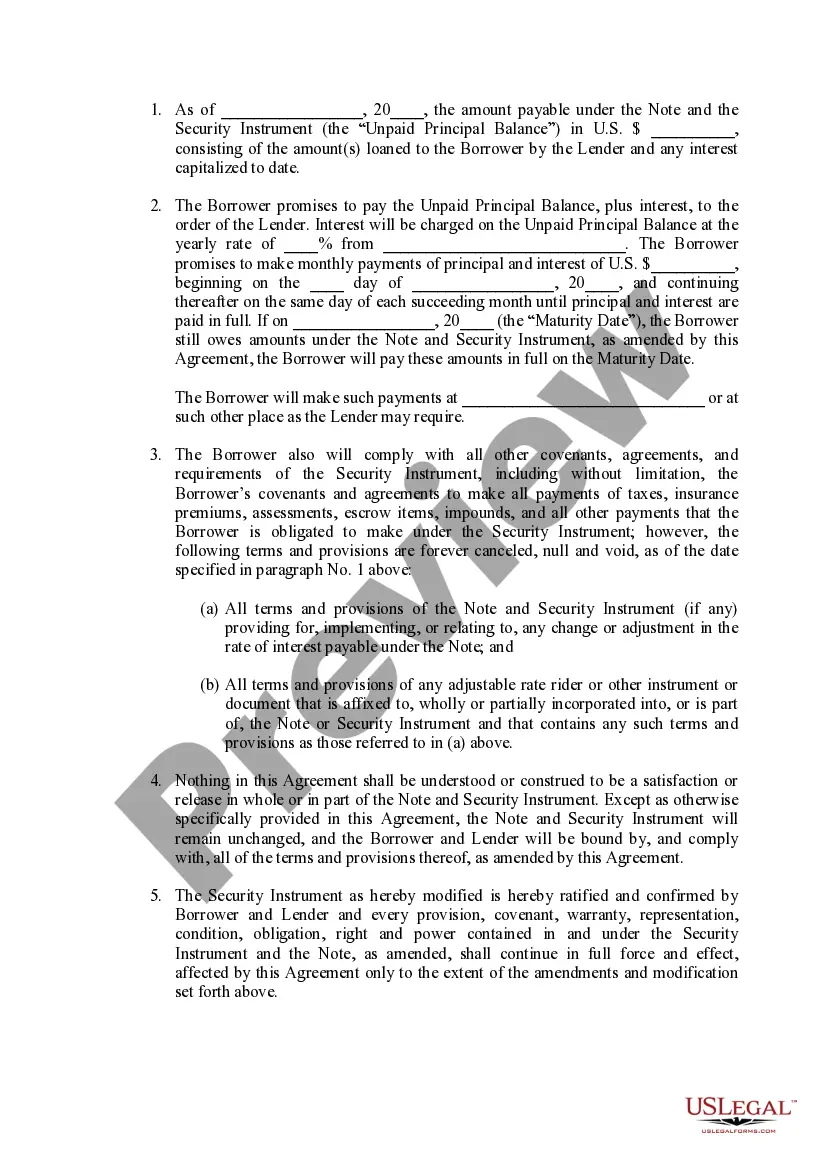

When you take a loan modification, you change the terms of your loan directly through your lender. Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater.

Qualifying for a Loan ModificationYou have to be suffering a financial hardship.You have to show you cannot afford your current mortgage payments.You have to be able to show that you can stay current on a modified payment schedule.The property has to be your primary residence to qualify for a HAMP modification.

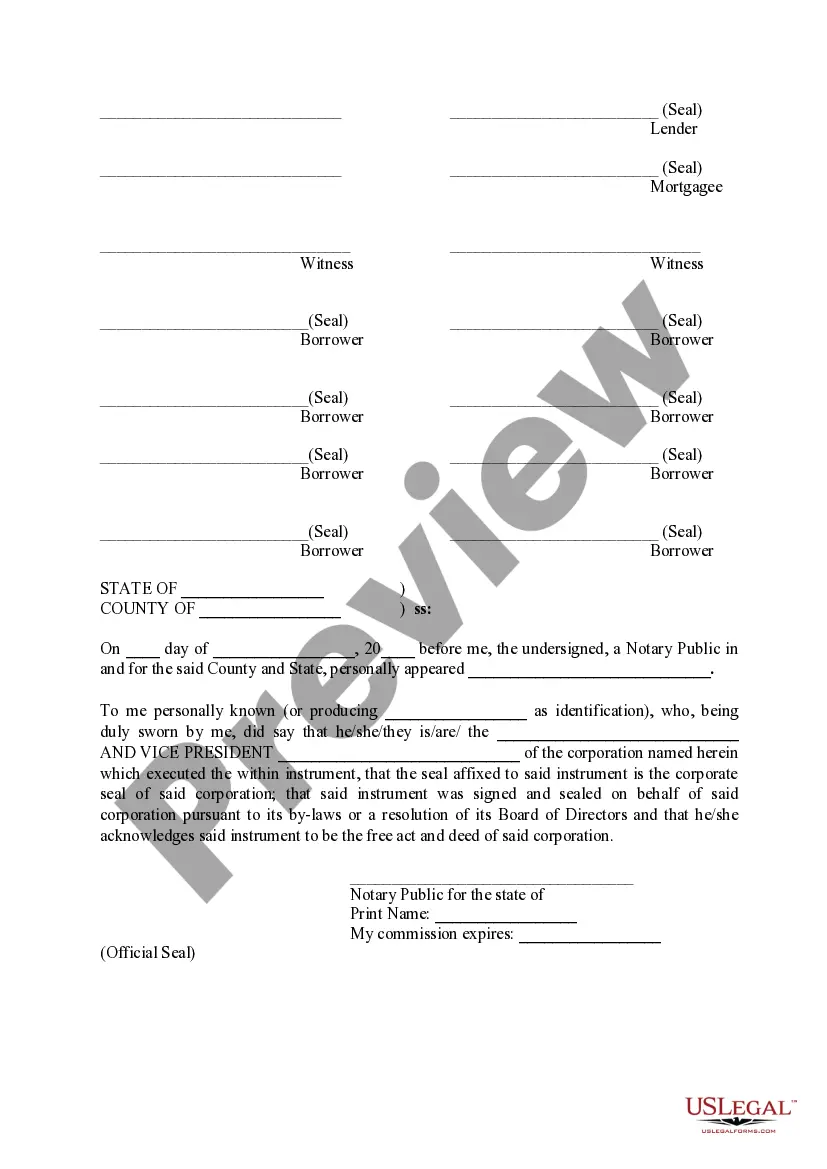

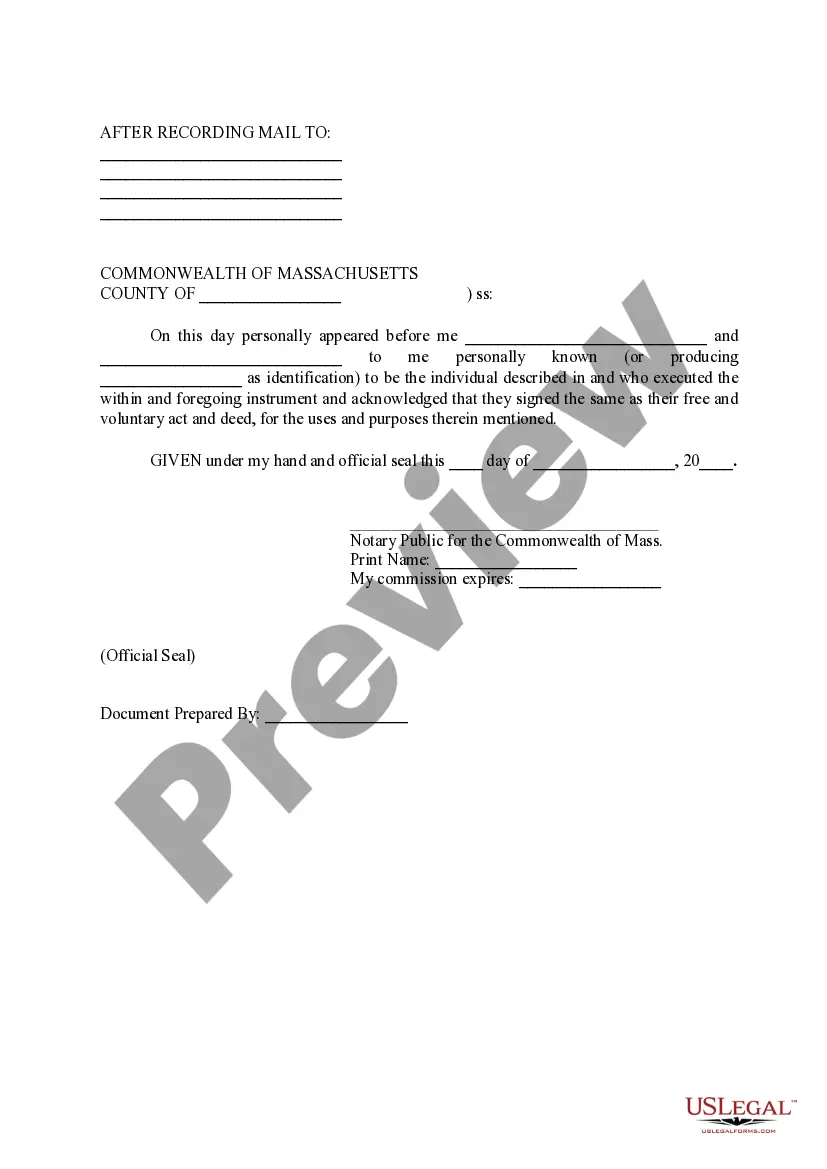

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.

1. Preparing For The Loan Document Signing. Confirm the time and location of the appointment with the signer, and make sure the signer will have a satisfactory form of identification ready for the appointment.

Fannie Mae will execute the mortgage loan modification agreement and return it to the servicer, regardless of whether the executed mortgage loan modification agreement needs to be recorded. Note: If the mortgage loan modification agreement needs to be recorded, the servicer must submit it for recordation.