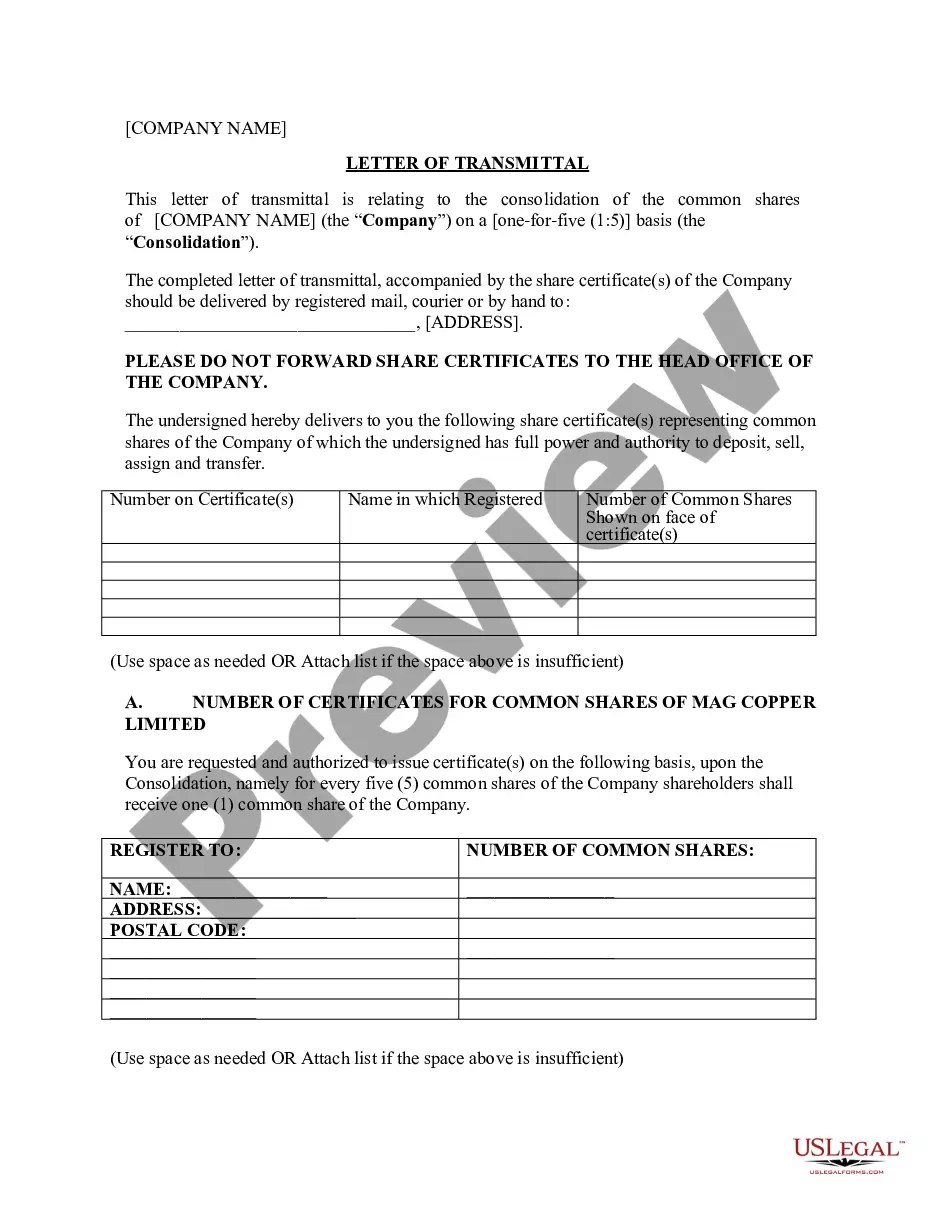

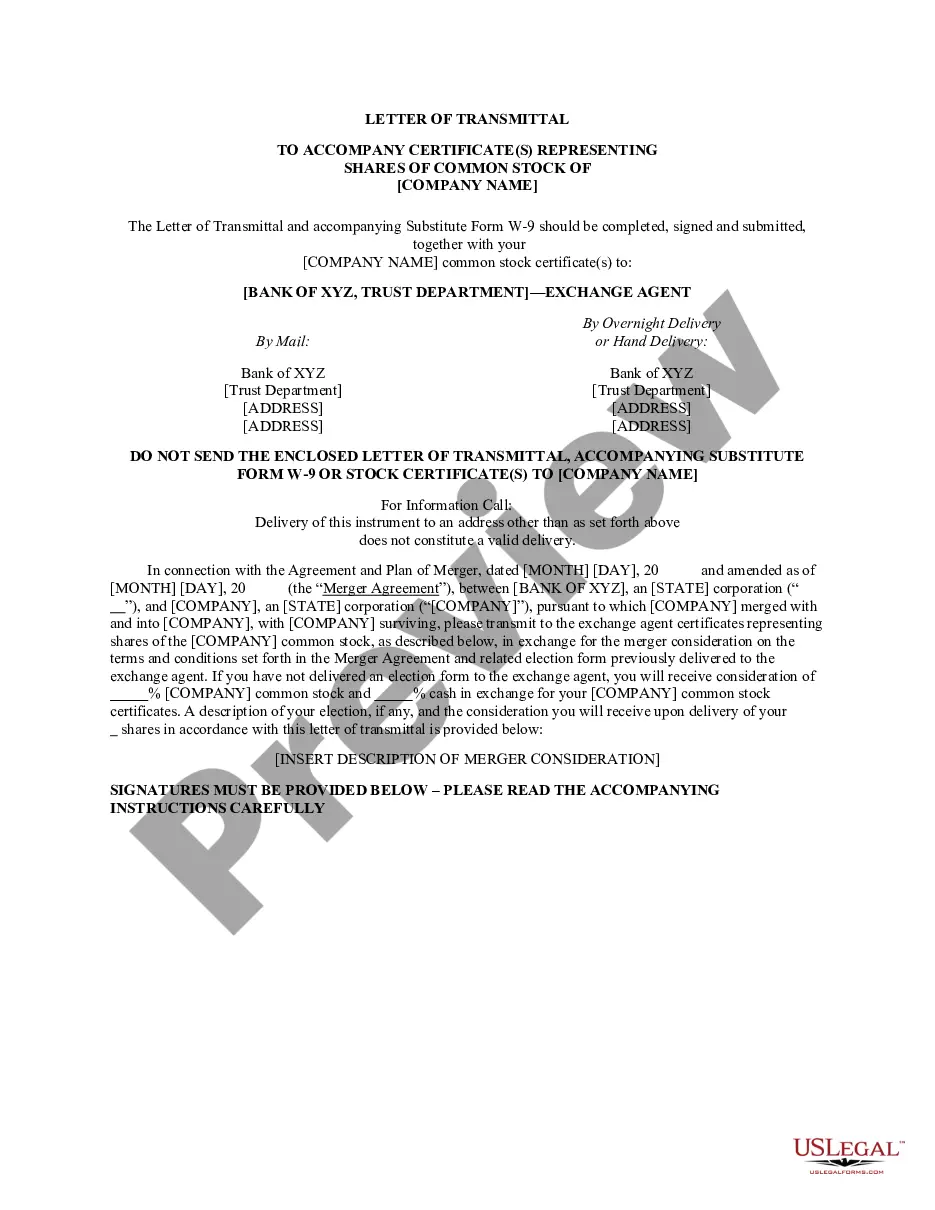

Ma Articles State Withholding

Description

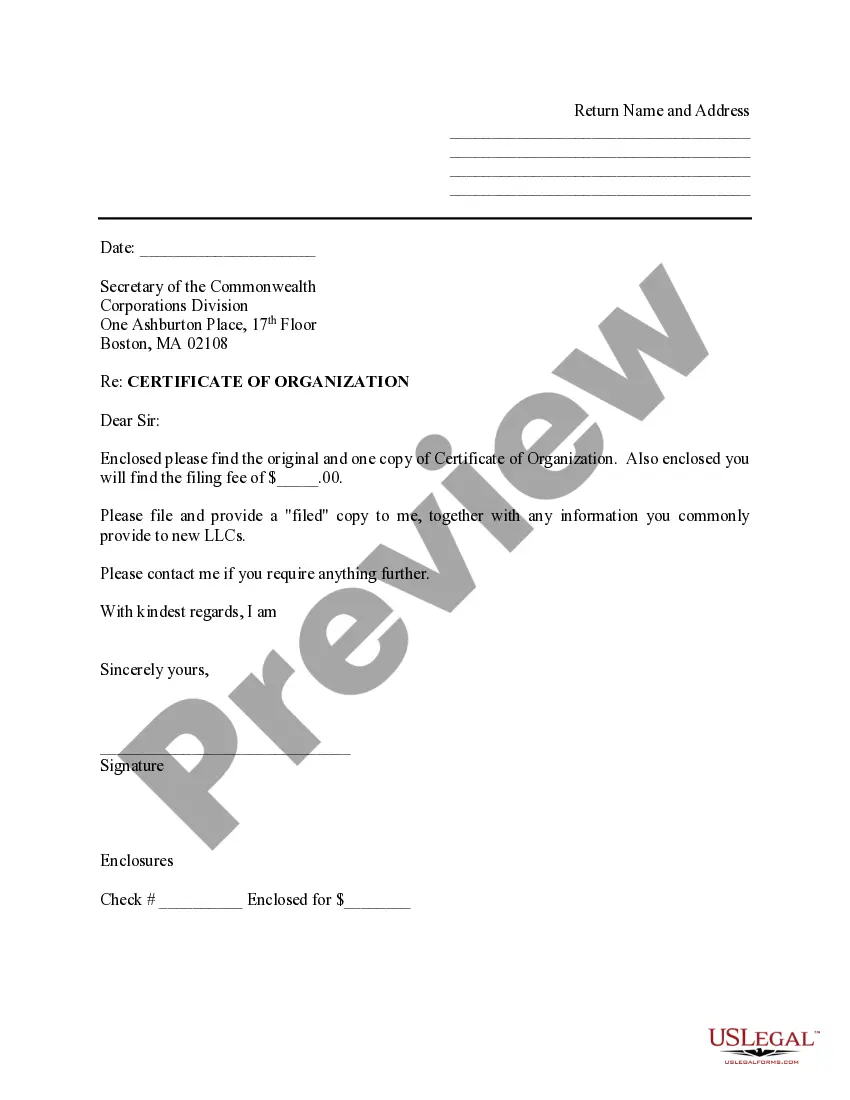

How to fill out Massachusetts Sample Cover Letter For Filing Of LLC Articles Or Certificate With Secretary Of State?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more cost-effective way of creating Ma Articles State Withholding or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of more than 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific templates diligently put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Ma Articles State Withholding. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and navigate the catalog. But before jumping directly to downloading Ma Articles State Withholding, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the document you are looking for.

- Check if template you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Ma Articles State Withholding.

- Download the file. Then complete, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us now and turn form completion into something simple and streamlined!

Form popularity

FAQ

Massachusetts is a flat tax state that charges a tax rate of 5.00%. That goes for both earned income (wages, salary, commissions) and unearned income (interest and dividends). No Massachusetts cities charge their own local income tax.

You should claim the total number of exemptions to which you are entitled to prevent excessive over-withholding, unless you have a significant amount of other income. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or have additional amounts withheld.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

On line 4(c), you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, don't factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated tax payments to the IRS yourself instead.