Massachusetts Mortgage Release Form

Description

How to fill out Massachusetts Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

There's no longer a necessity to squander time hunting for legal papers to satisfy your local state obligations.

US Legal Forms has compiled all of them in one location and streamlined their availability.

Our platform provides over 85k templates for various business and personal legal matters categorized by state and purpose.

By following these steps, you can efficiently prepare official documents under federal and state regulations. Experience US Legal Forms today to organize your documentation!

- All forms are accurately prepared and authenticated for legitimacy, ensuring you receive a current Massachusetts Mortgage Release Form.

- If you are acquainted with our service and already possess an account, confirm your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved forms whenever needed by navigating to the My documents section in your profile.

- If you've never utilized our service before, the procedure will require additional steps to finish.

- Here's how newcomers can locate the Massachusetts Mortgage Release Form within our repository.

- Examine the page content closely to verify it includes the sample you need.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

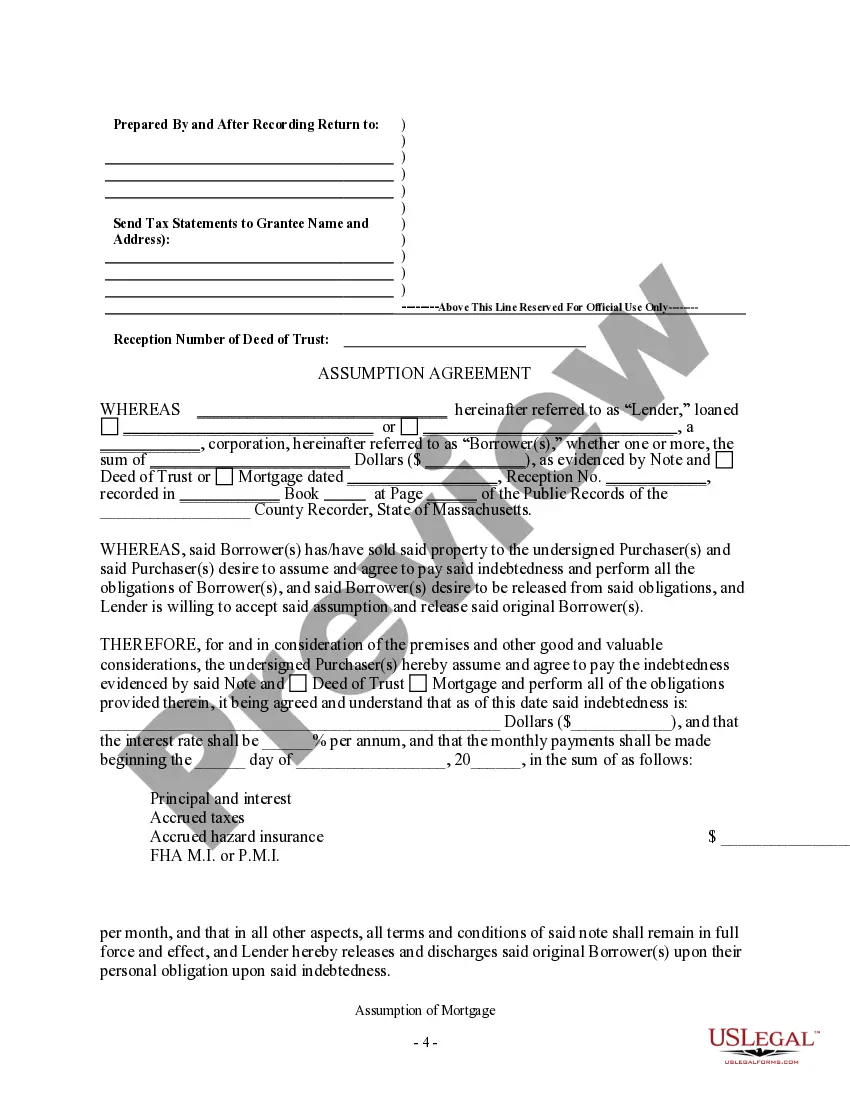

Discharging a mortgage is a fairly straightforward process:Notify your lender. Notify your lender to discuss your plans to discharge your mortgage.Complete and return the Discharge Authority form. Next, complete the form and return it to your lender.Register your discharge and Certificate of Title.01-Dec-2021

IN ORDER TO RELEASE THE MORTGAGE FROM THE TITLE TO THE PROPERTY, YOU MUST RECORD THE DISCHARGE AND ACCOMPANYING DOCUMENTATION, IF ANY, AT THE SAME REGISTRY OF DEEDS IN WHICH YOUR DEED WAS RECORDED. ALL RECORDING FEES THAT WE ARE REQUIRED TO PAY UNDER MASSACHUSETTS LAW HAVE BEEN INCLUDED IN THE ENCLOSED CHECK.

Discharging a mortgage means removing it from the title to your property. Did you know that your bank holds the title to your property until your home loan is completely repaid? Besides, once you have repaid the mortgage in full, you need to follow a set procedure to discharge it or clear the title to your property.

Step-by-step processSpeak to your lender. Let them know about your intention to discharge your mortgage, and confirm the fees and how long it will take.Contact a broker or conveyancer.Fill in a Discharge Authority form.Your bank registers the discharge of mortgage.The discharge is finalised.

A release deed would typically be executed at a time when your home loan provider grants you a legal certificate that you have fully paid your loan and the lender is freeing the collateral submitted as a security against the loan. An individual can also give up his right in a property through this instrument.