Alabama Power Of Attorney Form With Irs Verification

Description

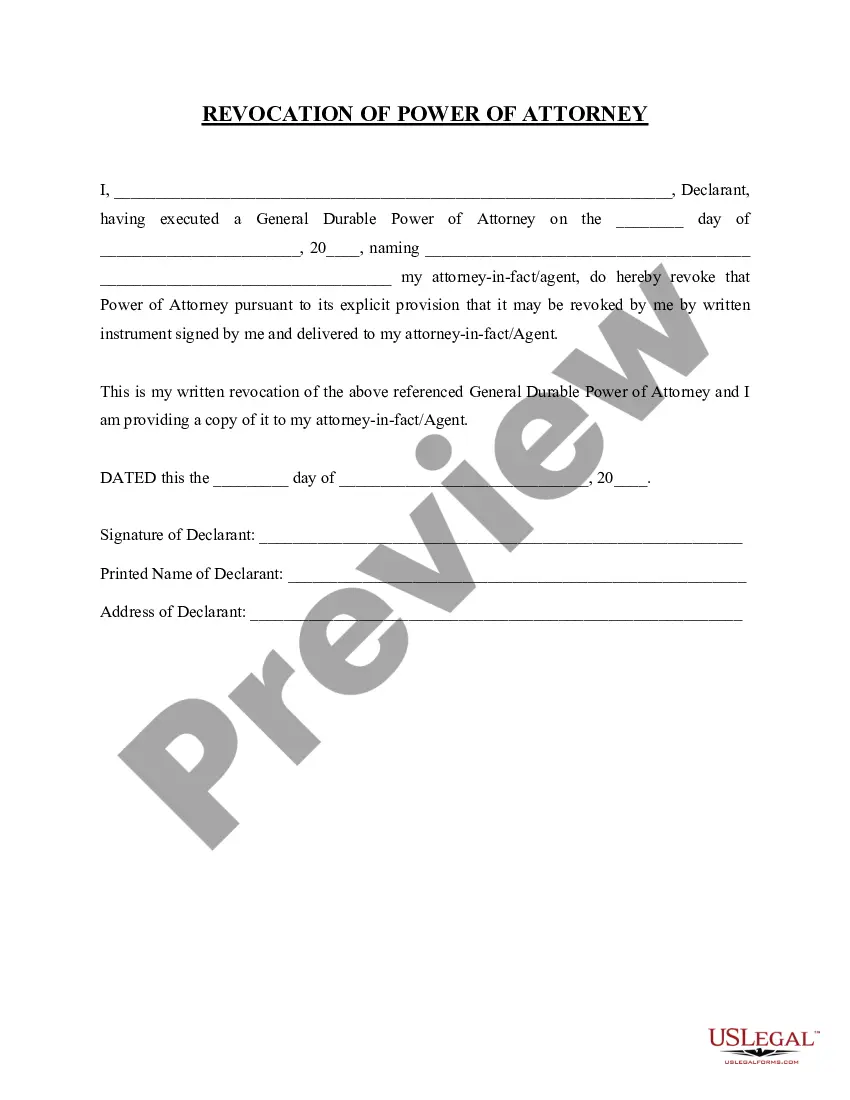

How to fill out Alabama Revocation Of General Durable Power Of Attorney?

How to acquire professional legal documents that adhere to your state's regulations and prepare the Alabama Power Of Attorney Form With Irs Verification without hiring a lawyer.

Numerous online services provide templates to address various legal circumstances and requirements. However, it can take some time to determine which available samples fulfill both your specific needs and legal standards.

US Legal Forms is a trusted service that assists you in locating official documents crafted in accordance with the latest state law updates, helping you save on legal fees.

If you haven't registered with US Legal Forms, follow the steps below.

- US Legal Forms is not just a typical online library.

- It's a compilation of over 85,000 verified templates for different business and personal situations.

- All documents are categorized by area and state to streamline your searching process.

- Furthermore, it integrates with powerful solutions for PDF editing and electronic signatures, enabling users with a Premium subscription to swiftly complete their paperwork online.

- Obtaining the necessary documents requires minimal effort and time.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Alabama Power Of Attorney Form With Irs Verification by clicking the related button next to the file name.

Form popularity

FAQ

Wet ink signatures are needed in order to fax or mail the Form 2848 to the IRS.

The IRS allows taxpayers and representatives to use electronic or digital signatures on these paper forms, which they cannot file using IRS e-file: Form 11-C, Occupational Tax and Registration Return for Wagering; Form 637, Application for Registration (For Certain Excise Tax Activities);

Even though these forms, in most cases, were submitted by professional tax preparers or advisors, the IRS still wanted an original signature on them, or they would not accept the form. After the COVID-19 pandemic began, the IRS temporarily changed their policy on certain forms, allowing for e-signatures.

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

The process to mail or fax authorization forms to the IRS is still available. Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed. Most Forms 2848 and 8821 are recorded on the IRS's Centralized Authorization File (CAF).