Llc Stands For Limited Liability Company And Can Issue Stock

Description

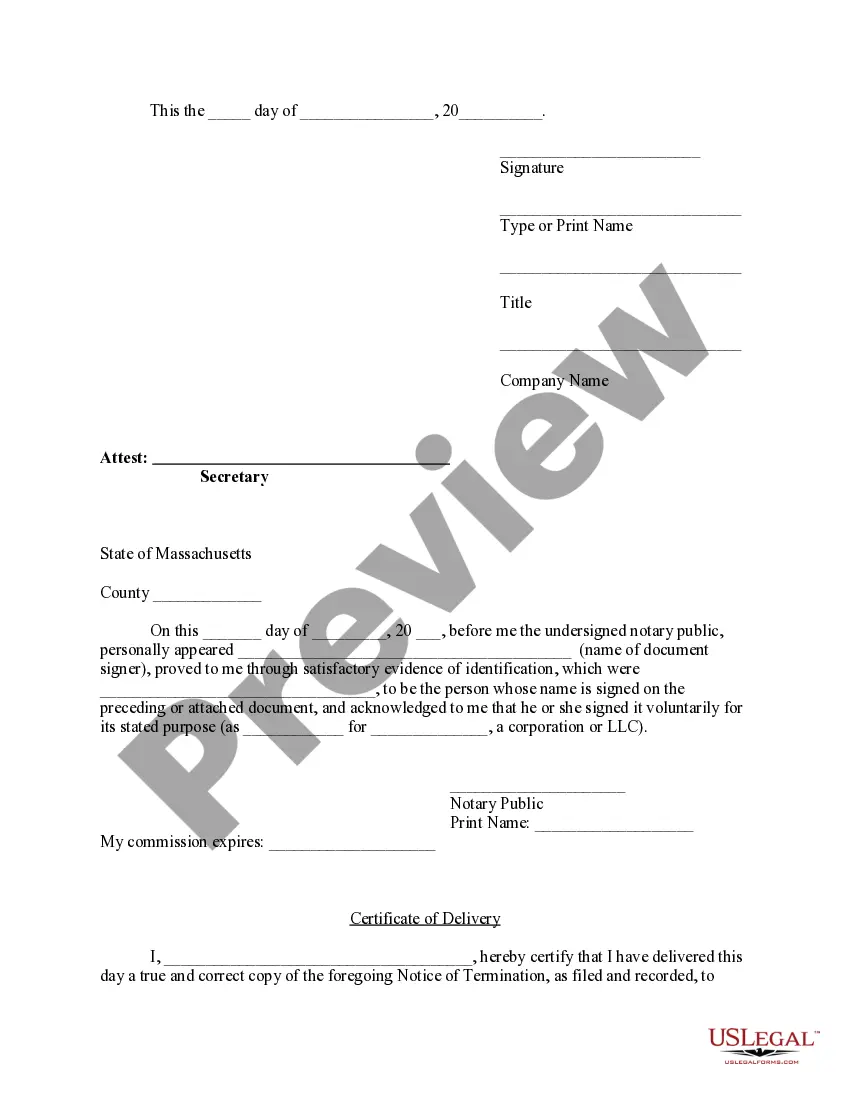

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your US Legal Forms account if you're a returning user, or register for a new account if you're new to the service.

- Review the Preview mode and detailed descriptions of form templates to ensure you select the correct legal document that aligns with your jurisdiction.

- If the desired form isn't quite right, utilize the Search tab to explore other templates until you find one that fits your specific needs.

- Once you've found the appropriate document, choose your subscription plan by clicking on the Buy Now button.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Finally, download the completed form to your device, making it accessible via the My Forms section of your account for future use.

By utilizing US Legal Forms, you gain not only access to a robust collection of legal documents but also the support of premium experts who assist in ensuring that your forms are filled out accurately.

Streamline your legal document process today and see how US Legal Forms can empower your endeavors. Start your journey by exploring their extensive library now!

Form popularity

FAQ

Yes, an LLC can establish an equity incentive plan to attract and retain talent. This plan allows you to offer ownership stakes in the form of membership units. This structure aligns employees’ interests with the company's success, while an LLC stands for limited liability company and can issue stock, making it a practical option for such plans.

To issue stock in an LLC, you should first determine how many membership units you want to create and what rights these units will convey. After that, you must amend your operating agreement to define these units officially. Using resources like USLegalForms can help simplify drafting your necessary documents, ensuring you comply with state regulations.

Yes, your LLC can own stock in other companies or even hold stocks of public corporations. This ownership can contribute to your LLC's overall investment strategy and financial goals. Remember, an LLC stands for limited liability company and can issue stock, making it a valuable entity for various investment opportunities.

Stock in an LLC is commonly referred to as membership interests or units. Unlike corporations, which issue shares, LLCs provide ownership in the form of these units. This terminology highlights how an LLC stands for limited liability company, and can issue stock while maintaining flexibility in ownership structure.

Yes, you can trade stocks through an LLC. This business structure allows you to operate a business while benefiting from limited liability protection. Additionally, as LLCs can issue stock, you can raise capital by selling shares. This makes an LLC an appealing choice for entrepreneurs looking to engage in stock trading.

To buy stocks on behalf of an LLC, first ensure that your LLC stands for limited liability company and can issue stock. Open a brokerage account in the LLC's name and fund it with business assets. You'll need to provide documentation that verifies the LLC's status and authorization to trade. Platforms like US Legal Forms can assist with the paperwork to make this process simpler.

Yes, you can establish an LLC for stock trading, since LLC stands for limited liability company and can issue stock. This structure can provide benefits, such as liability protection and potential tax advantages. Using an LLC for trading purposes allows you to separate personal assets from business risks. Be sure to familiarize yourself with the regulations surrounding trading activities to remain compliant.

Absolutely, LLCs can offer stock options, as LLC stands for limited liability company and can issue stock. This provides a method for attracting and retaining talent by giving employees a stake in the company's growth. Stock options can align the interests of employees with the success of the LLC. Consider using platforms like US Legal Forms to create the necessary agreements easily.

Yes, your LLC can buy stocks, as LLC stands for limited liability company and can issue stock. This means that the LLC can engage in various investment activities, including purchasing stocks in other companies. Such an approach allows for diversification of assets while protecting personal liabilities. It's wise to consult with a legal or tax professional to manage your investments effectively.

Yes, you can conduct a stock sale of an LLC, as LLC stands for limited liability company and can issue stock. When an LLC sells stock, it typically involves transferring ownership interests. This process ensures that the new investors understand the rights and responsibilities associated with their ownership. Using a platform like US Legal Forms can streamline the documentation for such transactions.