Llc Company Meaning

Description

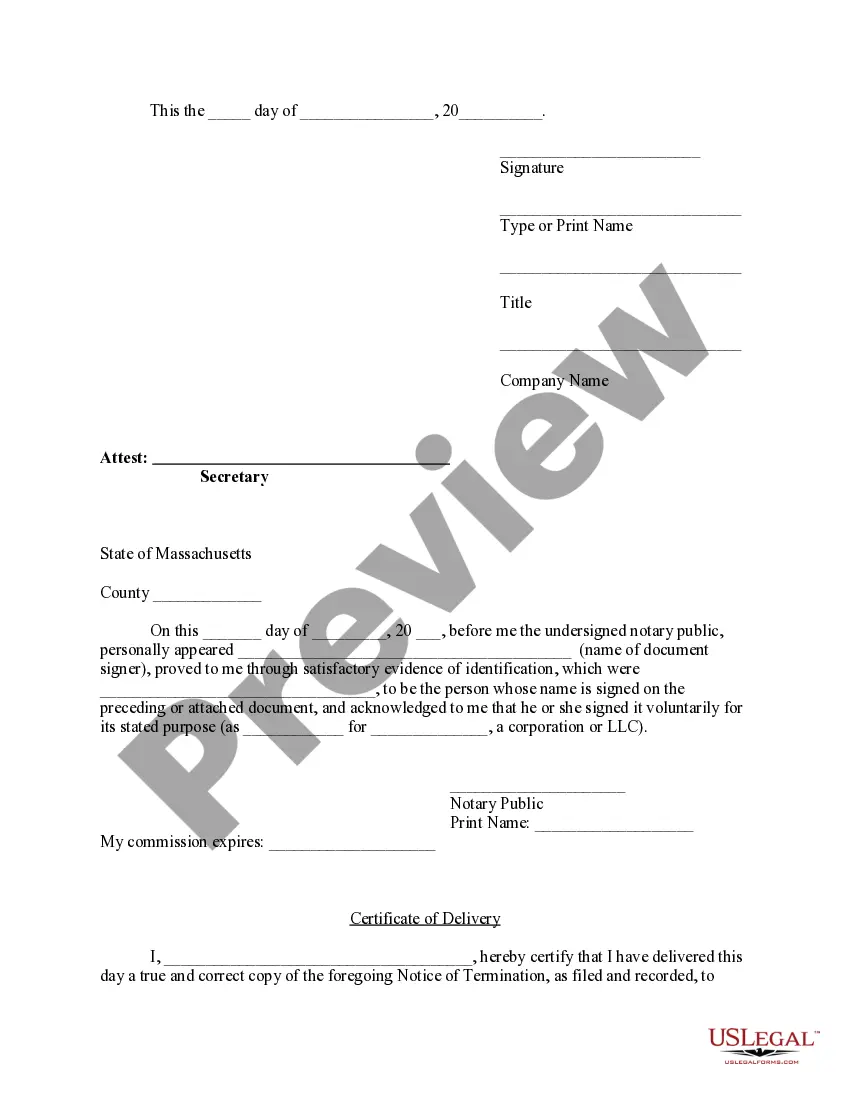

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- If you are a returning user, log in to your account and select the form you need. Ensure your subscription is current before proceeding to download.

- For new users, begin by reviewing the form previews and descriptions. Confirm that you select a form that fits your requirements and complies with local regulations.

- Use the search function if no suitable form is found. Adjust your search criteria until you find the appropriate document.

- Choose the desired document and click on the Buy Now button, selecting the subscription plan that best meets your needs. You will need to create an account for full access.

- Finalize your purchase by entering your payment information—either via credit card or PayPal.

- Once purchased, download the form to your device. You can access it anytime through the My Forms section of your profile.

Leveraging US Legal Forms not only simplifies the filing process but also ensures that you have access to the most accurate and legally compliant documents available online. With a robust collection of forms and expert support, you're equipped to navigate the legal landscape with confidence.

Start your journey toward effective business management today and explore the benefits of US Legal Forms!

Form popularity

FAQ

The presence of 'LLC' behind a company name indicates it is a Limited Liability Company. This means the company adheres to a specific legal structure that limits personal liabilities for its owners. The LLC designation provides both flexibility and protection for business owners. Understanding this aspect is vital for comprehending the LLC company meaning.

When writing a company LLC, you should include the business name followed by 'LLC.' For instance, if you have named your company 'Tech Innovations,' the correct representation would be 'Tech Innovations, LLC.' This format not only identifies the business type but also assures customers of its legal standing. Knowing how to write a company LLC correctly is essential when exploring the LLC company meaning.

To illustrate an LLC example, you can use a company name such as 'ABC Solutions, LLC.' This format clearly shows that ABC Solutions has chosen the LLC structure. Writing an LLC example emphasizes the protection and benefits this business type provides. Understanding this format is part of recognizing the LLC company meaning.

The 'LLC' in a company name signifies that the business is a Limited Liability Company. This designation indicates that the owners have limited personal liability for the company's debts and liabilities. It shows a commitment to a formal business structure that can attract investors and clients. Thus, grasping the LLC company meaning is crucial for any aspiring business owner.

A company may choose to become an LLC to protect its owners from personal liability for business debts. This structure also allows for pass-through taxation, where profits are taxed at the owner's personal tax rate, leading to potential tax savings. Moreover, an LLC can enhance the business's credibility with clients and partners. Understanding the LLC company meaning helps clarify these benefits.

While forming an LLC can provide liability protection and tax flexibility, there are some downsides to consider. An LLC may involve higher formation and maintenance costs compared to a sole proprietorship. Additionally, some states impose annual fees or taxes on LLCs, which can add to the overall expenses. It’s important to weigh these factors when considering the LLC company meaning.

Yes, you can file your LLC by yourself, but it does require attention to detail and knowledge of the process. If you feel uncertain, platforms like US Legal Forms can simplify the filing process. They provide resources and guidance for creating your LLC documents correctly. Thus, understanding the LLC company meaning can empower you to handle the filing with confidence.

Determining whether an LLC is worth the investment depends on your business needs. This structure can offer protection and flexibility, making it appealing for many entrepreneurs. If you're looking for ease in management and personal liability protection, the benefits often outweigh the costs. Therefore, grasping the LLC company meaning assists you in making a well-informed decision.

Filing an LLC means officially registering your business with the state, providing it with a legal identity. This process involves submitting the necessary documentation, such as the Articles of Organization, and paying associated fees. By filing an LLC, you enjoy limited liability and more credibility. Thus, understanding the LLC company meaning aids in appreciating the importance of this step.

LLCs are not inherently bad for taxes, but specifics depend on your individual situation. Some may find the pass-through taxation beneficial, as it avoids double taxation, while others might be burdened by self-employment taxes. It's crucial to consider factors such as income level and business structure to fully grasp the LLC company meaning in relation to taxes.