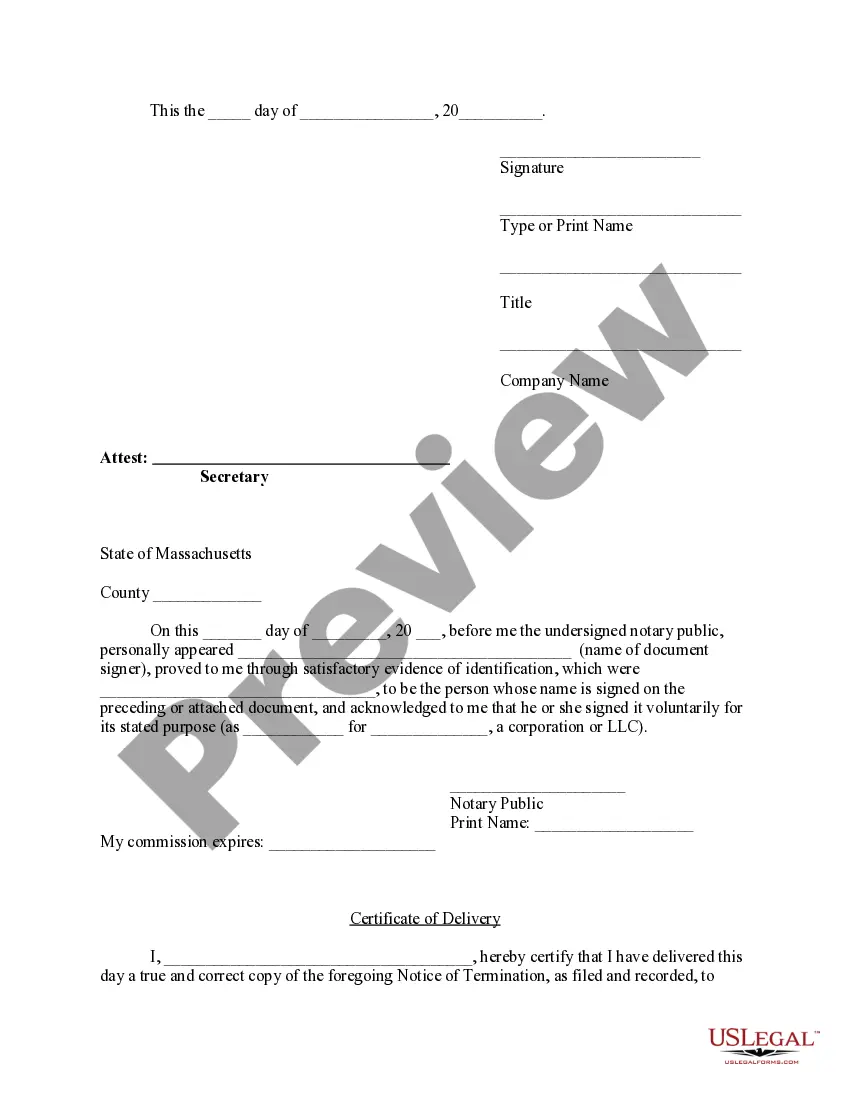

If in the event that a contract has been terminated prior to substantial completion, the owner shall provide a notice of termination by certified mail to every person who has filed or recorded a notice of contract and to the contractor. The contractor must then deliver a copy of said notice to every person who entered into a written contract directly with the contractor or who has given to the contractor written notice of identification.

Limited Vs Limited Partnership

Description

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your US Legal Forms account if you have used the service before. Ensure your subscription is active; renew if necessary.

- In the Preview mode, review the form description to confirm you have the appropriate document for your needs, adhering to local jurisdiction requirements.

- If discrepancies arise, utilize the Search function to find alternative templates that suit your requirements better.

- Purchase the selected document by clicking on the Buy Now button and selecting your preferred subscription plan. An account registration is necessary for library access.

- Complete your transaction by entering your payment details using a credit card or PayPal account.

- Finally, download your form and save it on your device. You can always access it later in the My Forms section of your profile.

In conclusion, US Legal Forms streamlines the process of obtaining crucial legal documents, ensuring individuals and attorneys can maneuver legal landscapes efficiently. With an extensive library at your disposal, creating precise and legally sound documents has never been easier.

Start your journey with US Legal Forms today and make your legal document creation a breeze!

Form popularity

FAQ

Limited and limited partnerships are not the same; they refer to different types of business structures. A limited partnership has general and limited partners with distinct roles and liabilities. When understanding limited vs limited partnership, recognizing these differences will help you make informed decisions regarding your business setup.

Members of an LLC are neither limited nor general partners in the traditional sense. Instead, all members enjoy limited liability protection, which is a significant benefit of forming an LLC. This protection contrasts with the limited vs limited partnership structure, where only general partners take full liability.

An LLC and a limited partnership are fundamentally different entities. While an LLC provides limited liability to all its members, a limited partnership has at least one general partner who holds full liability. When comparing limited vs limited partnership, it's essential to consider your specific business needs and liability concerns.

The correct abbreviation for limited partnership is 'LP'. This designation helps differentiate it from other business entities like LLCs. Understanding these abbreviations is crucial, especially when exploring the limited vs limited partnership distinction in legal documents or business listings.

An LLC, or limited liability company, is not the same as a limited partnership. While both structures offer some level of liability protection, they operate under different legal frameworks. The main difference lies in the management structure; in a limited partnership, there are general partners who manage the business, while an LLC provides flexibility in management without these distinctions.

Whether it is better to be a limited company or a partnership depends largely on your business objectives. Limited companies generally provide greater flexibility in raising capital and offer liability protection to owners. In contrast, partnerships may simplify operations but come with shared liability risks. Weigh these aspects carefully within the framework of limited vs limited partnership to find your optimal choice.

A 'Ltd' or limited company functions as a separate legal entity, providing liability protection to its owners. Conversely, a limited partnership consists of general and limited partners, where typically only the general partners have full liability while limited partners have restricted liability. Understanding these distinctions is essential when navigating the limited vs limited partnership landscape.

Deciding between a partnership and an LLC involves assessing your business needs. An LLC tends to offer more limited liability protection, which can safeguard personal assets, while a partnership may offer easier management. Evaluate your priorities and long-term goals in the context of limited vs limited partnership to make the best choice.

Partnerships come with challenges that you should consider carefully. Among them are shared liability, which means each partner may be responsible for the actions of others. Additionally, disagreements can arise over decision-making, profits, and growth strategies, impacting business continuity. Understanding these limitations is crucial when comparing limited vs limited partnership structures.

To determine if your LLC is classified as a C Corporation (CS) or a Partnership (P), examine how you have elected to be taxed. By default, single-member LLCs are treated as disregarded entities, while multi-member LLCs are treated as partnerships. Consult with a tax professional or legal expert if you need clarity on your classification in the limited vs limited partnership discussion.