Limited Liability Company Vs Limited Liability Partnership

Description

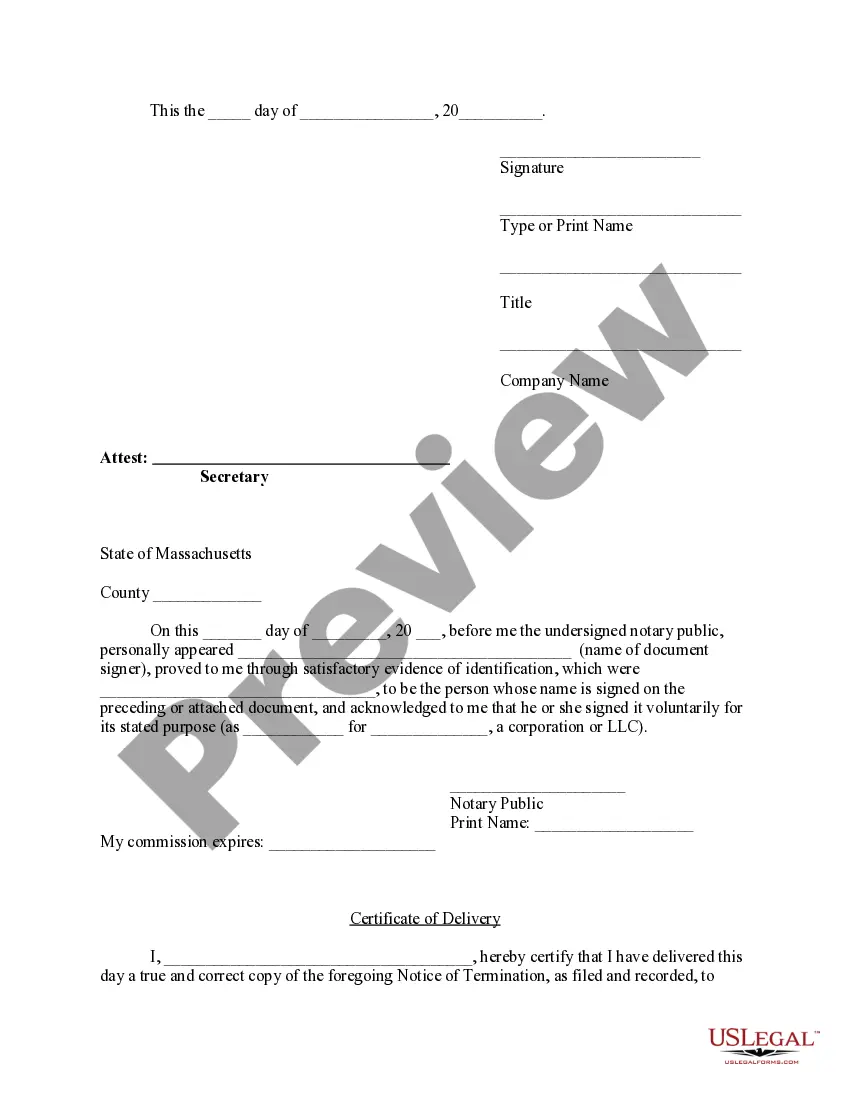

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- If you have used US Legal Forms before, log in to your account and click the Download button to get the necessary form template. Ensure your subscription is current; if not, renew it according to your payment plan.

- For first-time users, begin by checking the Preview mode and description of the form you need, ensuring it fits your requirements and complies with local laws.

- If adjustments are needed, utilize the Search tab to find a more suitable template. Once you find a match, proceed to the next step.

- Select and buy the desired document by clicking the Buy Now button, choosing your subscription plan, and registering an account for access.

- Complete your purchase by entering your credit card information or PayPal details to pay for the subscription.

- Finally, download your form and save it on your device. You can always access it later from the My documents section of your profile.

With US Legal Forms, individuals and attorneys can rapidly execute legal documents using an extensive collection of over 85,000 fillable and editable forms. This robust library is designed for efficiency and legal accuracy.

In conclusion, whether you choose an LLC or an LLP, US Legal Forms simplifies the document acquisition process. Get started today and ensure your business is set up correctly!

Form popularity

FAQ

Ltd, or limited company, indicates a registered company that limits shareholders' liability, whereas a limited partnership consists of at least one general partner and one limited partner, with varying degrees of management involvement. This distinction is crucial for understanding legal obligations and risk profiles. To choose wisely between Ltd and limited partnership, reflect on how these structures align with your business goals and the benefits of limited liability company vs limited liability partnership.

While both the limited liability company and limited liability partnership share liability protection features, their operational structures and management practices differ. The limited liability company offers a flexible management style, allowing members to engage directly, whereas a limited liability partnership primarily focuses on professional services, with partners sharing management responsibilities. When deciding between these two entities, consider the nuances of limited liability company vs limited liability partnership.

A limited company operates as an independent legal entity, providing limited liability to its owners, while a limited partnership consists of general partners who manage the business and limited partners who invest without management control. This fundamental difference in structure affects liability and management roles. Analyzing the limited liability company vs limited liability partnership helps you identify which format suits your business objectives.

An LLC, or limited liability company, is a flexible business structure that combines the protection of a corporation with the tax benefits of a partnership. In contrast, a LLP, or limited liability partnership, is designed primarily for professional businesses, allowing partners to limit their liabilities while maintaining management roles. When comparing limited liability company vs limited liability partnership, consider the specific needs and goals of your business.

A limited liability company (LLC) provides flexibility in management and protects members from personal liability, while a limited liability limited partnership (LLLP) typically has both general and limited partners, with limited partners having limited control. This structure can be beneficial for investors who want to limit their risk. If you're weighing the options between a limited liability company vs limited liability partnership, understanding these distinctions is essential.

The key difference between a limited company and a limited liability partnership lies in their structure and management. A limited company is a separate legal entity owned by shareholders, while a limited liability partnership combines elements of a partnership and a corporation, allowing partners to limit their personal liability. Understanding the differences can help you choose the right entity for your business, especially when considering the benefits of limited liability company vs limited liability partnership.

Opting for an LLP instead of an LLC can be advantageous if you prioritize partner liability protection while maintaining a partnership atmosphere. LLPs typically require less formal structure than LLCs, making them approachable for small firms or professional practices. Recognizing the differences between limited liability company vs limited liability partnership helps you align your decision with your business's operational needs.

Selecting a limited partnership can be beneficial if you plan to have passive investors who want to limit their liability. This structure allows general partners to manage daily operations while giving limited partners financial involvement without personal liability. By understanding the advantages of limited liability company vs limited liability partnership, you can make an informed choice that suits your business ambitions.

The primary difference between an LLC and an LLC partnership lies in membership and management. An LLC can consist of members who share management responsibilities, while an LLC partnership typically has designated partners who take on specific roles. Understanding these distinctions allows you to decide which structure fits best with your vision when navigating the limited liability company vs limited liability partnership landscape.

Determining whether a limited partnership or an LLC is better requires examining your business framework. Limited partnerships allow for both active management by general partners and passive investment from limited partners, whereas LLCs provide full personal asset protection for all members. Your choice should reflect the level of control and liability you are comfortable managing as you weigh the differences between limited liability company vs limited liability partnership.