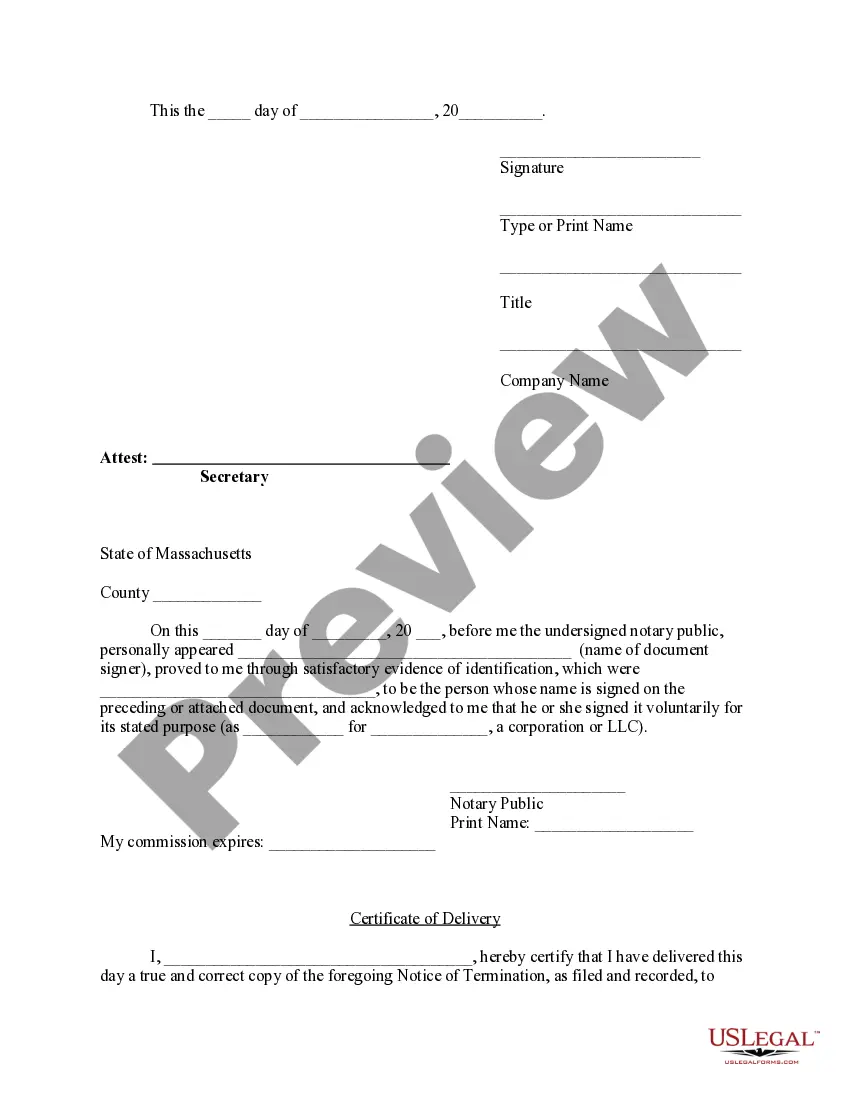

If in the event that a contract has been terminated prior to substantial completion, the owner shall provide a notice of termination by certified mail to every person who has filed or recorded a notice of contract and to the contractor. The contractor must then deliver a copy of said notice to every person who entered into a written contract directly with the contractor or who has given to the contractor written notice of identification.

Limited Liability Company For Rental Property

Description

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- If you're a returning user, log in to your US Legal Forms account and download the required form template by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, start by checking the Preview mode and form description to confirm you’ve selected the right document for your jurisdiction’s requirements.

- If the form isn’t suitable, use the Search tab above to locate another template that fits your needs.

- Once you’ve found the right document, click on the Buy Now button and select your preferred subscription plan, then create an account for access to the resource library.

- Proceed with the transaction by entering your payment details or using your PayPal account to complete your purchase.

- After making your payment, download the template to your device. Access it anytime in the My Documents menu of your profile.

Using US Legal Forms, users benefit from an extensive collection of over 85,000 editable legal documents, ensuring they find the exact paperwork needed for their LLC.

With expert assistance available, you can confidently create legally sound documents. Start streamlining your rental property management today by visiting US Legal Forms!

Form popularity

FAQ

Yes, you can put your rental property in a limited liability company (LLC) even if it has a mortgage. However, it is crucial to review your mortgage agreement first, as some lenders may require you to get their consent. Transferring the property to an LLC can provide liability protection and potential tax benefits, but it is wise to consult with a legal expert and your lender. Overall, forming a limited liability company for rental property can be a strategic move for managing your assets.

Transferring your rental property to a limited liability company for rental property can provide personal liability protection and may offer tax benefits. However, consider factors like potential tax implications and the costs involved in setting up an LLC before making a decision. Utilizing the uslegalforms platform can simplify the process of establishing an LLC, helping you navigate the necessary paperwork efficiently.

Filing taxes for a limited liability company for rental property requires you to report income and expenses on your individual tax return, using IRS Form 1065 for multi-member LLCs or Schedule C for single-member LLCs. Additionally, keep organized records of all revenue and expenses related to your rental property to ensure accurate reporting. It's advisable to consult a tax professional, as they can provide tailored advice based on your circumstances.

To put your rental property in a limited liability company for rental property, start by creating the LLC through your state's business registration office. Once your LLC is established, you will need to transfer the property's title from your name to the LLC. This process generally involves filling out specific paperwork and may require the assistance of a legal expert to ensure all steps comply with local laws.

The best type of LLC for rental property largely depends on your ownership structure. A series LLC can be ideal for multiple investments, as it allows you to manage each property separately while enjoying liability protection. Alternatively, a standard single-member or multi-member LLC may suit your needs if you prefer simplicity in management.

The 50% rule in rental property suggests that you should anticipate spending about 50% of your rental income on operating expenses, excluding mortgage payments. This guideline helps investors estimate whether a property is a sound investment. By keeping this rule in mind, you can better assess the financial potential of a limited liability company for rental property.

It is advisable to start an LLC before buying rental property. This setup offers protection for your personal assets from liabilities associated with the rental property. Establishing the LLC beforehand ensures that all profits and losses from the property are accounted for under the business entity.

The best business type for a rental property is often a limited liability company for rental property. This structure not only provides personal asset protection but also offers tax benefits. It allows you to separate your rental income from your personal finances, making it easier to manage your investment.

When considering a limited liability company for rental property, you should choose a single-member LLC if you are the sole owner. However, if you have multiple partners, a multi-member LLC may be more appropriate. This structure allows you to customize the management of the property and better distribute profits among members.

While a limited liability company for rental property offers many benefits, it does have disadvantages. For instance, setting up an LLC involves initial costs and ongoing administrative responsibilities. Additionally, you may face difficulty in securing financing compared to personal loans, as lenders might view LLCs as higher risk.