Quit Claim Deed

Description

How to fill out Massachusetts Condominium Unit Quitclaim Deed - Life Estate From Husband And Wife, Or Two Grantors, To An Individual With Remainder To Grantors.?

- If you're a returning user, log in to your account and access the needed form template by clicking the Download button. Confirm that your subscription is current; if not, promptly renew it.

- For first-time users, start by previewing and reading the form descriptions to select the correct quit claim deed that suits your needs.

- If you encounter discrepancies, utilize the search feature to find the right template tailored to your local regulations.

- Once you find the appropriate document, click on the Buy Now button and select your desired subscription plan. Registration is required to use the library.

- After selecting your plan, enter your payment details either via credit card or PayPal to complete the purchase.

- Finally, download the quit claim deed template to your device. You can access it anytime from the My Forms menu on your profile.

By using US Legal Forms, you'll benefit from an unparalleled selection of legal documents and expert resources to ensure your quit claim deed is filled out correctly and legally valid.

Ready to get started? Visit US Legal Forms today to efficiently handle your legal document needs!

Form popularity

FAQ

In Illinois, you technically do not need a lawyer to file a quit claim deed; however, consulting one can provide valuable guidance. A lawyer can help you navigate local regulations and make sure your paperwork is properly completed. While you can use resources like US Legal Forms to assist you with the filing, professional advice can help prevent any potential issues. Being informed about the process can ensure your quit claim deed is effective and valid.

Quit claim deeds often face skepticism due to the lack of warranty they provide. Unlike other deeds, a quit claim deed does not guarantee that the property title is clear of issues or claims. This can lead to unexpected legal disputes for the grantee if any problems arise later. It's essential to understand this risk when considering a quit claim deed for your property transfer.

To obtain a copy of your quit claim deed, contact the county recorder's office where the deed was filed. Most counties allow you to request copies online, by mail, or in person. Having your deed copy is essential for your records and potential future transactions. If you need assistance with acquiring or understanding your quit claim deed, US Legal Forms can help guide you through the process.

Indeed, you can complete a quit claim deed yourself. By following the proper legal steps and using accurate information, you can create a valid document. However, it’s crucial to be diligent in ensuring compliance with state laws to avoid complications. To simplify this process, consider using US Legal Forms, which provides user-friendly tools and resources.

Yes, you can create a quit claim deed on your own, but it is important to ensure that it meets all legal requirements. If you choose to do it yourself, take the time to research your state’s specific laws and regulations. Completing your deed accurately can prevent potential disputes in the future. US Legal Forms offers templates and guides to assist you in crafting your quit claim deed correctly.

In Missouri, a quit claim deed must include the names of the grantor and grantee, a clear description of the property, and it must be signed by the grantor. Additionally, it must be notarized to be valid. Ensure that you also check local laws for any additional requirements, as these can vary by county. Using a platform like US Legal Forms can help you navigate these requirements effectively.

In Minnesota, a quit claim deed transfers property ownership without warranties regarding the title. It effectively allows the grantor to relinquish their interest in the property to the grantee. However, the grantee takes on the risk of any claims against the property. For individuals unfamiliar with the process, using resources from US Legal Forms can simplify the process and ensure compliance with Minnesota's legal requirements.

The most widespread use of a quit claim deed is among family members, typically to transfer property ownership without the need for complicated legal procedures. This can include passing property to children or settling estate matters. Since it does not guarantee a clear title, it is crucial that both parties trust each other. Always conduct due diligence regarding the property's status.

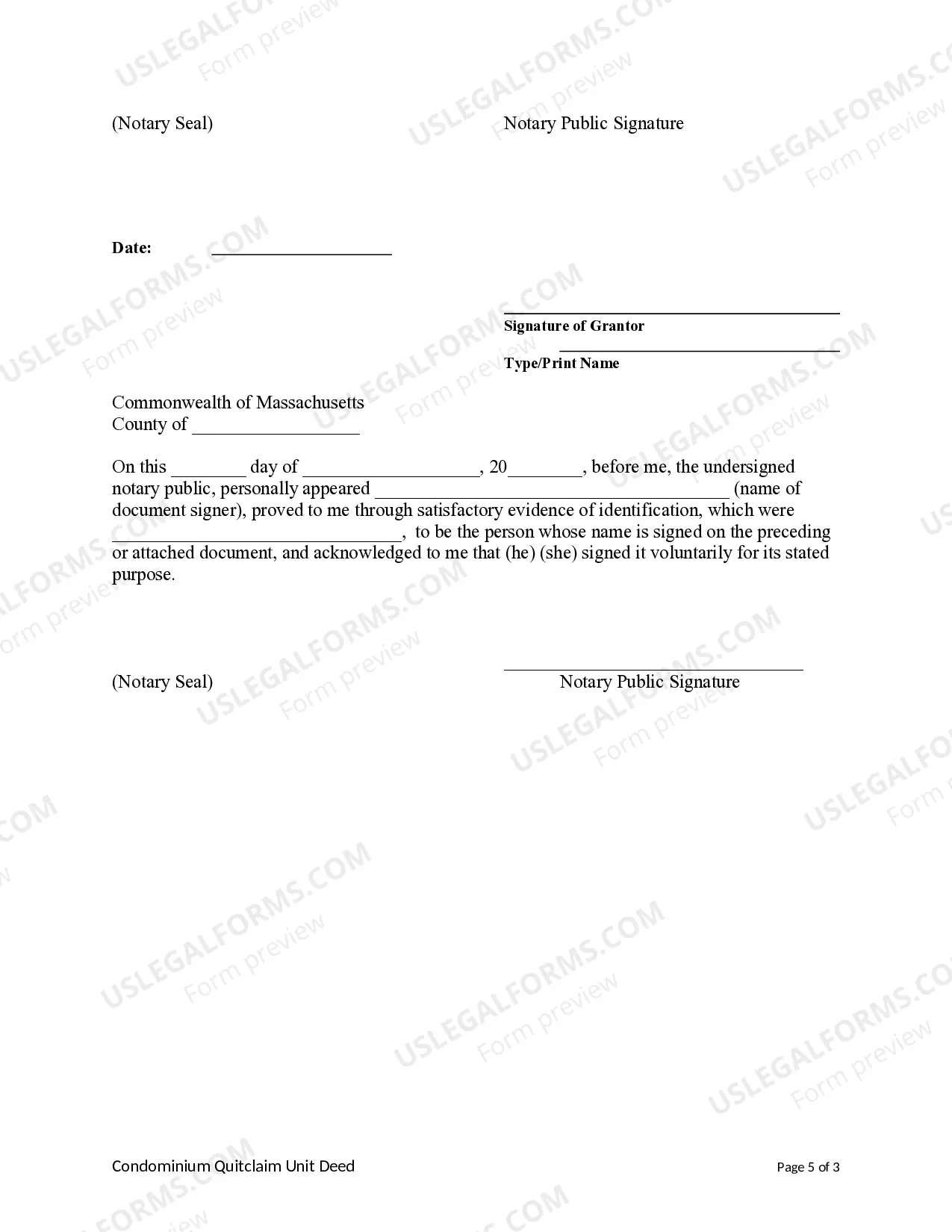

To fill in a quit claim deed, you need to start by entering the grantor's full name and address. Then, add the grantee's details before thoroughly describing the property involved, including its legal description. After completing these sections, sign the deed in front of a notary to validate it. For even more guidance, consider using US Legal Forms, which offers easy-to-fill templates suitable for your scenario.

People commonly use a quit claim deed to transfer property interest between family members or during divorce settlements. The simplicity of this deed allows for easy transfer without the need for warranties or guarantees about the title. Additionally, it can resolve disputes or settle inheritances smoothly. Always remember, though, that this deed does not protect the grantee from potential claims.