Massachusetts Fiduciary Deed Form

Description

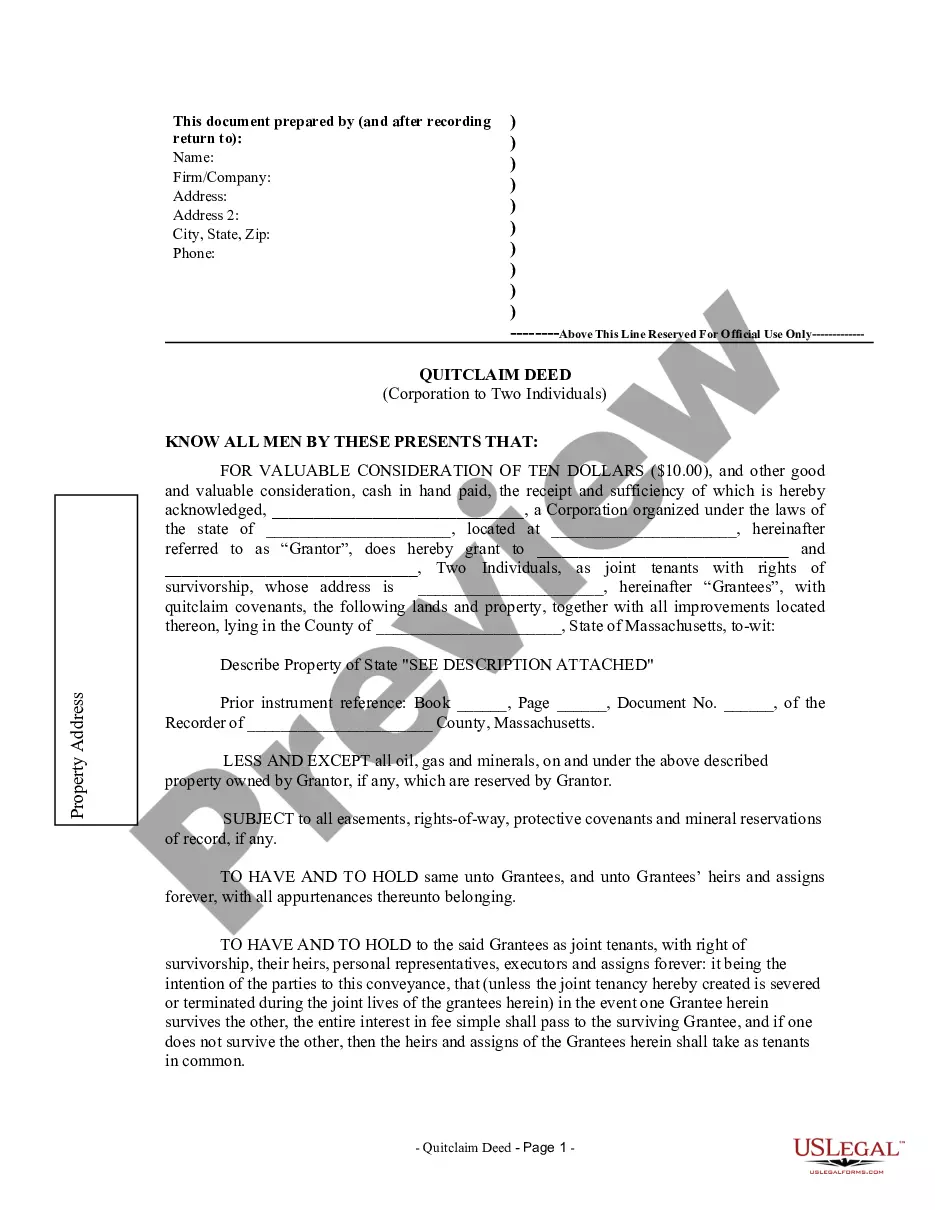

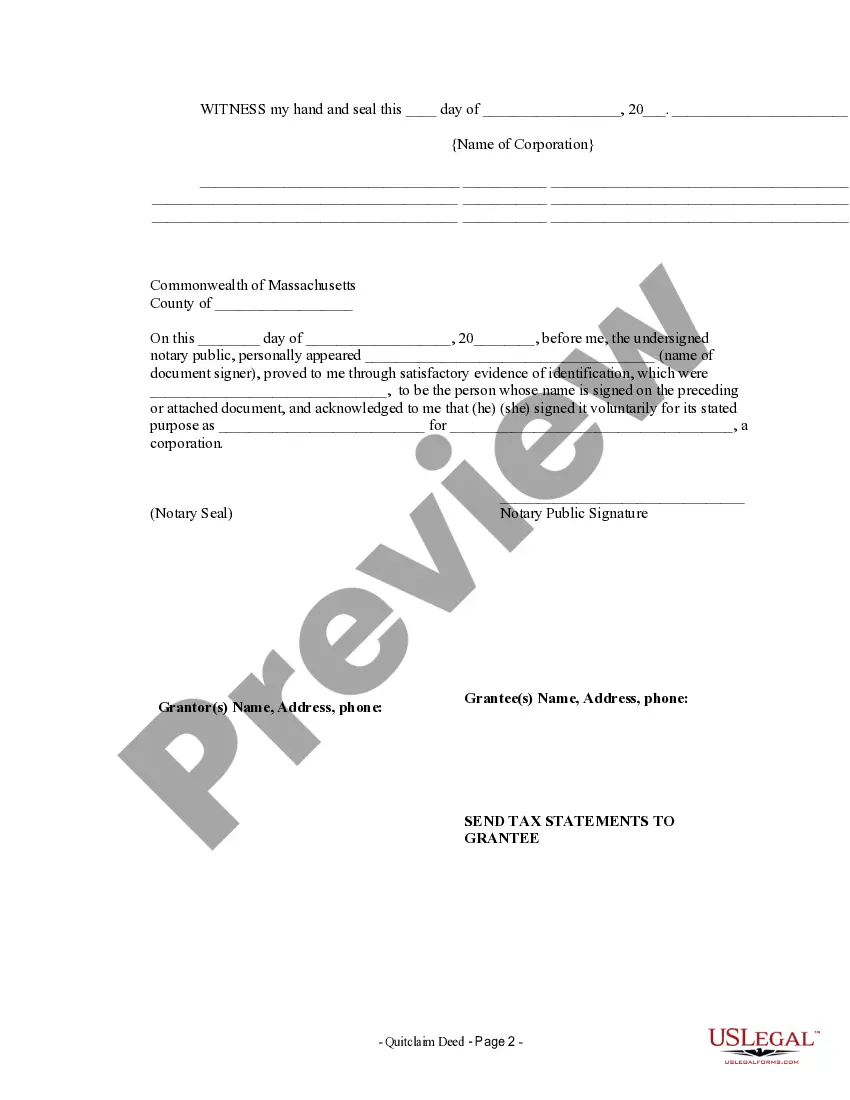

How to fill out Massachusetts Quitclaim Deed From Corporation To Two Individuals?

There's no further justification to waste time searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our website offers over 85k templates for various business and personal legal situations categorized by state and application area.

Utilize the search bar above to look for another template if the previous one does not suit your needs. Click Buy Now next to the template title when you identify the appropriate one. Select the most suitable subscription plan and create an account or Log In. Complete your subscription purchase using a credit card or PayPal to proceed. Choose the file format for your Massachusetts Fiduciary Deed Form and download it onto your device. Print your form to fill it out by hand or upload the template if you prefer to use an online editor. Creating legal documents under federal and state laws and regulations is quick and easy with our platform. Explore US Legal Forms today to keep your records organized!

- All documents are expertly crafted and verified for accuracy, allowing you to trust that you are obtaining an up-to-date Massachusetts Fiduciary Deed Form.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- Additionally, you can revisit all saved documents whenever necessary by accessing the My documents section in your profile.

- If you're new to our platform, the process will require additional steps to complete.

- Here's how new users can find the Massachusetts Fiduciary Deed Form in our catalog.

- Review the page content thoroughly to confirm it contains the sample you require.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

Fiduciary and estate refer to different concepts in property law. A fiduciary manages the assets and financial affairs of another person or estate, acting in their best interest. Meanwhile, the estate encompasses all the assets owned by a deceased person. If you are navigating these responsibilities, using the Massachusetts fiduciary deed form can help streamline property transfers effectively.

You can obtain your Massachusetts deed online through various legal form platforms. It is crucial to select a reputable site that provides the Massachusetts fiduciary deed form to ensure compliance with state regulations. Our platform simplifies this process, offering easy access to the necessary forms and guidance to make your property transfer smooth and efficient.

A fiduciary and an executor are not the same, although they may perform similar roles in handling estates. A fiduciary is a broad term referring to someone entrusted to manage another person's assets, while an executor specifically manages the estate of a deceased person. When it comes to property transfers, you may need a Massachusetts fiduciary deed form if you are acting as an executor, ensuring transparency and legality in the process.

The strongest form of deed is typically considered the warranty deed. This deed provides comprehensive guarantees that the grantor owns the property and has the right to transfer it. However, if you are dealing with fiduciary responsibilities, using the Massachusetts fiduciary deed form will ensure that you maintain the necessary legal protections while acting in the best interest of the beneficiaries.

The best deed for transferring property often depends on the situation. Many property owners choose a warranty deed for its strong protection against claims, but if you are acting on behalf of someone else, a fiduciary deed may be the most suitable option. For a secure and clear transfer, consider using the Massachusetts fiduciary deed form available on our platform to meet legal requirements.

A fiduciary deed is not the same as a regular deed. While both are used to transfer property, a fiduciary deed specifically allows a fiduciary, such as an executor or trustee, to act on behalf of another party. This type of deed ensures that the interests of the beneficiaries are protected during the property transfer process. If you are looking for a Massachusetts fiduciary deed form, our platform offers easy access and guidance.

To file a quit claim deed in Massachusetts, you need to complete the form with all necessary details regarding the property and the parties involved. Next, you must submit the completed deed to the appropriate registry of deeds in your county. If you are unsure about the process, using services like uslegalforms can provide you with straightforward templates and instructions related to the Massachusetts fiduciary deed form, ensuring that you complete the filing correctly.

To file your MA annual report, you can do it easily online through the Massachusetts Secretary of the Commonwealth's website. You will need to provide relevant business details, including your entity name and identification number. When dealing with a Massachusetts fiduciary deed form, understanding proper reporting is vital for legal compliance and transparency in your financial matters.

To file your MA Form 2, which is specifically for estates and trusts, you will send it to the Massachusetts Department of Revenue at P.O. Box 7010, Boston, MA 02204. Make sure to include all necessary documentation to ensure smooth processing. If you are also completing a Massachusetts fiduciary deed form, doing so accurately can help you avoid delays in your tax filings or estate processes.

When mailing your W2 form to the state of Massachusetts, send it to the Massachusetts Department of Revenue, P.O. Box 7010, Boston, MA 02204, unless advised otherwise. This is necessary for proper tax filing and record-keeping. If you are navigating the complexities of a Massachusetts fiduciary deed form, ensure that all tax documents, including your W2, are submitted accurately to avoid complications.