Vehicle Bill Of Sale Without Notary

Description

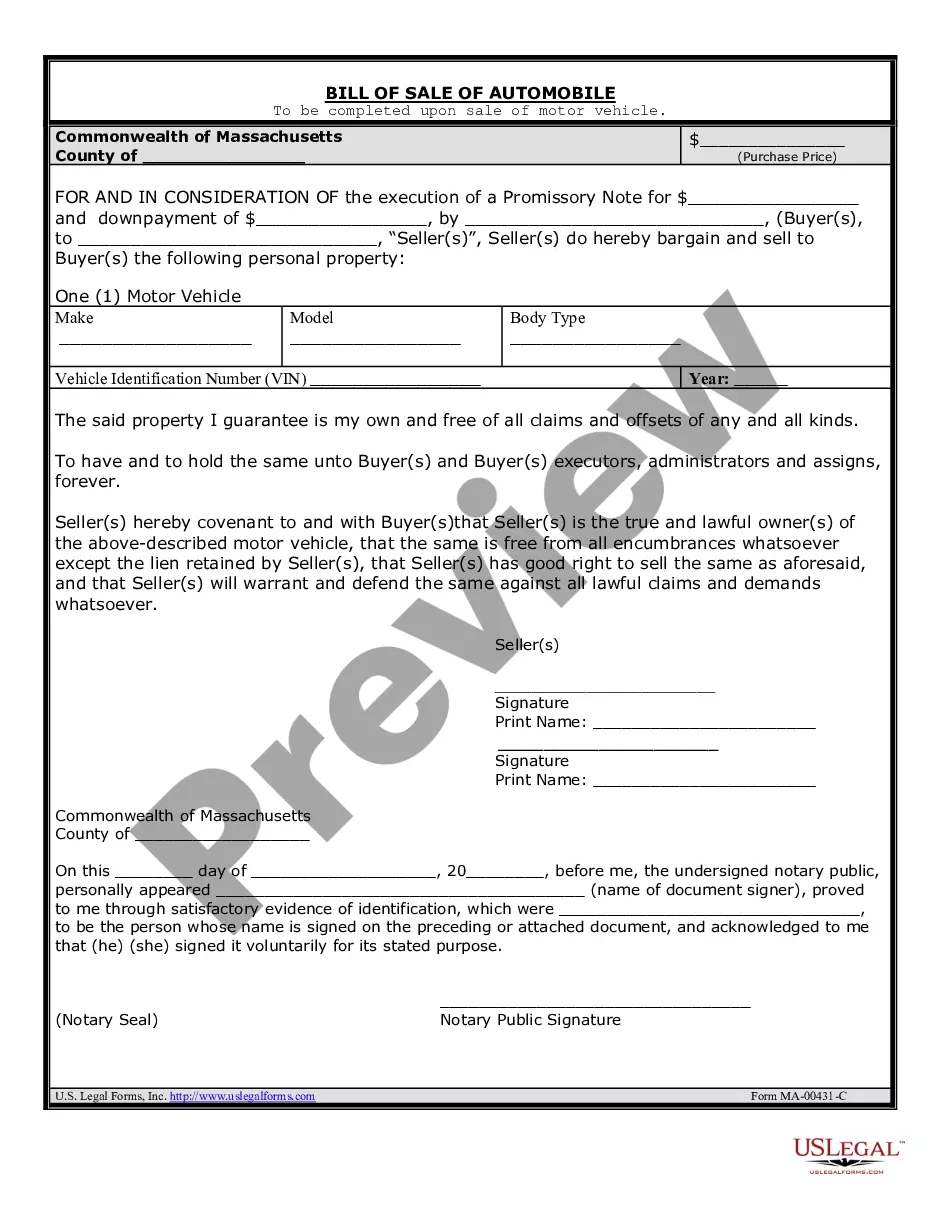

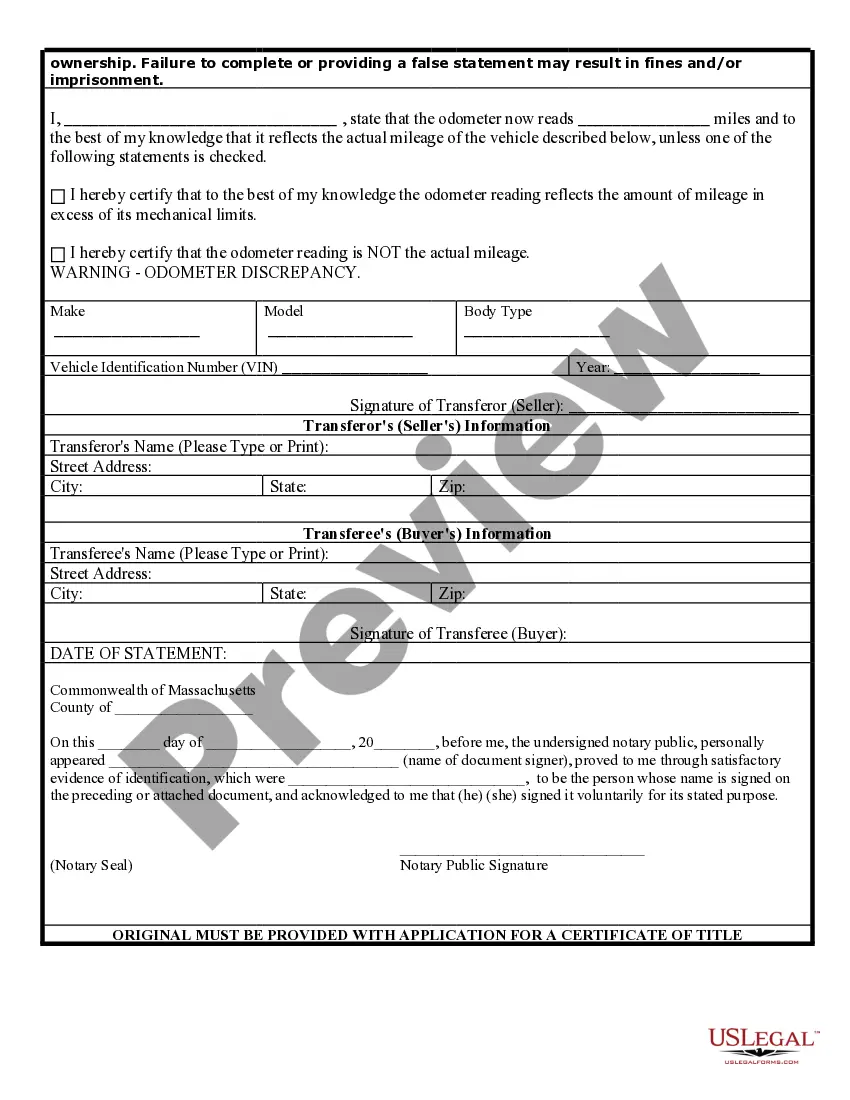

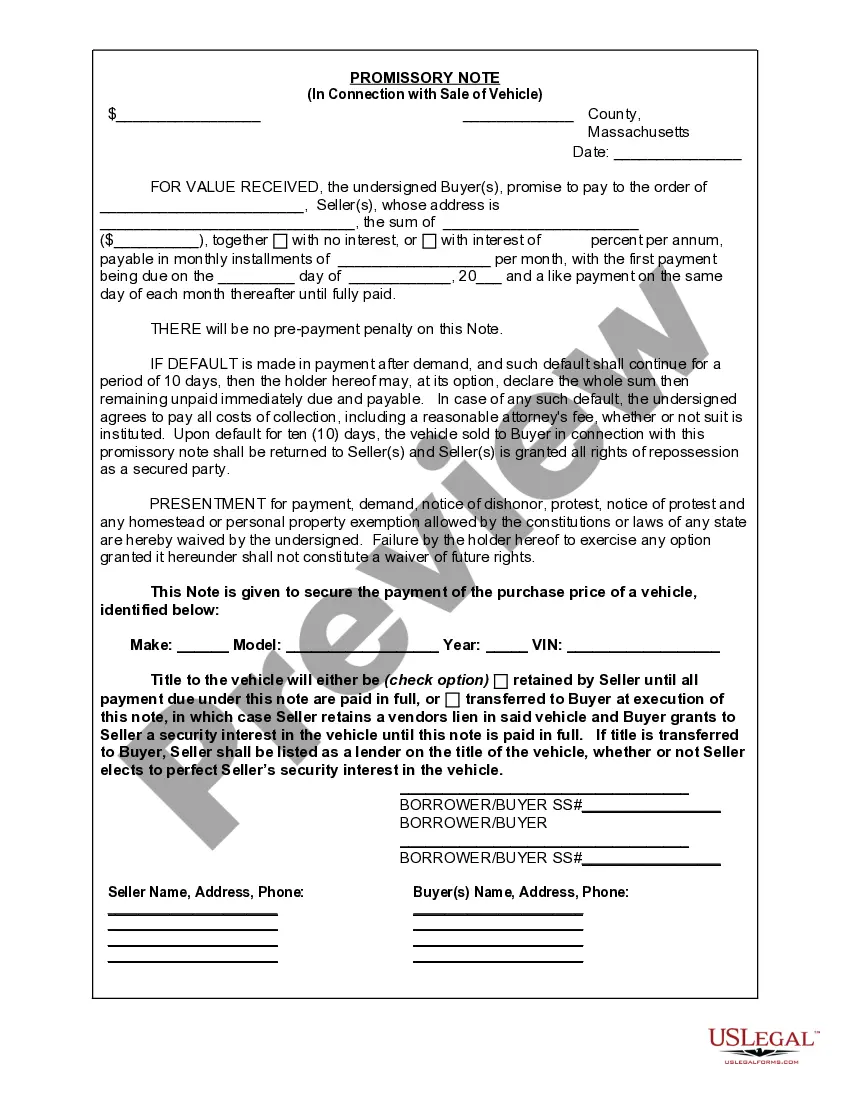

How to fill out Massachusetts Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

Precisely created formal documentation is one of the key assurances for preventing issues and legal disputes, but obtaining it without assistance from a lawyer may require time.

Whether you need to swiftly locate an updated Vehicle Bill Of Sale Without Notary or any other templates for employment, family, or business scenarios, US Legal Forms is always available to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and hit the Download button next to the selected file. Additionally, you can retrieve the Vehicle Bill Of Sale Without Notary at any point later, as all documents previously obtained on the platform remain accessible within the My documents section of your profile. Save time and funds on preparing official paperwork. Give US Legal Forms a try today!

- Ensure that the document is appropriate for your circumstances and location by reviewing the description and preview.

- Search for another example (if required) through the Search bar in the page header.

- Press Buy Now once you find the relevant template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to obtain the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Vehicle Bill Of Sale Without Notary.

- Click Download, then print the template to fill it in or upload it to an online editor.

Form popularity

FAQ

Missouri will allow buyers and sellers to create their own bills of sale for most items. Templates for a bill of sale are easy to find online, or you can write one yourself. They are also available at your local department of motor vehicles or county tax assessor's office.

Though standard form bill of sales are available online and from your local county tax collector's office, it's also perfectly acceptable to write your own.

Remember: All sellers and purchasers must print their names and sign the back of the title in the assignment area. These signatures do not need to be notarized. The seller must write in the odometer reading and date of sale. You may not use correction fluid (white-out) or erase marks from the title.

You'll also need a certificate of title or a manufacturer's statement of origin, a signed Application for Missouri Title and License (Form 108), an odometer inspection, a completed odometer disclosure form, and a notarized lien release (if applicable). You should also be prepared to pay your sales tax and a title fee.

The seller must complete all applicable information and sign this form. The Bill of Sale or Even-Trade Bill of Sale must be notarized when showing proof of ownership on major component parts of a rebuilt vehicle or when specifically requested to be notarized by the Department of Revenue.