Community Property Regime Form

Description

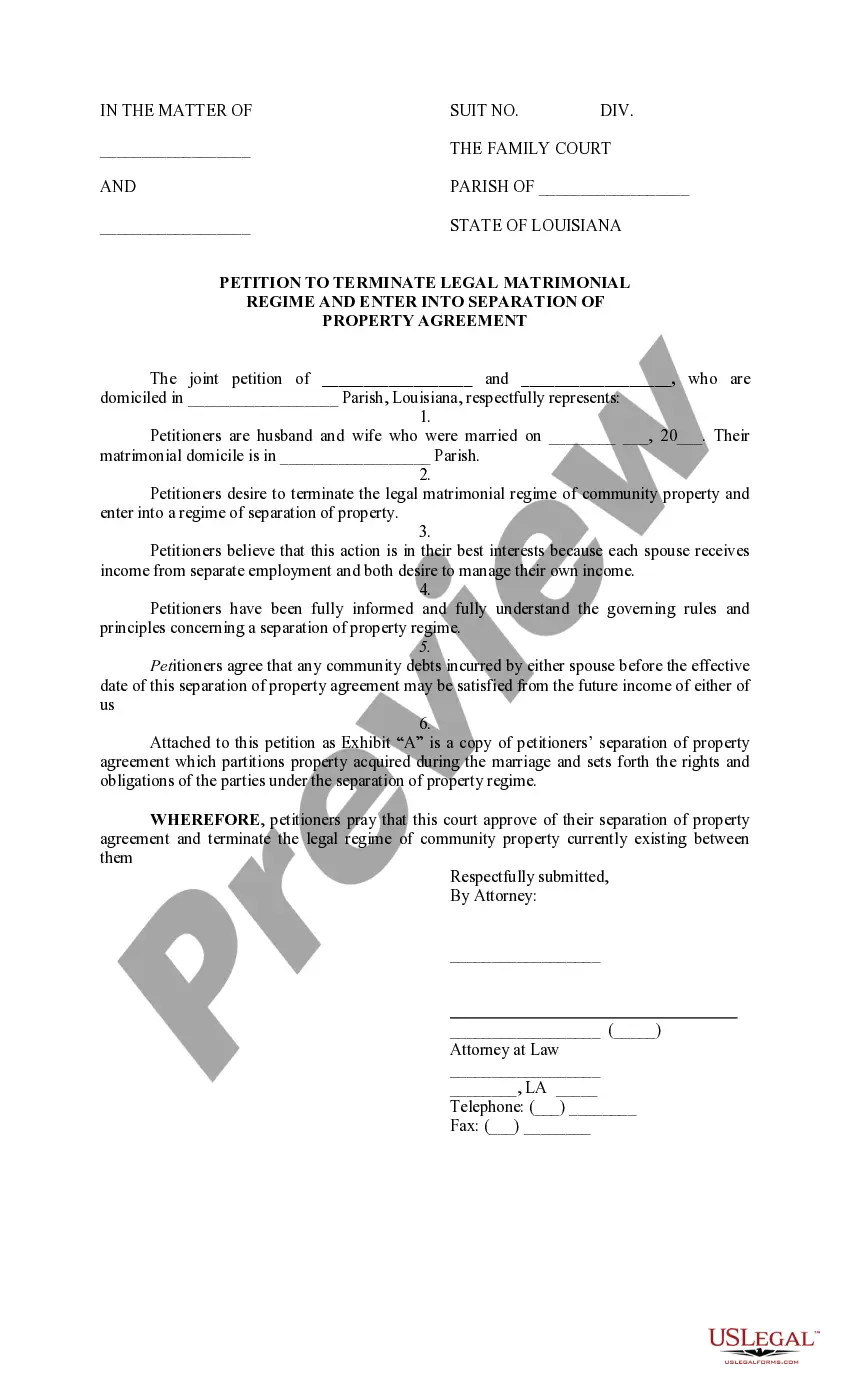

How to fill out Louisiana Joint Petition For Approval Of Matrimonial Regime Of Separation Of Property, With Order?

Bureaucracy requires meticulousness and correctness.

If you're not accustomed to completing forms like the Community Property Regime Form daily, it may lead to some misinterpretations.

Choosing the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avert any hassles of resending a file or beginning the task entirely from the start.

If you're not a registered user, locating the desired template will require a few additional steps: Search for the template using the search box. Ensure that the Community Property Regime Form you’ve located is suitable for your state or county. Preview the form or review the description that includes details on its use. When the result aligns with your search, hit the Buy Now button. Choose the appropriate option from the suggested pricing plans. Log In to your account or sign up for a new one. Complete the transaction using a credit card or PayPal. Download the form in your preferred file format.

- You can always locate the appropriate template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms offering over 85 thousand templates across various fields.

- You can easily find the latest and most pertinent version of the Community Property Regime Form by performing a quick search on the platform.

- Discover, organize, and save templates in your account or review the description to confirm you have the correct one available.

- With an account at US Legal Forms, it’s straightforward to gather, store in one location, and navigate through the templates you save for quick access.

- While on the website, click the Log In button to authenticate.

- Next, head to the My documents page, where your forms history is kept.

- Review the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

To enter community property income adjustments, begin by calculating each spouse's share of the total community income. It's important to document all sources of income distinctly. Then, make the necessary adjustments on the tax forms to reflect these amounts accurately. A community property regime form can assist in effectively organizing and reporting these adjustments.

When filing married filing separately (MFS) in a community property state, individuals must report half of community income and expenses. This requires both spouses to collaborate effectively in reporting their income. Accuracy is key to avoid potential audits or discrepancies. Utilizing a community property regime form helps ensure that all shared income is recorded correctly.

Community property is a form of ownership that applies to assets acquired during marriage. In community property states, most assets and debts incurred by either spouse are owned jointly. This principle can significantly affect tax obligations and income reporting. Therefore, understanding how to effectively use a community property regime form is crucial for managing these assets.

Filing as married filing separately in a community property state requires couples to report half of the community income on each return. Both spouses must clearly document their income and deductions. This process can be a bit complex, so using a community property regime form can simplify the calculations. Be sure to check local regulations for specific community property reporting requirements.

To file married separately, both spouses must choose that status on their tax returns. This means each spouse reports their individual income, deductions, and credits. Keep in mind that filing separately can affect eligibility for certain tax benefits. Using a community property regime form can clarify how to split shared income and expenses correctly.

The 1040EZ form has been replaced by the redesigned Form 1040. This change aims to simplify the filing process for taxpayers. The new Form 1040 includes a variety of schedules that allow for more detailed reporting. For those managing their community property regime form, having an updated form is essential for accurate reporting.

Forgetting to report income can lead to penalties and interest charges on your tax return. If you realize that you have omitted income related to the community property regime form, it is important to file an amended return promptly. Making corrections helps you avoid potential issues with the IRS and ensures your tax filings reflect your true financial situation. Utilizing services like uslegalforms can provide the support you need to address these concerns and complete the necessary steps.

Form 8958, which relates to the community property regime form, is generally required for taxpayers who live in community property states and have income to report from a community property arrangement. While it is essential for accurate reporting of income and expenses, the specific requirements can depend on your individual situation. If you are unsure about your obligations, consider consulting a tax professional. Using the community property regime form correctly aids in compliance and can simplify tax filing.

Filling out Form 8958 requires you to gather information about both spouses' incomes and deductions. The form guides you through reporting community property accurately. For assistance, consider using platforms like USLegalForms, which provide resources and templates to help you complete the Community Property Regime form confidently.

Filing as single when you are still legally married, even if separated, can lead to significant tax implications. The IRS may question your filing status and how you report community property. To navigate this correctly and avoid complications, consider using Form 8958 to report your financial situation accurately.