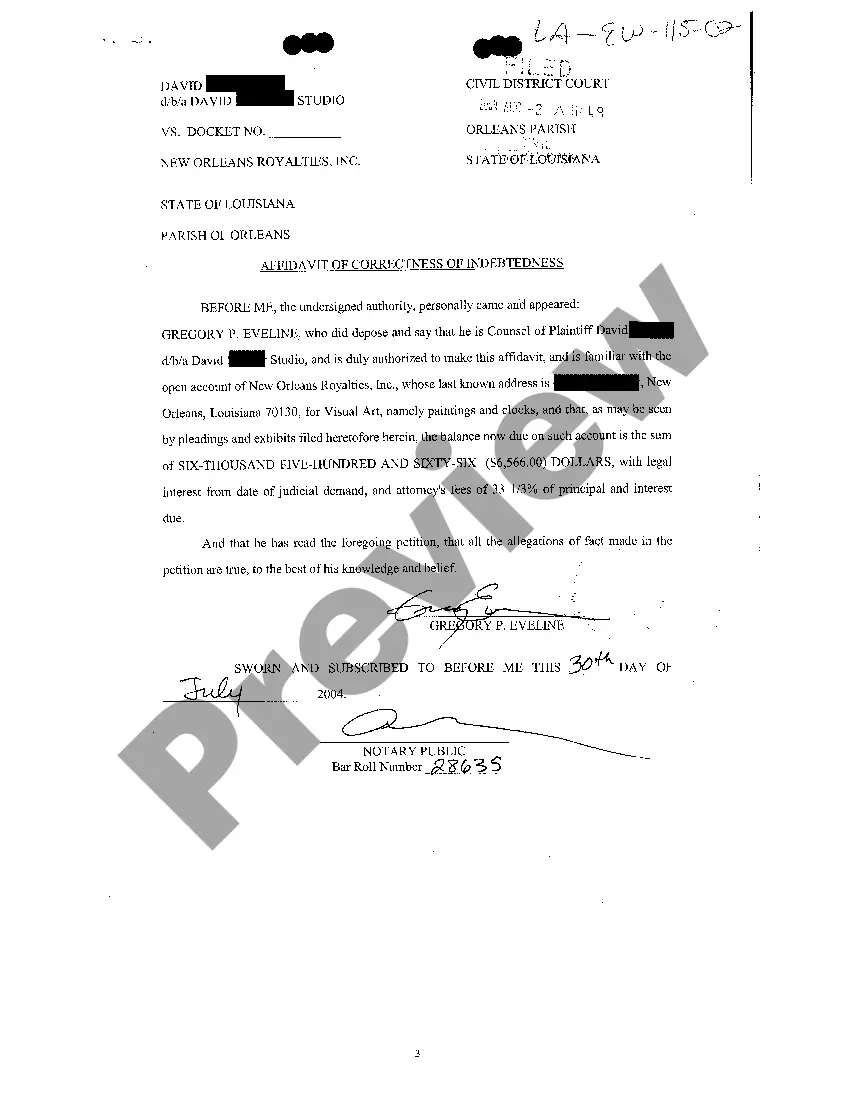

Foreclosure Affidavit Of Indebtedness

Description

How to fill out Foreclosure Affidavit Of Indebtedness?

Whether you frequently work with paperwork or occasionally need to file a legal document, it is essential to have a reliable source where all examples are interconnected and current.

One important task when dealing with a Foreclosure Affidavit Of Indebtedness is to ensure that it is the latest version, as this determines its acceptability.

If you wish to streamline your hunt for the most recent document examples, look for them on US Legal Forms.

Utilize the search function to locate the form you desire.

- US Legal Forms is a repository of legal documents that includes nearly every sample you may be searching for.

- Locate the templates you require, verify their relevance instantly, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 form templates across numerous domains.

- Find the Foreclosure Affidavit Of Indebtedness examples in just a few clicks and store them in your account anytime.

- Having a US Legal Forms account enables you to access all the examples you need more conveniently and with less difficulty.

- Simply click Log In in the site header and enter the My documents section to find all the forms at your fingertips, eliminating the need to waste time searching for the right template or validating its authenticity.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

No, you can't get the home back after the foreclosure. In Connecticut, you have up until the "Law Day" in a strict foreclosure or until the court confirms the foreclosure sale in a decree of sale foreclosure to "redeem" the house.

Foreclosure auctions are usually held at the courthouse in the county where the property is located. After a sale has taken place, it usually takes approximately 30-45 days for the sale to be ratified, however the ratification time can vary significantly from county to county.

Foreclosure Eliminates Liens, Not Debt But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property. While the security for the debt has been eliminated, the obligations remain in place.

If a foreclosure is nonjudicial, the foreclosing bank must file a lawsuit following the foreclosure to get a deficiency judgment. On the other hand, in a judicial foreclosure, most states allow the bank to seek a deficiency judgment as part of the underlying foreclosure lawsuit; a few states require a separate lawsuit.

When a borrower loses their home to foreclosure and still owes their lender money after the sale, the remaining debt is usually referred to as a deficiency. Lenders can sue to recover this amount.