Letter Of Guarantee From Lienholder For Car

Description

Form popularity

FAQ

A letter of guarantee from lienholder for car serves as a formal document that assures you about the financial backing for the vehicle. This letter is typically provided by the lender or lienholder, confirming their responsibility in case of financial obligations related to the car. It assures third parties that the lienholder will cover any claims or debts in specific circumstances. Understanding this document is crucial, as it plays a vital role in securing loans and protecting both the borrower and the lender.

A guarantee is usually issued by the lienholder who holds the title of the car. This entity may be a bank, credit union, or financial institution that financed the vehicle. Engaging with your lienholder directly allows you to understand their specific processes for issuing the letter of guarantee from lienholder for car, ensuring you have the assurance you need.

Typically, a guarantee letter is written by the lienholder or their authorized representative. They will outline the conditions of the guarantee and ensure it complies with legal standards. In some cases, you may seek assistance from platforms like uslegalforms to help draft or review the letter to ensure it meets all requirements.

You may need a letter of guarantee from a lienholder for a car to secure financing or confirm the lienholder's approval, especially when transferring ownership. This letter acts as assurance for potential buyers, lenders, or other parties involved in the transaction. It highlights the lienholder's consent and protects all parties in the deal.

A letter of guarantee from a lienholder for a car generally involves multiple parties. The primary parties include the lienholder, who provides the guarantee, and the borrower or car owner, who seeks the guarantee. Understanding the roles of each party can help streamline the process and clarify expectations.

To obtain a letter of guarantee from a lienholder for a car, you typically need to contact your lienholder directly. Provide them with relevant details about your vehicle and your need for the letter. They will guide you through their procedure and requirements for issuing the letter, ensuring you have everything you need to move forward.

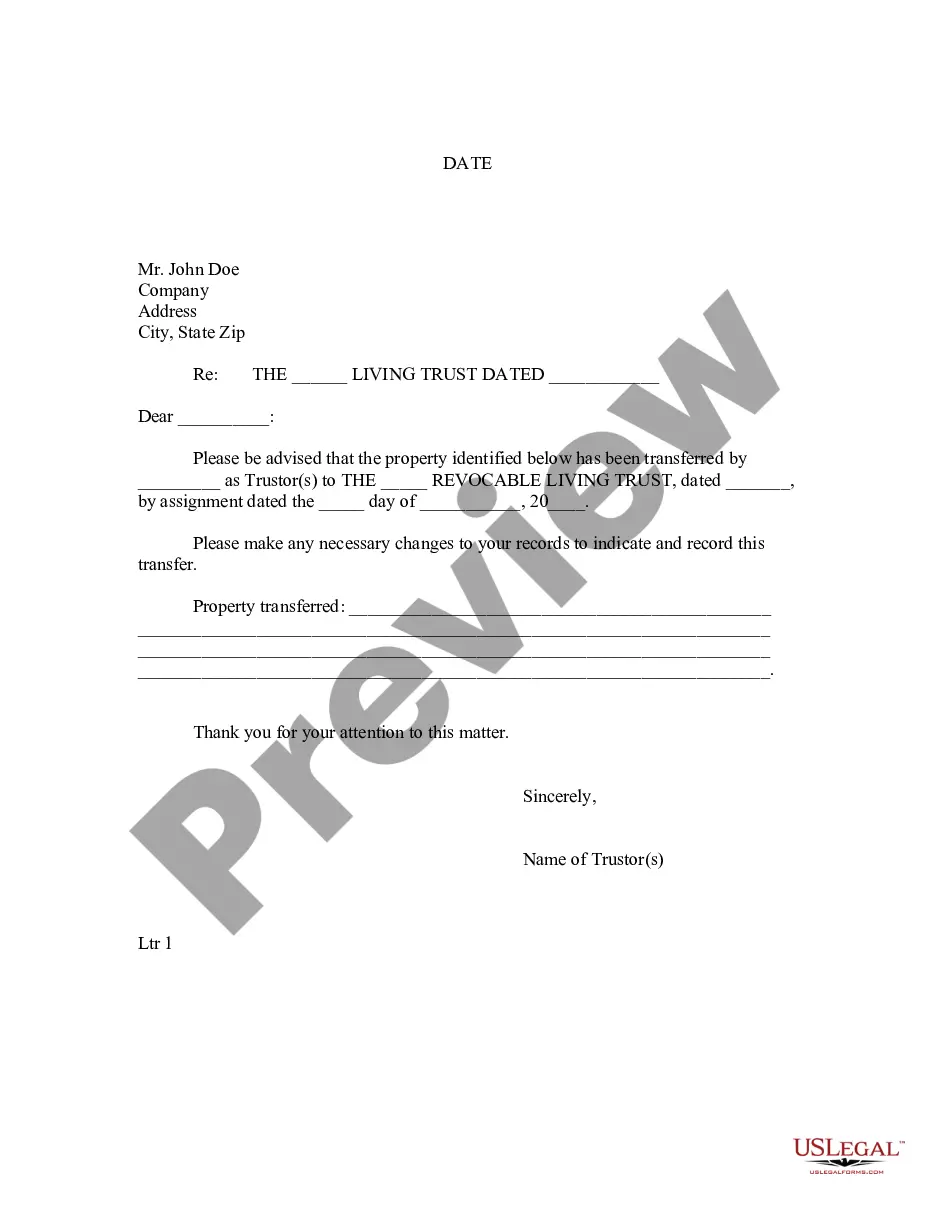

Filling out a letter of guarantee requires including all necessary parties and their details, alongside the specifics of the obligation being guaranteed. Clearly state the conditions under which the guarantee is valid, and don’t forget to provide spaces for signatures and dates. This structured approach makes the document legally binding. For customizable templates, check out US Legal, especially for a letter of guarantee from lienholder for car.

Writing a guarantee involves stating your intention to assume responsibility for another party’s obligations. Start with a clear introduction, specify what you are guaranteeing, and mention any relevant terms and conditions. Remember to sign the document for legal validity. If you want a precise format, US Legal can provide the necessary guidance for a letter of guarantee from lienholder for car.

A letter of guarantee serves as a formal commitment from a third party, ensuring the fulfillment of a borrower's obligations. For example, if you need to secure financing for a car, the lienholder may issue a letter confirming their willingness to cover payments if you default. This document enhances trust and helps lenders feel more secure. Visit US Legal for easily customizable templates and examples of a letter of guarantee from lienholder for car.

Writing a personal guarantee letter requires you to begin with your personal information and that of the party you are guaranteeing. Clearly outline your commitment to cover debts or obligations, and specify any limits or conditions involved. It is essential to include your signature to make it official. Explore US Legal forms for a streamlined process when drafting a letter of guarantee from lienholder for car.