Letter Of Guarantee For Payment

Description

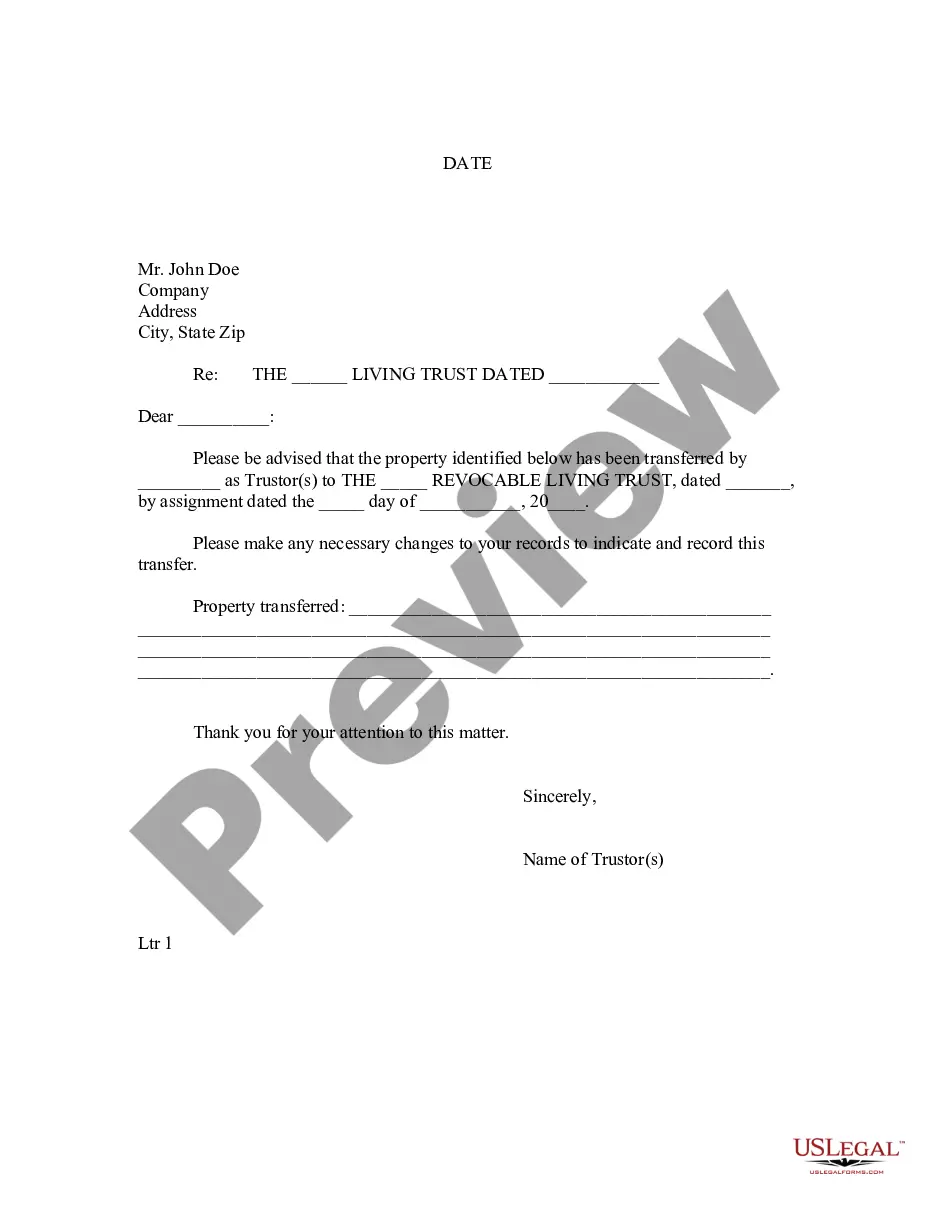

How to fill out Louisiana Letter To Lienholder To Notify Of Trust?

It’s clear that you cannot become a legal specialist instantly, nor can you comprehend how to swiftly draft a Letter Of Guarantee For Payment without possessing a specialized skill set.

Assembling legal documents is a labor-intensive task that necessitates particular training and expertise.

So why not entrust the development of the Letter Of Guarantee For Payment to the professionals.

You can revisit your documents from the My documents section whenever you wish. If you’re a current customer, you can simply Log In and locate and download the template from the same section.

Regardless of the intention behind your forms—be it financial, legal, or personal—our platform has everything you need. Experience US Legal Forms today!

- Find the document you need using the search feature at the top of the webpage.

- Preview it (if this option is available) and review the accompanying description to ascertain if the Letter Of Guarantee For Payment is what you’re seeking.

- Start your search again if you require a different document.

- Create a free account and choose a subscription plan to acquire the document.

- Click Buy now. Once the purchase is finalized, you can download the Letter Of Guarantee For Payment, fill it out, print it, and send or mail it to the relevant parties or organizations.

Form popularity

FAQ

A letter of guarantee can be issued by banks, insurance companies, or other financial entities that evaluate the risk involved. Additionally, individuals with sufficient resources and trust can also act as guarantors. It is advisable to work with professionals who can ensure the letter of guarantee for payment meets all necessary legal requirements.

To guarantee payment, the guarantor must assure that they will cover the payment if the primary party defaults. This can include issuing a formal letter of guarantee for payment outlining the terms and conditions. It is vital that all parties involved understand the extent of the guarantee and the obligations it entails.

The three common types of guarantees include performance guarantees, payment guarantees, and bid bonds. Each type serves a distinct purpose in contract agreements and provides assurance to the other party involved. Understanding these distinctions is essential when considering a letter of guarantee for payment, ensuring you select the right type for your needs.

You can get a payment guarantee by approaching a reputable financial institution or interested guarantor with a solid proposal. Start by preparing your financial records to demonstrate your creditworthiness. Platforms like US Legal Forms can provide templates and legal assistance to draft a proper letter of guarantee for payment.

Guarantees are typically issued by banks, credit unions, or insurance companies that independently assess the financial capacity of the individual or entity seeking the guarantee. These institutions ensure that there is sufficient collateral to back the letter of guarantee for payment. Their involvement lends credibility and security to the transaction.

A guarantee letter is often written by a lender, financial institution, or a reliable individual who agrees to take responsibility for a payment. This writer outlines the terms and conditions of the guarantee, ensuring it aligns with the expectations of the recipient. It's critical that the writer clearly expresses their intention to guarantee payment.

To obtain a payment guarantee, you must first identify a reliable financial institution or guarantor willing to issue the letter. You will need to provide relevant financial documentation and information to support your request. Using a platform like US Legal Forms can simplify this process, guiding you to create an appropriate letter of guarantee for payment.

A guarantor letter can be written by individuals with sufficient financial standing and trustworthiness. This could include family members, close friends, or business partners. It is essential that the guarantor understands the obligations tied to the letter of guarantee for payment, as they assume liability for the payment responsibility.

A letter of guarantee for payment is typically provided by a financial institution, such as a bank, or a trusted third party. These entities assess the creditworthiness of the individual or business requesting the letter and then issue it based on their financial stability. This letter assures the recipient that payment will be made as agreed.

A letter of guarantee on a financial statement indicates a company’s commitment to fulfill another company’s financial obligations. It reassures stakeholders of the company’s reliability and integrity in business transactions. This letter is often included to provide additional assurance to investors and creditors, highlighting the company’s financial stability and responsibility.