Living Trust Louisiana Forms Pdf

Description

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is not clearly communicating their intentions. Parents should establish guidelines and expectations for how and when their children will receive the trust funds. Furthermore, ensure that the trust is properly funded using living trust Louisiana forms PDF to avoid complications later.

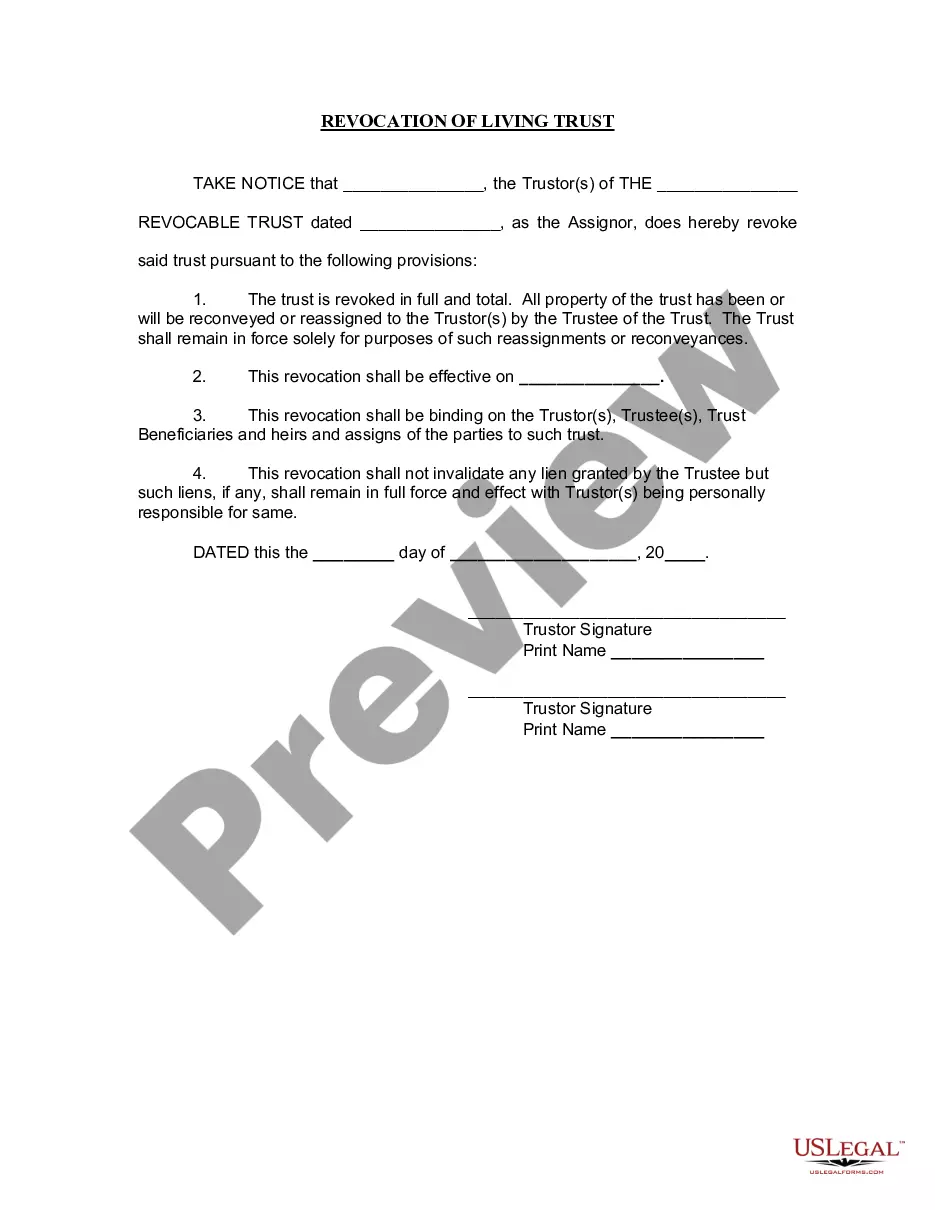

Creating a living trust in Louisiana involves a series of steps. First, you should gather information about your assets and choose your beneficiaries. Next, utilize living trust Louisiana forms PDF to draft your trust agreement. Finally, execute the trust document according to state laws, and consider funding the trust with your assets.

To create a living trust, you'll typically need the trust agreement form and a property transfer form. The trust agreement outlines the terms of the trust, while the property transfer form is necessary to transfer your assets into the trust. Using living trust Louisiana forms PDF makes it easy to access these needed documents and simplifies the entire process.

Creating a living trust by yourself is a straightforward process. Start by gathering essential information such as your assets and beneficiaries. Then, download and fill out the living trust Louisiana forms PDF from reputable sources like US Legal Forms to ensure you complete each section correctly. Finally, sign the document in front of a notary to make it legally binding.

The best way to create a living trust is to start with clear planning. First, define your goals for the trust and gather the necessary details about your assets. Using living trust Louisiana forms PDF can simplify the process significantly, allowing you to fill out the required information accurately. If you encounter complex situations, consider seeking assistance from a legal professional to ensure your trust meets all requirements.

Creating a valid trust requires five essential elements: a settlor, the trust property, a trustee, a beneficiary, and an intention to create a trust. The settlor is the person who establishes the trust, while the property consists of the assets involved. The trustee manages the trust, and the beneficiary receives the benefits. You can find living trust Louisiana forms PDF that can guide you through documenting these critical components.

To set up a living trust in Louisiana, begin by gathering your assets and deciding which ones you want to include in the trust. Next, choose a trustee who will manage the trust. You can then fill out the necessary living trust Louisiana forms PDF to legally document the trust. Finally, review and sign the documents, ensuring that all assets are transferred into the trust for proper management.

To put your assets into a living trust, start by gathering all necessary items, including titles, deeds, and account information. Using living trust louisiana forms pdf can streamline this process, allowing you to fill in the details needed for each asset. Next, transfer ownership of your assets to the trust; this step may require updating titles and deeds. Consulting with a legal expert can also help ensure that everything is done correctly.

A living trust in Louisiana operates by holding and managing your assets during your lifetime and after your death. By creating this trust, you can ensure that your property is distributed according to your wishes without going through probate. This process is generally more efficient and can provide greater privacy. You can use living trust louisiana forms pdf to create a comprehensive plan that outlines how your assets will be managed.

In a living trust, not all assets are appropriate for inclusion. You should typically avoid putting personal belongings, such as jewelry or collectibles, unless you can easily manage their value. Also, assets that might have tax implications, like certain investment properties, should be cautiously evaluated. By utilizing living trust louisiana forms pdf, you can help ensure that you make informed decisions about which assets to include.