Louisiana Living Trust Without A Will

Description

Form popularity

FAQ

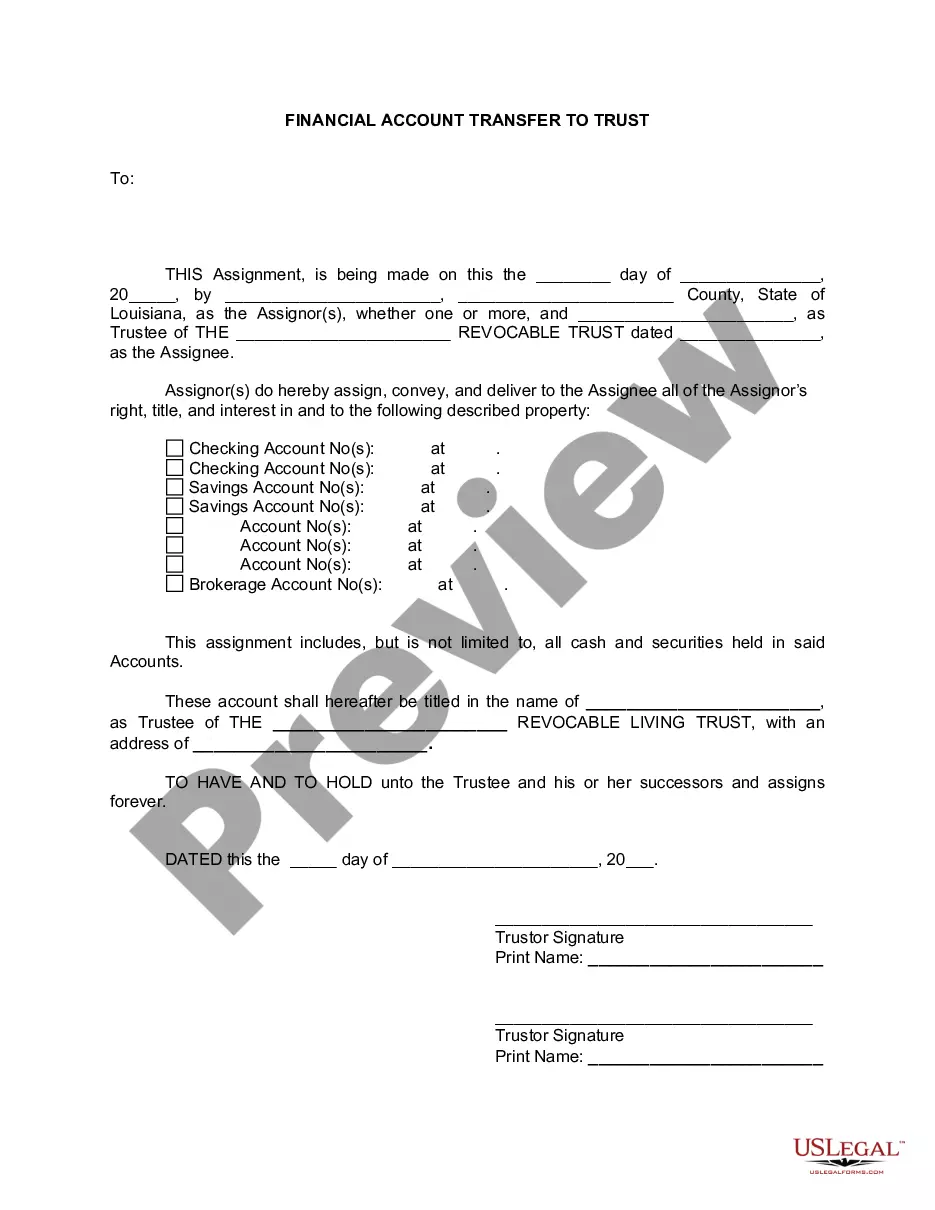

To set up a Louisiana living trust without a will, start by determining the assets you want to include. Choose a trustee who will manage the trust, and gather necessary personal and financial information. You can then create the trust document, outlining how you want your assets distributed. Utilizing platforms like US Legal Forms can provide guidance and templates to streamline this process, ensuring that your living trust complies with Louisiana laws.

While placing your house in a trust can streamline the inheritance process, there are some disadvantages to consider. Transferring your property into a trust may trigger tax implications or affect your property tax assessment. Also, if you choose to create a Louisiana living trust without a will, it may complicate refinancing or selling your home. It's important to weigh the pros and cons and consult with a specialist before making decisions.

Whether a will or a trust is better in Louisiana largely depends on your specific situation. A Louisiana living trust without a will can offer benefits like avoiding probate and ensuring smoother asset distribution. However, a will provides clear instructions for guardianship of minor children and can cover any assets not included in a trust. Carefully assessing your needs will guide you to the right choice for your estate planning.

Certain assets are typically not ideal for placement in a revocable trust, such as retirement accounts and life insurance policies. These assets often have designated beneficiaries that allow them to bypass the Louisiana living trust without a will, making the trust unnecessary for these particular holdings. Additionally, it's advisable to keep any jointly owned property outside the trust, as it may complicate the trust’s terms. Always consult with an expert to understand the best strategy for your unique situation.

A living trust in Louisiana allows you to manage your assets during your lifetime and dictate how they should be distributed after your death. When you create a Louisiana living trust without a will, your assets transfer directly to your beneficiaries, bypassing the probate process. This approach can save time and reduce the stress of settling an estate. Additionally, you retain control of your assets while you are alive, allowing for flexibility.

One significant mistake parents often make when setting up a trust fund is failing to communicate their intentions with their heirs. It’s crucial that your family understands how the trust will operate, especially when a Louisiana living trust without a will is involved. If they don’t know what to expect, misunderstandings can arise, leading to conflicts down the road. Clarity ensures that your objectives are met and your loved ones are prepared.

Creating a living trust in Louisiana involves drafting the trust document that outlines how your assets will be managed during your lifetime and distributed after your death. You can appoint a trustee to manage the trust on your behalf. For an easy process, consider using platforms like uslegalforms, which provide resources for establishing a Louisiana living trust without a will.

The order of inheritance without a will in Louisiana generally follows a specific hierarchy starting with your spouse and children, then parents, siblings, and further down the family line. These laws aim to ensure those closest to you inherit. Utilizing a Louisiana living trust without a will helps to outline your preferences and offers an organized approach to inheritance.

In Louisiana, the first in line for inheritance typically includes your spouse and children. If there are no children or spouse, parents and siblings follow in the inheritance hierarchy. To clarify your wishes and prevent potential disputes, consider setting up a Louisiana living trust without a will.

Yes, you can create a trust without a will in Louisiana. A living trust can be established that governs how your assets are managed and distributed during your life and after you pass. This makes a Louisiana living trust without a will an attractive option for those seeking to avoid the probate process.