Limited Lliability

Description

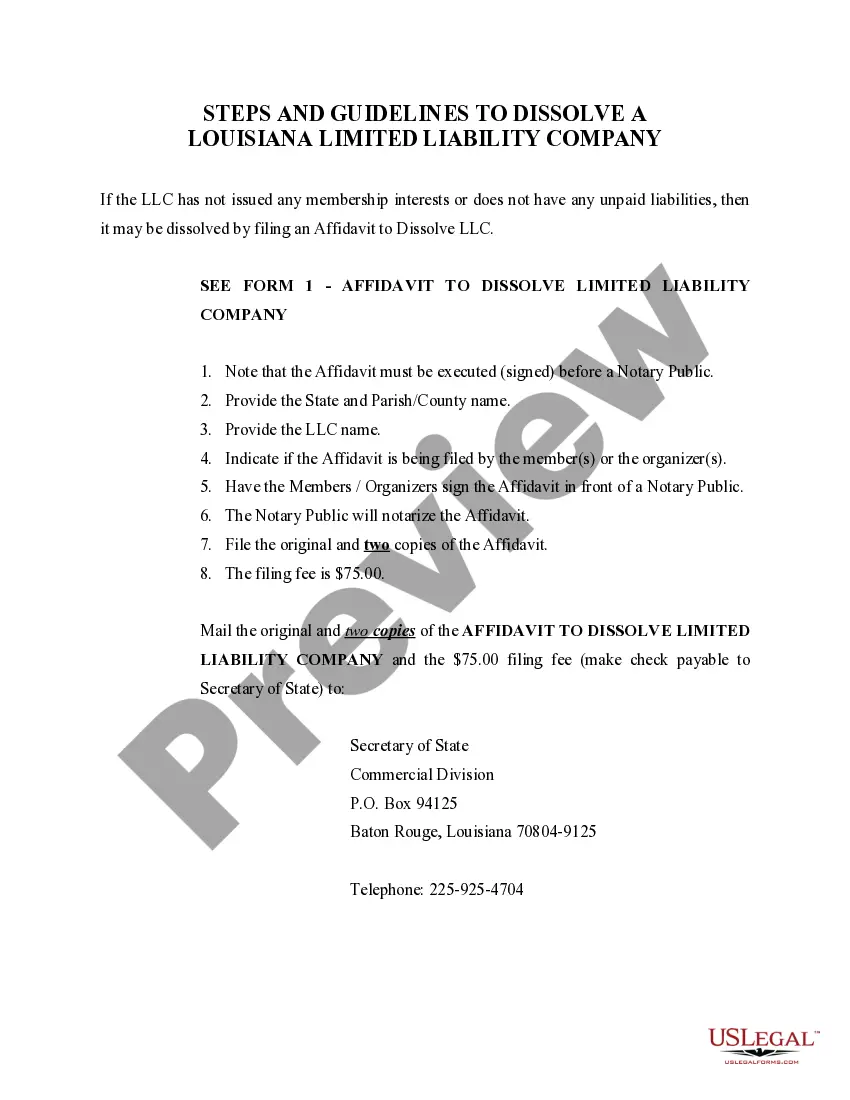

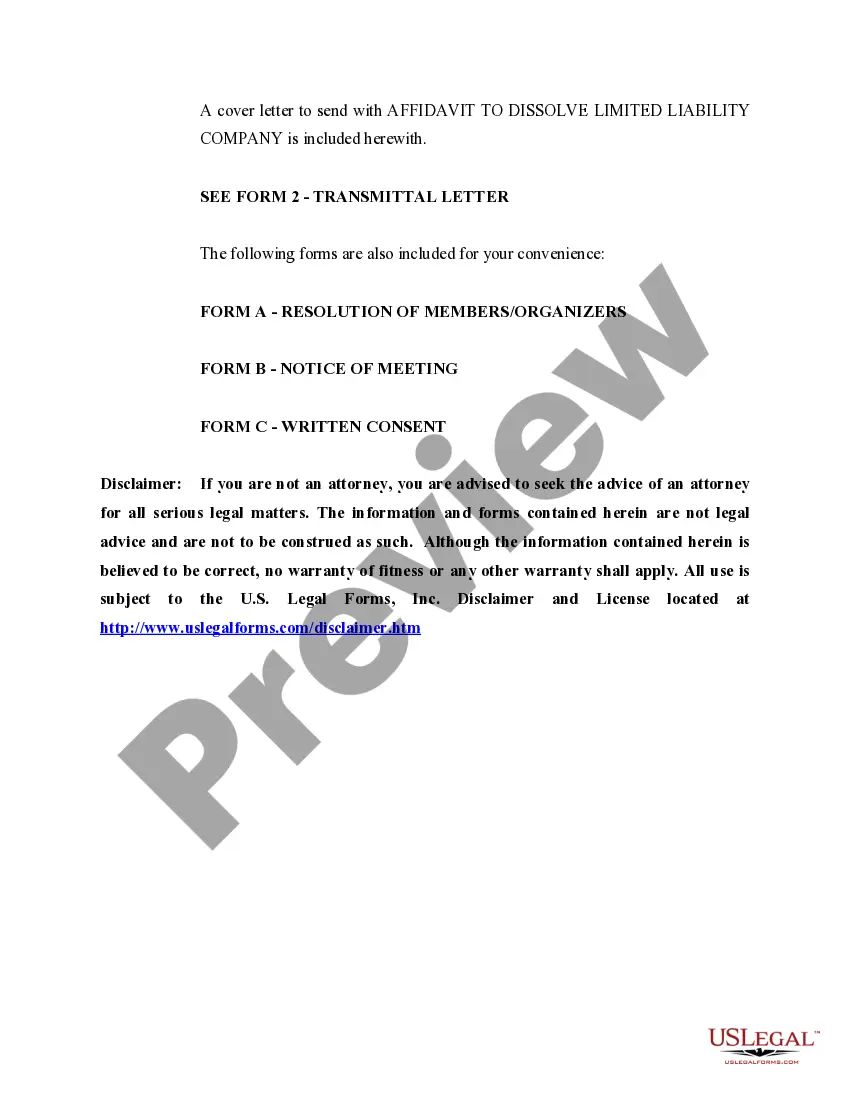

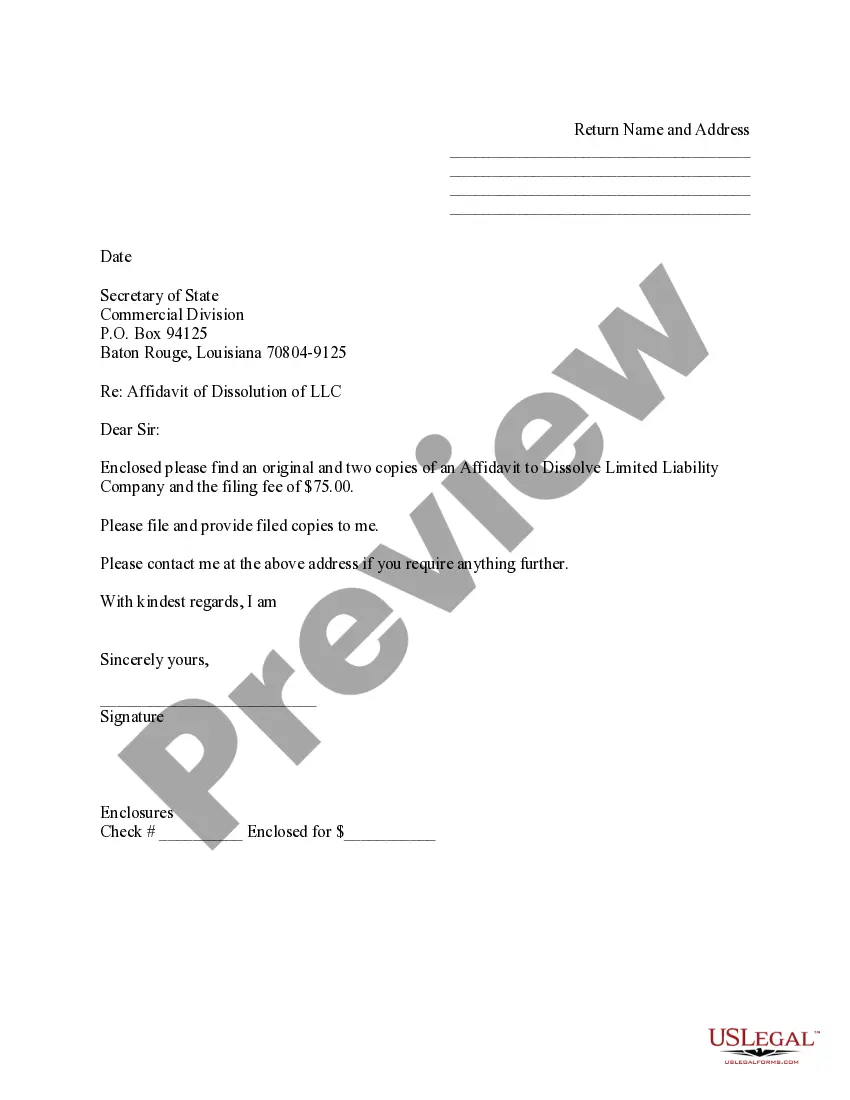

How to fill out Louisiana Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, log in to your account and click the Download button next to your desired form template, ensuring your subscription is active.

- For first-time users, start by exploring the Preview mode and the form descriptions to confirm you select a document that suits your needs and complies with local regulations.

- If necessary, use the Search tab to find alternative templates that fit your requirements more accurately.

- Choose your document by clicking the Buy Now button, then select a subscription plan and create an account for library access.

- Complete your purchase by entering your credit card information or utilizing your PayPal account to finalize the subscription.

- Download the template to your device and easily manage your documents through the My Forms section of your profile.

Following these steps not only saves you time but also ensures you have access to a legal form library that surpasses competitors by offering over 85,000 forms. Each document is easily fillable and editable.

Leverage the expertise of US Legal Forms for precision in your legal paperwork. Start safeguarding your assets with limited liability today!

Form popularity

FAQ

An LLC is a business structure that can choose its tax classification, either as an S Corporation or C Corporation. This flexibility allows you to select the classification that best aligns with your financial goals while enjoying the limited liability features. It’s crucial to understand these options and their implications. For tailored assistance, consider platforms like US Legal Forms to guide you through the process.

The tax form that a limited liability company files varies based on its number of members and chosen tax classification. Typically, single-member LLCs file Schedule C with their personal return, while multi-member LLCs file Form 1065. Understanding your LLC's tax requirements is vital to maintaining compliance while enjoying the benefits of limited liability.

An LLC usually files Form 1065 if it has multiple members, as it serves as an informational tax return. In contrast, an LLC can opt to be taxed as a corporation, choosing to file Form 1120 instead. This decision impacts how you manage your limited liability and tax obligations. Consulting with a tax professional can help determine the best choice for your specific situation.

An LLC is not inherently a Schedule C; rather, a single-member LLC typically reports its income through Schedule C. This process allows you to benefit from limited liability while simplifying your tax obligations. For multi-member LLCs, the structure changes, and they file Form 1065 instead. Therefore, it’s crucial to understand your LLC’s specific requirements.

Yes, if you have a single-member LLC, you file your business income and expenses together with your personal tax return. This combines the benefits of limited liability with the simplicity of filing. However, multi-member LLCs file their own returns, such as Form 1065. It’s advantageous to keep your finances organized and clear.

The tax form an LLC files depends on its structure and tax classification. For a single-member LLC, you typically use Schedule C, which you include with your Form 1040. Multi-member LLCs generally file Form 1065, which is an informational return. Understanding these forms can help you maintain your limited liability status while ensuring compliance with tax regulations.

A single member LLC files taxes as a sole proprietorship by default, representing a form of limited liability. You report business income and expenses on Schedule C of your personal tax return. As an owner, you enjoy the benefits of limited liability while keeping tax filings straightforward. You can also choose to be taxed as an S Corporation or C Corporation for potential tax advantages.

While an LLC offers many benefits, there are potential downsides to consider. For instance, you may face additional paperwork and costs compared to a sole proprietorship. Additionally, some states impose annual fees or taxes on LLCs. However, the limited liability protection LLCs provide often outweighs these drawbacks, as it shields your personal assets from business liabilities.

You should consider forming an LLC when you start your business or if you're taking on new clients or contracts. An LLC helps protect your personal assets from business debts, thanks to limited liability. Additionally, if you're earning income consistently, establishing an LLC can provide tax benefits and legitimacy. Explore options like US Legal Forms for a smooth transition into forming your LLC.

There is no specific income requirement before starting an LLC. However, many decide to form one when they have a consistent income stream or have specific business plans. Forming an LLC can provide you with limited liability protection, making it a wise decision as soon as you generate revenue. Evaluate your business goals and consider forming an LLC early to maximize your benefits.