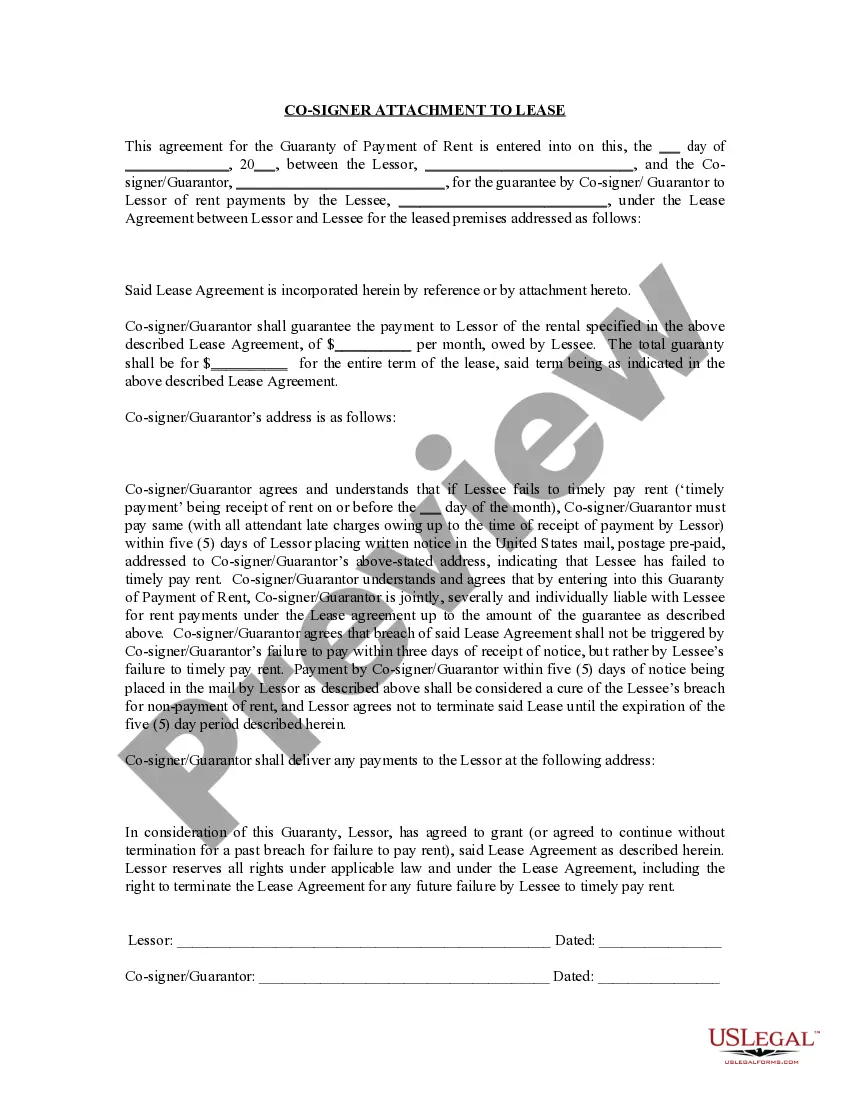

Guarantor On Lease Without Down Payment

Description

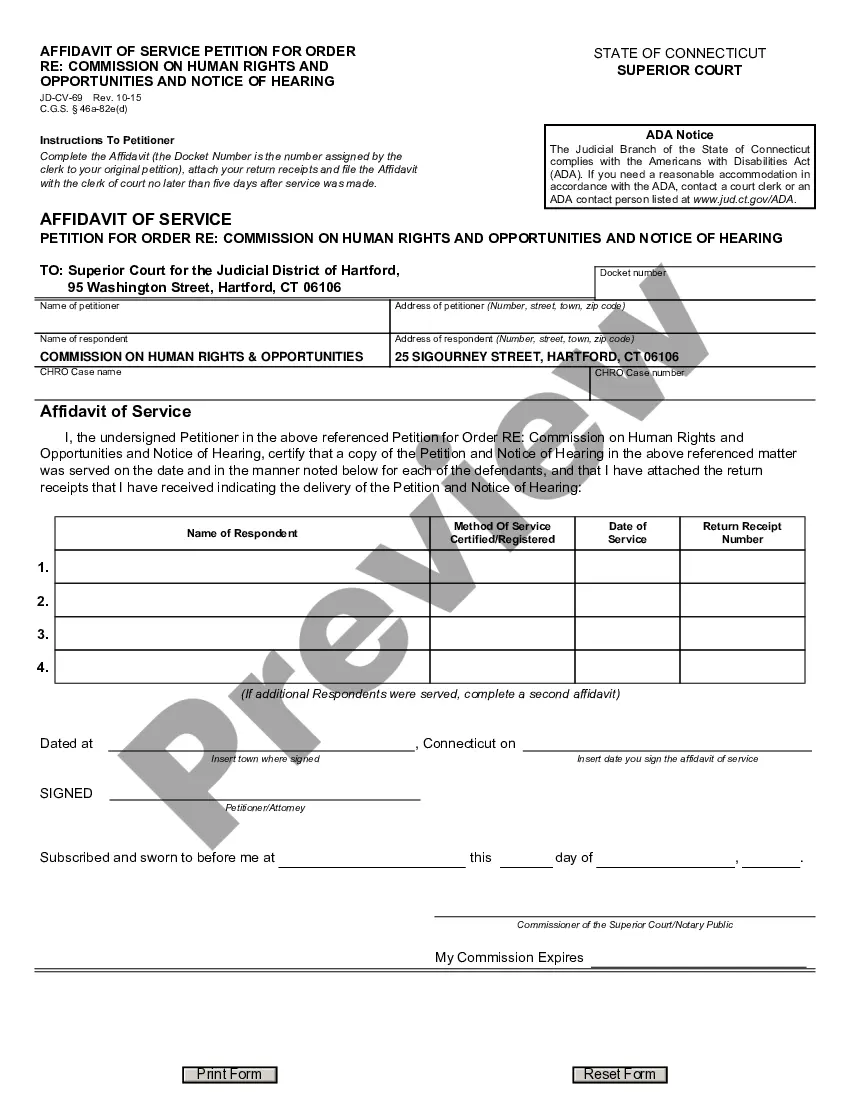

How to fill out Louisiana Guaranty Attachment To Lease For Guarantor Or Cosigner?

Bureaucracy requires exactness and correctness.

Unless you are accustomed to completing documents like Guarantor On Lease Without Down Payment daily, it may result in some misunderstanding.

Selecting the appropriate sample from the outset will ensure that your document submission proceeds effortlessly and avoids any hassles of re-submitting a file or starting the same task entirely from the beginning.

Obtaining the correct and up-to-date samples for your documentation is a matter of moments with an account at US Legal Forms. Eliminate the bureaucracy worries and simplify your document work.

- Locate the template using the search feature.

- Verify that the Guarantor On Lease Without Down Payment you have found is suitable for your state or locality.

- Access the preview or examine the description that offers the details regarding the use of the sample.

- If the result aligns with your search, click the Buy Now button.

- Choose the suitable option from the provided subscription plans.

- Sign in to your account or set up a new one.

- Finalize the purchase using a credit card or PayPal account.

- Download the form in your preferred format.

Form popularity

FAQ

To be a guarantor you'll need to be over 21 years old, with a good credit history and financial stability. If you're a homeowner, this will add credibility to the application.

Applying to be your guarantor should not impact your father's credit score, but the landlord's request will likely show up on his credit report.

Cosigning for an apartment may have no impact on your credit at all. If the landlord doesn't check your credit report when you apply, the lessee pays their rent on time and the landlord doesn't report rent payment to the credit bureaus, you're not likely to see any changes to your report.

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

The guarantor must have good or excellent credit but more often than not, they will be required to have credit in the excellent range, which is anything from 750 and above. Every landlord or management company is different so note the requirements on the application.