Affidavit Of Facts Form Louisiana Withholding

Description

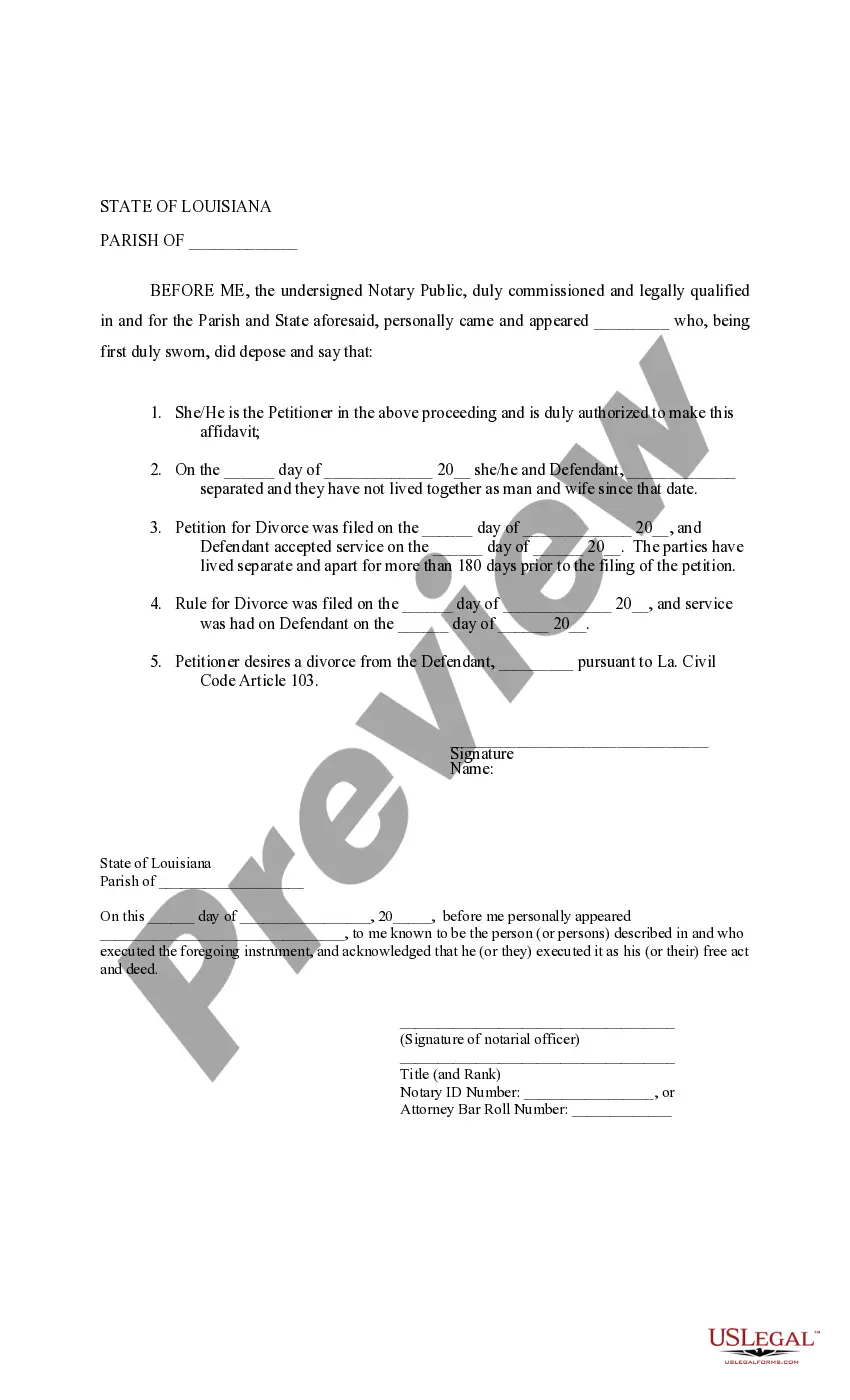

How to fill out Louisiana Affidavit - La. CC Art. 103 - No Children?

Individuals frequently link legal documentation with intricacy that solely an expert can handle.

In some respects, this is accurate, as preparing the Affidavit Of Facts Form Louisiana Withholding demands comprehensive understanding of specific criteria, encompassing state and county laws.

However, with US Legal Forms, the process has become much simpler: pre-prepared legal documents for various life and business scenarios tailored to state legislation are compiled in a single online repository and are currently accessible to everyone.

All templates in our library are reusable: once obtained, they remain saved in your profile. You can maintain access to them whenever necessary via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Register today!

- Examine the webpage content carefully to confirm it meets your requirements.

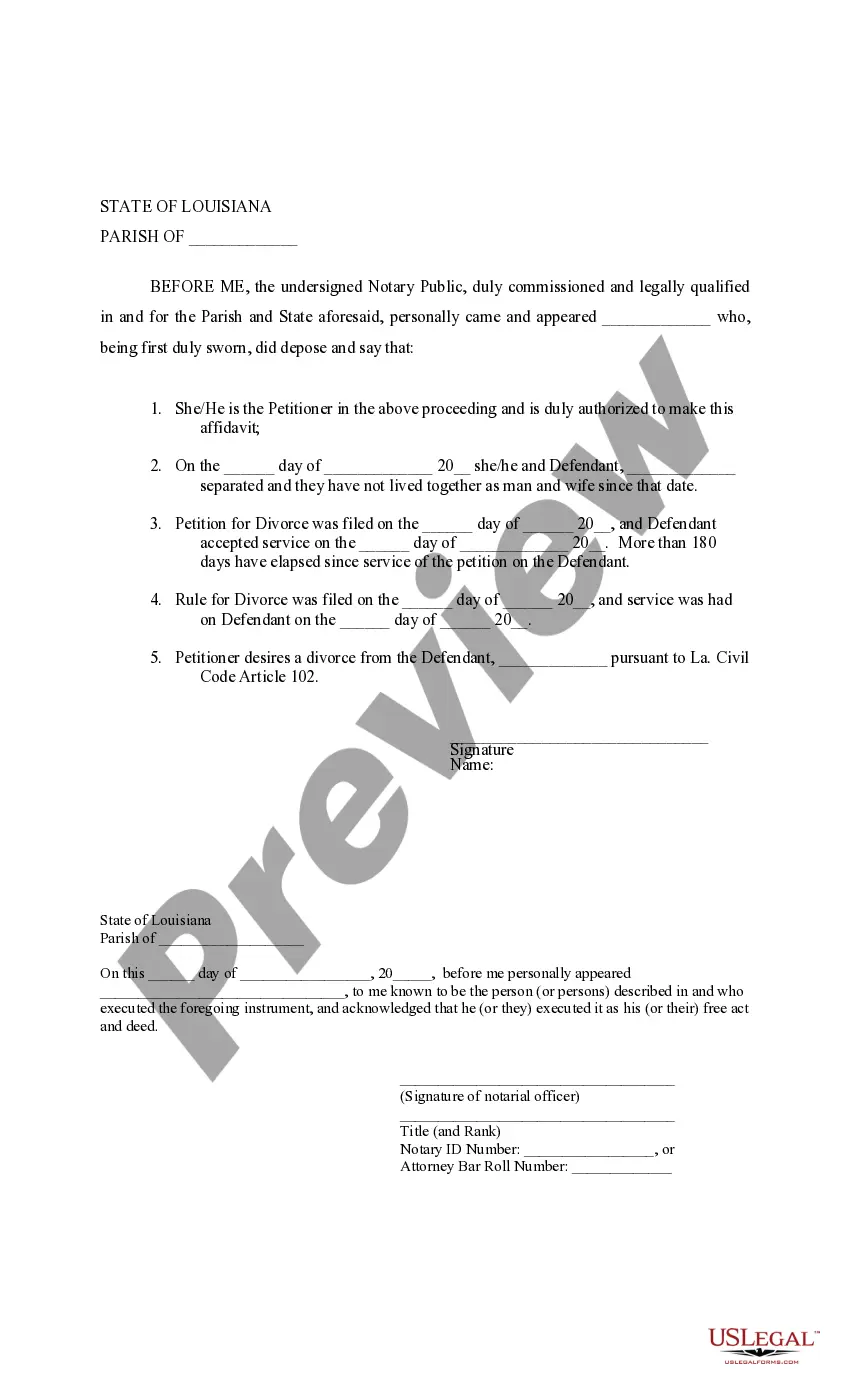

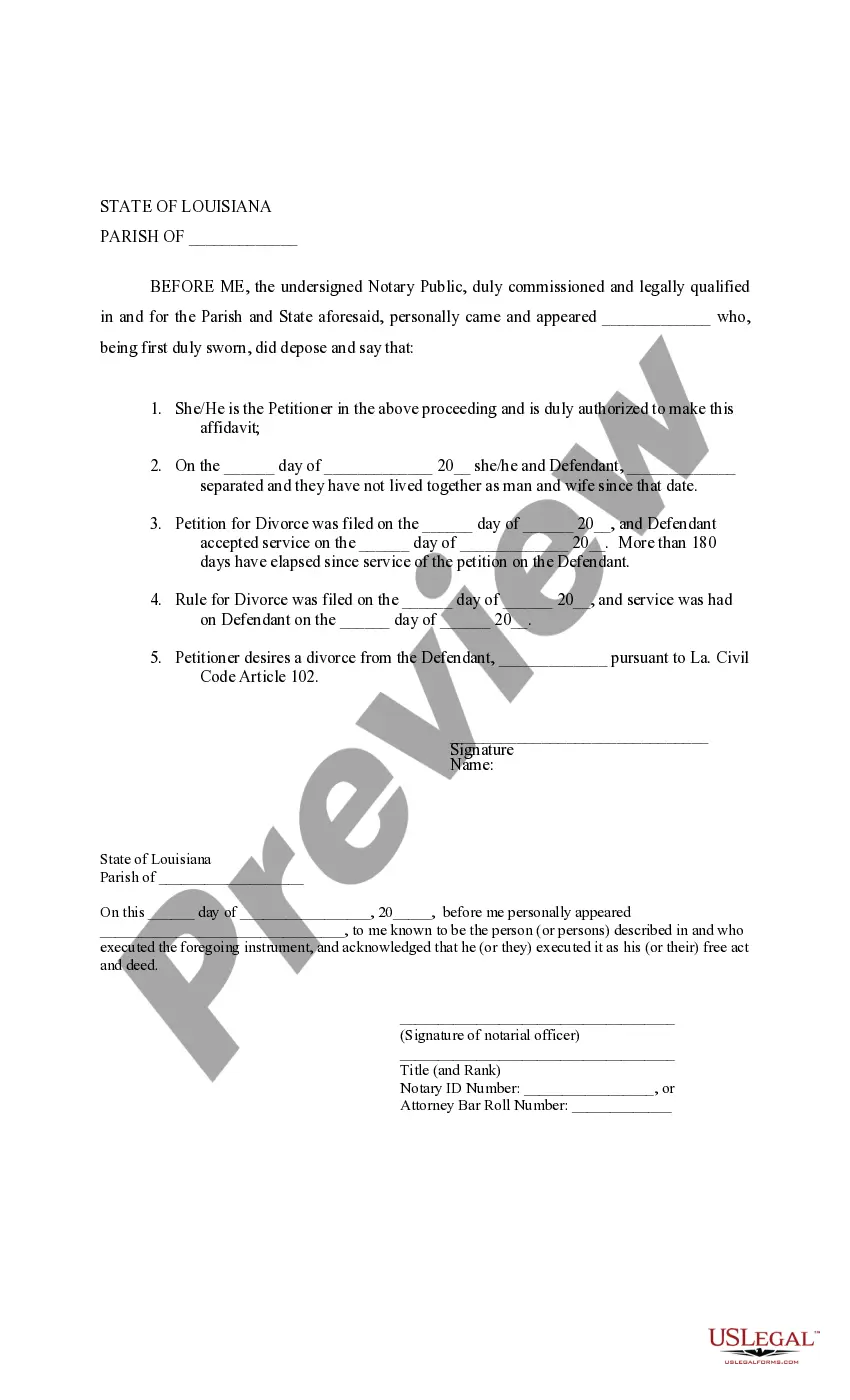

- Review the form summary or verify it through the Preview option.

- Find another example using the Search field in the header if the previous one does not meet your needs.

- Click Buy Now once you identify the appropriate Affidavit Of Facts Form Louisiana Withholding.

- Select a pricing plan that aligns with your needs and financial plan.

- Establish an account or Log In to continue to the payment section.

- Pay for your subscription through PayPal or using your credit card.

- Choose the format for your document and click Download.

- Print your document or submit it to an online editor for quicker completion.

Form popularity

FAQ

Employers are required to withhold income tax on all wages that are subject to Louisiana income tax as follows: Employers located in Louisianaincome tax must be withheld on all employee wages earned in Louisiana regardless of whether the employee is a resident or not.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

DOMESTIC CORPORATIONS Corporations organized under the laws of Louisiana must file Form CIFT-620, Louisiana Income Tax and Louisiana Corporation Franchise Tax return each year unless exempt from both taxes.

Louisiana Payroll Tax and Registration GuideApply online at the DOR's Taxpayer Access Point portal to receive an Account Number immediately after registration or apply with this form.Find an existing Account Number: on Form L-1, Employer's Return of Income Tax Withheld. by contacting the Dept of Revenue.

This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold Louisiana income tax from the employee's wages without exemption. Note to Employer: Keep this certificate with your records.