Louisiana Separate Property

Description

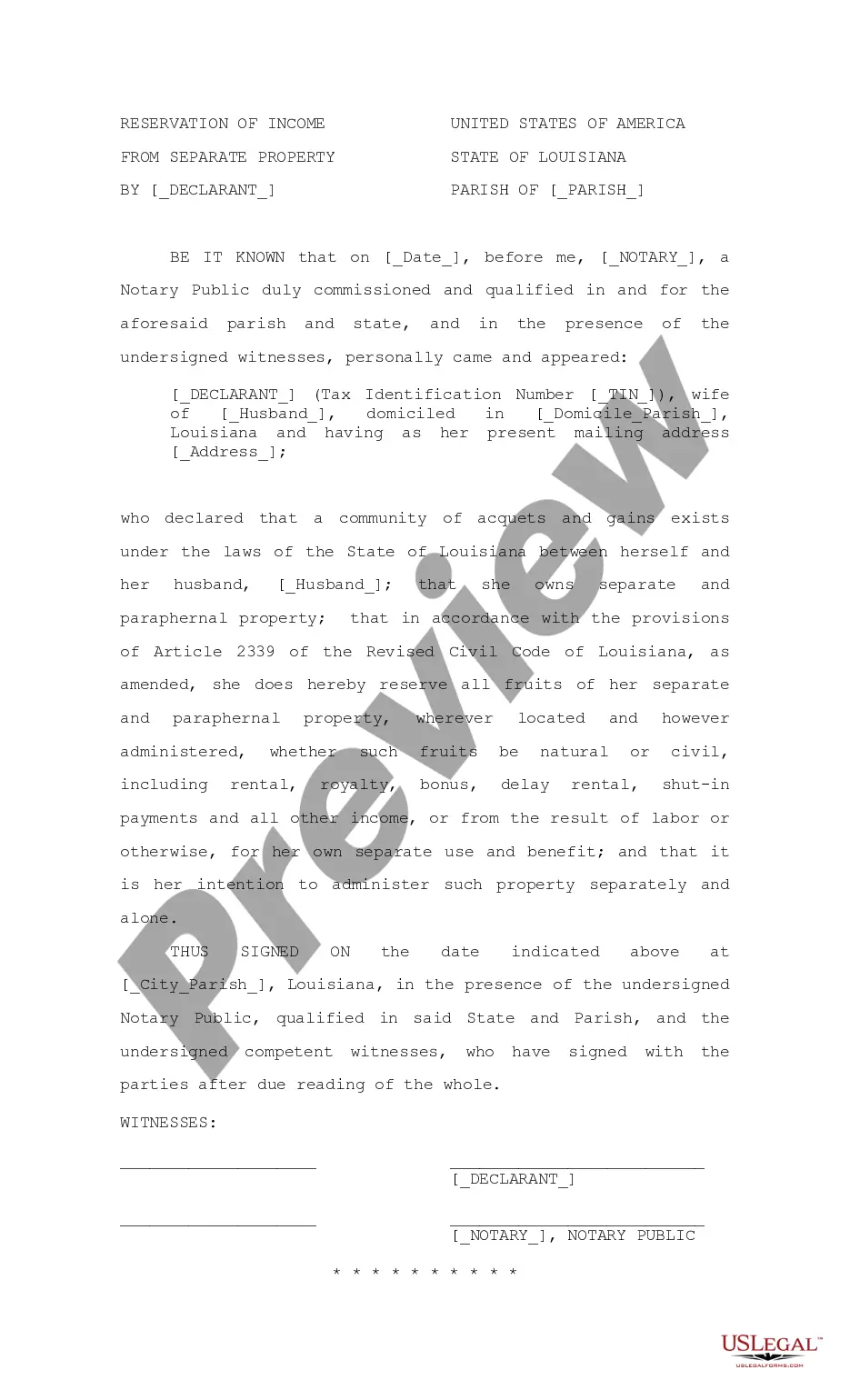

How to fill out Louisiana Reservation Of Income From Separate Property?

- Log in to your US Legal Forms account if you're a returning user, or create a new account if this is your first visit.

- Browse through our extensive collection of legal forms and utilize the Preview mode to find the specific Louisiana separate property document that suits your needs.

- Should you find any discrepancies, use the Search tab to pinpoint the correct form that aligns with your local jurisdiction.

- Click on the Buy Now button to select your preferred subscription plan and proceed to register for full access.

- Complete your purchase using a credit card or PayPal account to activate your subscription.

- Once the transaction is successful, download the form onto your device and access it any time via the My Forms menu in your profile.

US Legal Forms simplifies the legal document process, empowering users to execute necessary forms with confidence and ease. With access to a vast selection of over 85,000 templates, it stands out for its robust offerings and expert assistance.

Take charge of your legal matters today! Visit US Legal Forms and start your journey to accessing comprehensive legal support.

Form popularity

FAQ

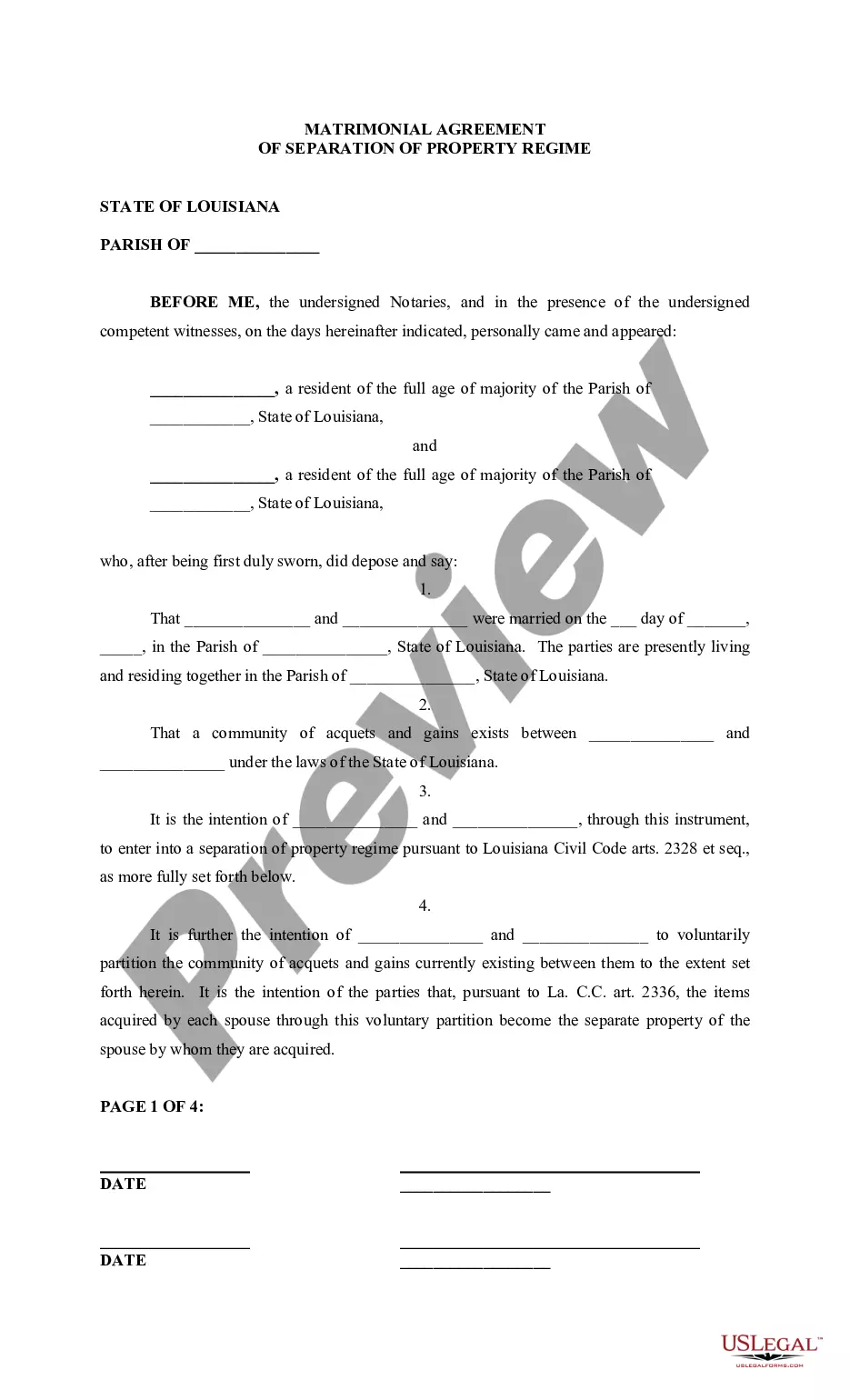

To file for separation in Louisiana, you need to start by preparing the necessary legal documents that showcase your status regarding Louisiana separate property. It is important to include all pertinent information about your marriage and the separation agreement. After completing the paperwork, you should file it with your local court. Utilizing a platform like US Legal Forms can simplify this process, as they provide templates that guide you through the filing requirements effectively.

To legally separate in Louisiana, you must file a petition with the court and be granted a separation judgment. This process involves providing evidence of your living arrangements and reasons for separation. Utilizing resources like USLegalForms can simplify your legal journey, ensuring your rights concerning Louisiana separate property are safeguarded.

The distinction between joint family property and separate property lies in ownership. Joint family property is owned collectively by both spouses, while separate property solely belongs to one spouse. Understanding this difference is essential for managing finances and planning for the future in compliance with Louisiana separate property laws.

Separate property in Louisiana includes assets acquired before marriage, inheritances, and gifts given to one spouse. Additionally, any income earned from separate property continues to be classified as separate. Recognizing what qualifies as separate property helps individuals protect their assets during disputes.

Separation of property in Louisiana allows spouses to manage their individual assets independently. In this arrangement, each spouse retains ownership of their property and debts, meaning Louisiana separate property laws apply. This can be advantageous for couples who wish to maintain financial independence while married.

Legally separated in Louisiana means that spouses have a court-declared separation that allows them to live apart while remaining married. This legal status affects property rights and obligations, especially in regard to Louisiana separate property. It's important to follow the proper legal procedures to ensure your assets are properly classified.

In Louisiana, separate property refers to assets that belong solely to one spouse, distinct from community property. During Louisiana succession, only separate property is passed down to heirs without sharing with the surviving spouse. Understanding this distinction is crucial, as it influences how assets are distributed after death.

The concept of joint family refers to a family structure where members share ownership of property and financial responsibilities. In comparison, separate family pertains to individual family units with distinct property rights, such as Louisiana separate property. This distinction can impact legal rights and considerations, particularly when navigating marriage or inheritance issues.

Louisiana separate property ensures that individual assets remain protected during marital disputes. This type of property allows for greater financial security and independence, especially if a marriage ends. Moreover, knowing how to manage Louisiana separate property can safeguard your investments and provide peace of mind regarding your financial future.

In Louisiana, the distinction between community property and separate property is clear. Community property includes everything earned or purchased during the marriage, while separate property includes assets owned prior to marriage or received as gifts. This classification is vital for legal purposes, particularly in divorce settlements, where Louisiana separate property can be shielded from division.