Seizure Notice Meaning

Description

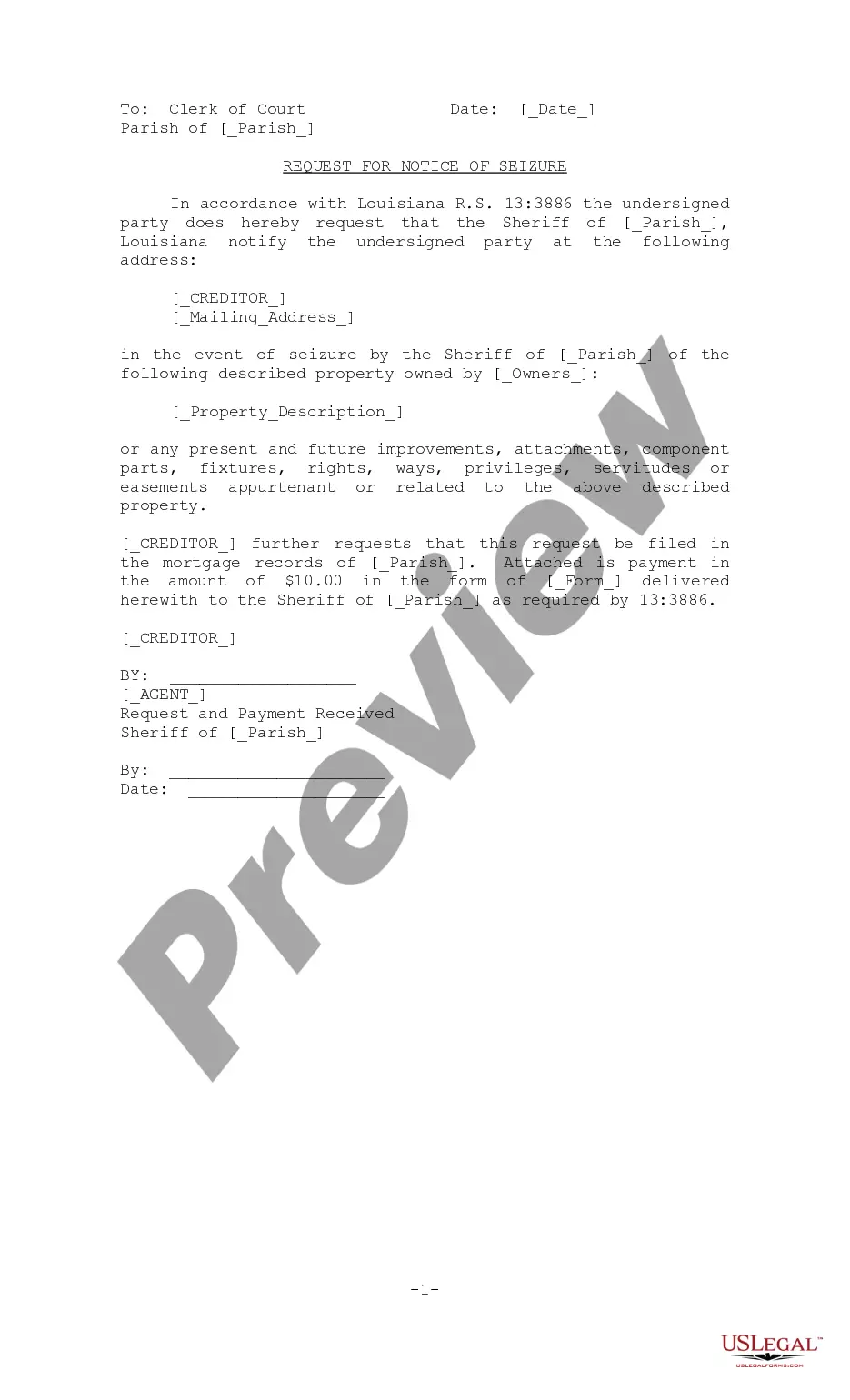

How to fill out Louisiana Request For Notice Of Seizure?

Securing a reliable source for obtaining the latest and suitable legal templates is a significant part of navigating bureaucracy. Selecting the appropriate legal documents necessitates accuracy and careful consideration, which is why it is crucial to gather examples of Seizure Notice Meaning exclusively from credible sources, such as US Legal Forms. An incorrect template can squander your time and hinder your current situation. With US Legal Forms, you can rest easy. You can access and review all the details regarding the document’s application and relevance for your case and within your state or county.

Take into account the following steps to complete your Seizure Notice Meaning.

Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms catalog to find legal templates, verify their applicability to your case, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- View the form’s description to ensure it meets the criteria of your state and locality.

- Check the form preview, if available, to confirm the form is indeed the one you need.

- Continue searching and find the suitable template if the Seizure Notice Meaning does not fit your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Choose the pricing plan that meets your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment option (credit card or PayPal).

- Select the file format for downloading Seizure Notice Meaning.

- After you have the form on your device, you can edit it using the editor or print it to complete it manually.

Form popularity

FAQ

The IRS must send you several notices before seizing your assets. The last notice is called "Final Notice. Notice Of Intent To Levy and Notice of Your Right to a Hearing". This means you are running out of time before the IRS can levy your bank account.

What Is a Notice of Seizure? A notice of seizure is a written notice from the Internal Revenue Service (IRS) to inform either an individual taxpayer or business that the government has seized its property.

What Does This Notice Mean? U.S. Customs may seize goods if they are contrary to law. If your merchandise is seized, you have options. In your seizure notice, you are provided a Fines, Penalties, and Forfeitures (FP&F) case number and assigned a paralegal.

Here are some reasons why you should not ignore a customs seizure letter: Legal Consequences: Ignoring a customs seizure letter can result in legal repercussions. The government has the authority to pursue legal action against individuals who fail to respond or take appropriate steps after receiving a seizure notice.

Seizure occurs when the government or its agent removes property from an individual's possession as a result of unlawful activity or to satisfy a judgment entered by the court.