Usufruct Louisiana Law

Description

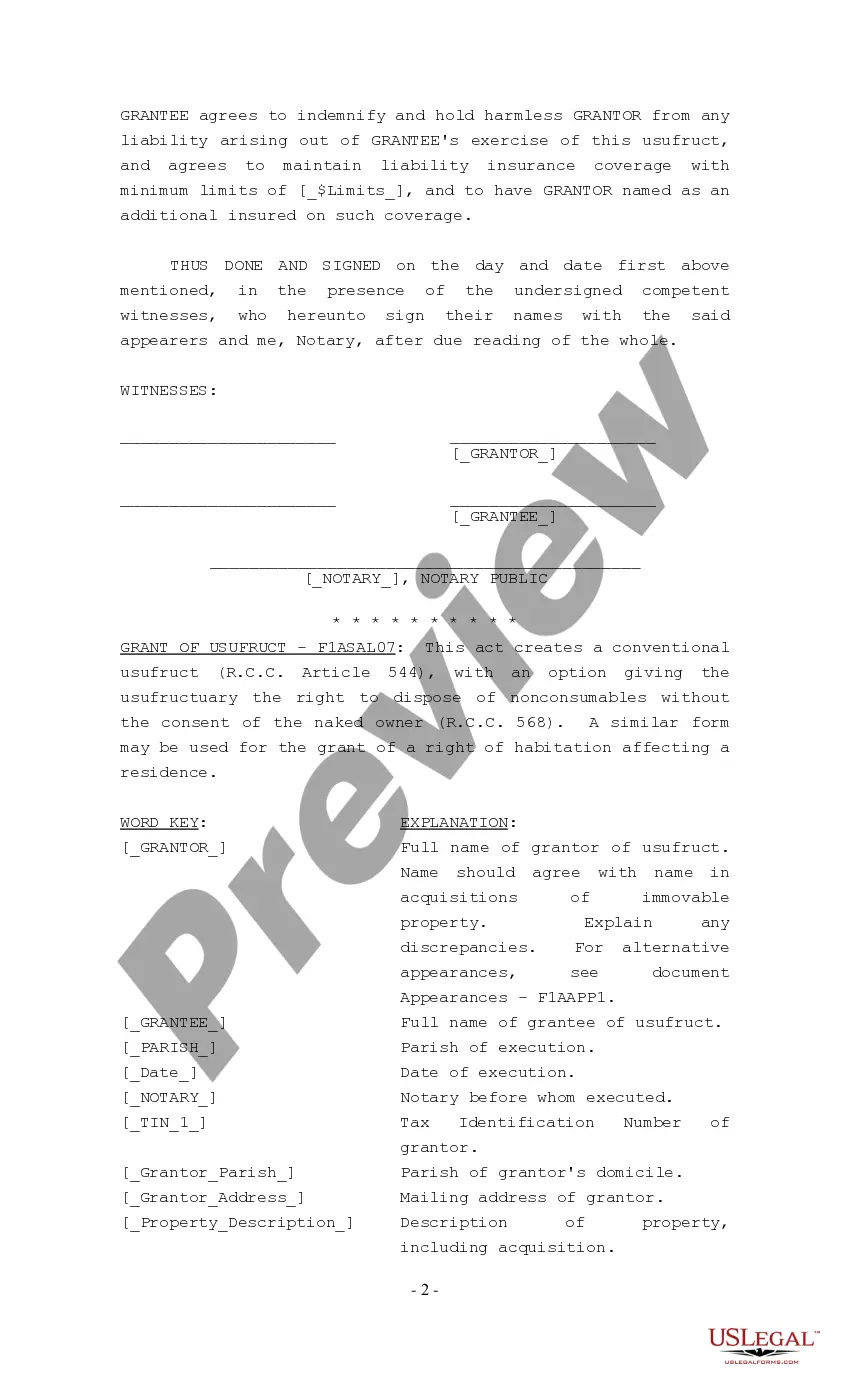

How to fill out Louisiana Grant Of Usufruct?

- Log in to your US Legal Forms account if you've used the service before, and ensure your subscription is active. If necessary, renew your plan.

- If you're new to US Legal Forms, start by checking the Preview mode and form description to confirm you've selected the correct document that aligns with your needs and local jurisdiction requirements.

- Search for any additional templates if needed by using the Search tab for the specific form that best meets your legal requirements.

- Click on the 'Buy Now' button to purchase your chosen document. Select a subscription plan that works for you and create an account to access the legal library.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the completed form to your device for easy access. You can also find it in the 'My Forms' section of your profile whenever needed.

In conclusion, US Legal Forms is an invaluable tool for individuals and attorneys alike, enabling seamless access to more than 85,000 legal forms and packages. The platform not only simplifies the document acquisition process but also connects users with legal experts for additional support.

Start your journey with US Legal Forms today to effortlessly handle your legal documents!

Form popularity

FAQ

Usufruct laws in Louisiana govern the rights and obligations of usufructuaries and owners under the state's civil code. Under these laws, a usufructuary has the right to use and benefit from the property, while the owner maintains the bare ownership. Understanding these laws is crucial for anyone involved in such arrangements. To gain deeper insights, you might explore platforms like uslegalforms, which offer detailed information on usufruct louisiana law.

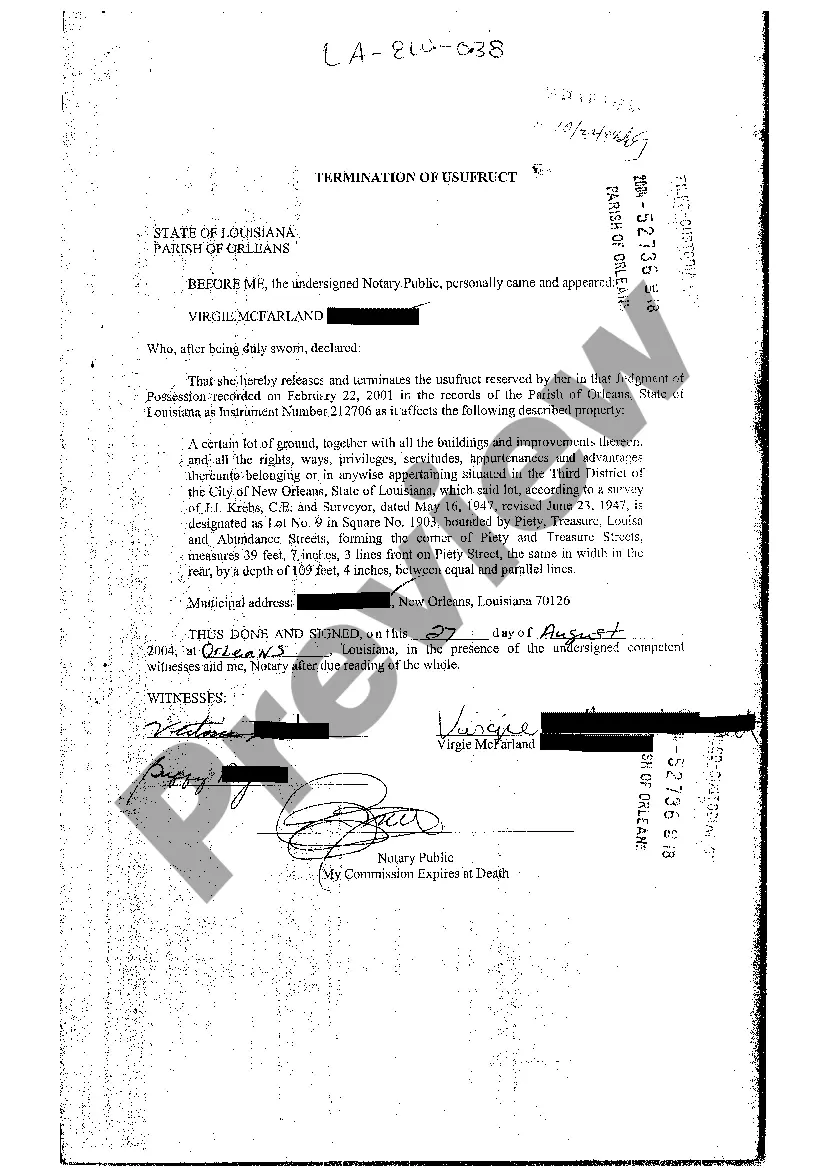

To terminate an usufruct in Louisiana, you must follow specific procedures that align with usufruct louisiana law. Start by reviewing your original agreement for termination clauses. Ensure you meet any conditions, such as notifying relevant parties or fulfilling specific obligations. For assistance, consider using legal services such as uslegalforms that can provide the templates and information you need to navigate the termination process smoothly.

In Louisiana, an usufruct can be terminated under several circumstances as defined by usufruct louisiana law. One common method is through the expiration of the time period established for the usufruct. Additionally, the usufruct can end if the usufructuary does not fulfill their obligations or by mutual agreement between parties. Knowing when and how to terminate an usufruct is essential, and you can refer to legal resources or platforms like uslegalforms for guidance.

The duration of usufruct in Louisiana can vary but usually lasts for the life of the usufructuary or a specific period indicated in the agreement. According to usufruct Louisiana law, clear terms should be established in the usufruct contract to minimize confusion. This clarity supports both parties in managing their rights and responsibilities effectively.

In Louisiana, if someone dies without a will, state intestacy laws determine inheritance. The deceased’s property typically goes to their closest relatives, which can include children, parents, or siblings. Understanding these laws can aid in estate planning and ensure your assets are distributed according to your wishes.

The duration of an usufruct in Louisiana is generally specified in the legal agreement, but according to usufruct Louisiana law, it can last for the lifetime of the usufructuary or a specified number of years. This flexibility allows for tailored arrangements that suit the needs of both parties. It's essential to formalize these terms to avoid future disputes.

An usufruct can be terminated in several ways under usufruct Louisiana law. It may end when the agreed-upon time expires, through mutual consent of the parties, or if the usufructuary fails to fulfill their obligations. Additionally, if the usufructuary sells the property without any authority, this can also lead to termination.

When a usufructuary dies, the usufruct automatically terminates, and the property reverts fully to the original owner. This transition is significant as it underscores the temporary nature of the usufruct rights. Usufruct louisiana law ensures that all benefits and responsibilities revert back to the titleholder. For clarity on such transitions, users can explore resources available through platforms like uslegalforms.

One of the primary tax implications of a usufruct agreement includes the potential income tax responsibilities on any income generated from the property. Additionally, understanding how property taxes are assessed can be significant. Usufruct louisiana law also impacts estate tax considerations upon the death of the usufructuary or owner. Therefore, it is wise to discuss these implications with a legal expert to avoid surprises.

Typically, the usufructuary pays the income and property taxes related to the property they are using under the usufruct arrangement. Meanwhile, the original owner remains responsible for certain taxes, particularly those on real estate. Understanding these dynamics is essential as you navigate the intricacies of usufruct louisiana law. Consulting with professionals can clarify your tax obligations.