Usufruct La Without A Will

Description

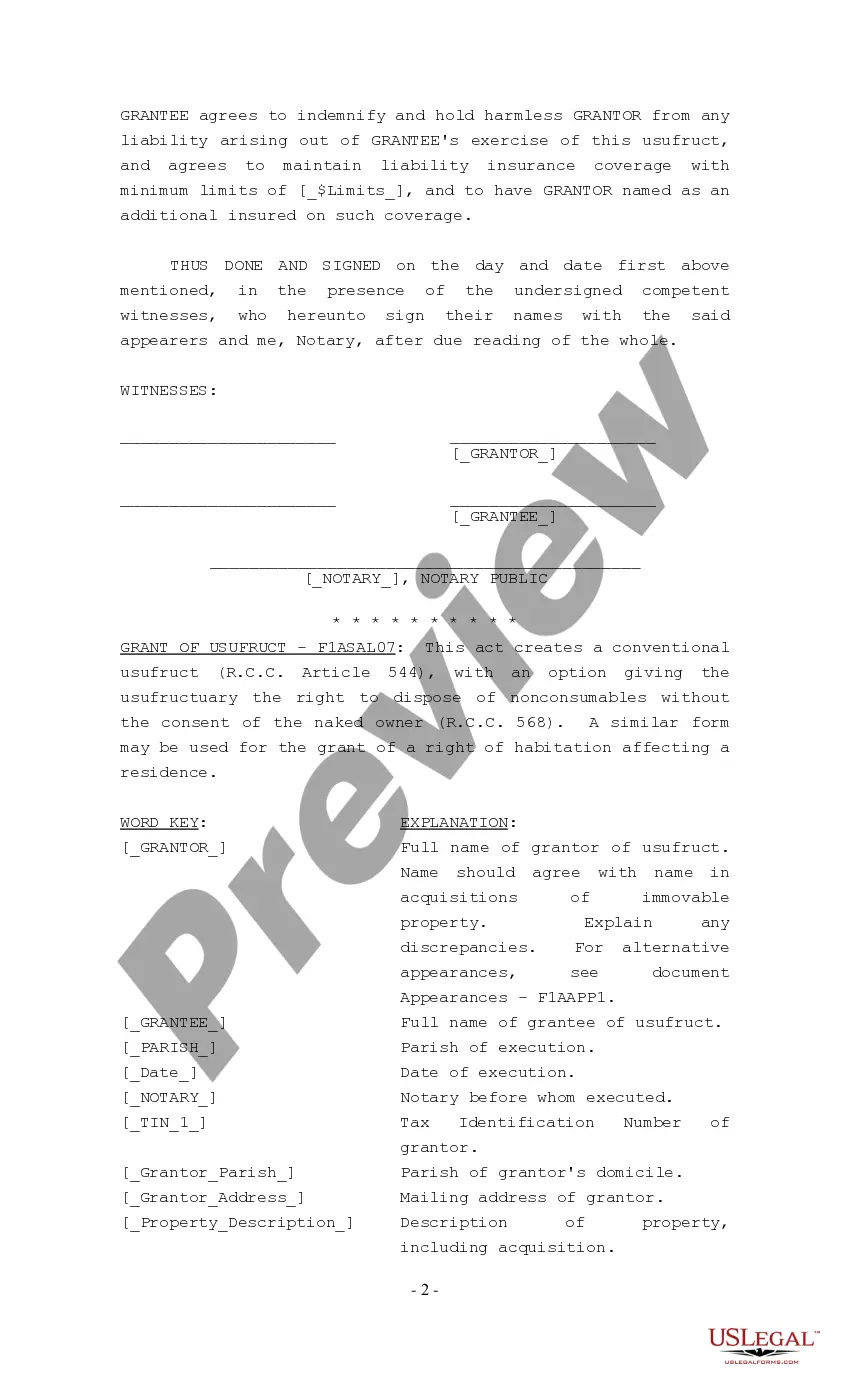

How to fill out Louisiana Grant Of Usufruct?

Securing a reliable source for obtaining the latest and suitable legal documents is a significant part of navigating bureaucracy.

Selecting the appropriate legal forms requires accuracy and meticulousness, which is why it is crucial to obtain Usufruct La Without A Will samples exclusively from trustworthy providers, such as US Legal Forms. An incorrect document can squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns. You can access and review all pertinent information regarding the document’s application and relevance to your situation and in your jurisdiction.

Once you have the form saved on your device, you can modify it using the editor or print it out and fill it in by hand. Remove the stress associated with your legal paperwork. Explore the extensive US Legal Forms database to discover legal templates, review their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search function to find your template.

- Examine the form’s description to determine if it aligns with your state and local requirements.

- Check the form preview, if available, to ensure it is indeed the document you are seeking.

- Continue searching and locate the correct document if the Usufruct La Without A Will does not meet your needs.

- If you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing option that fits your requirements.

- Proceed to registration to complete your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file type for downloading Usufruct La Without A Will.

Form popularity

FAQ

Louisiana's intestate rules distribute a deceased person's assets to various relatives, beginning with the children and spouse and extending to other descendants, ancestors, and descendants of ancestors.

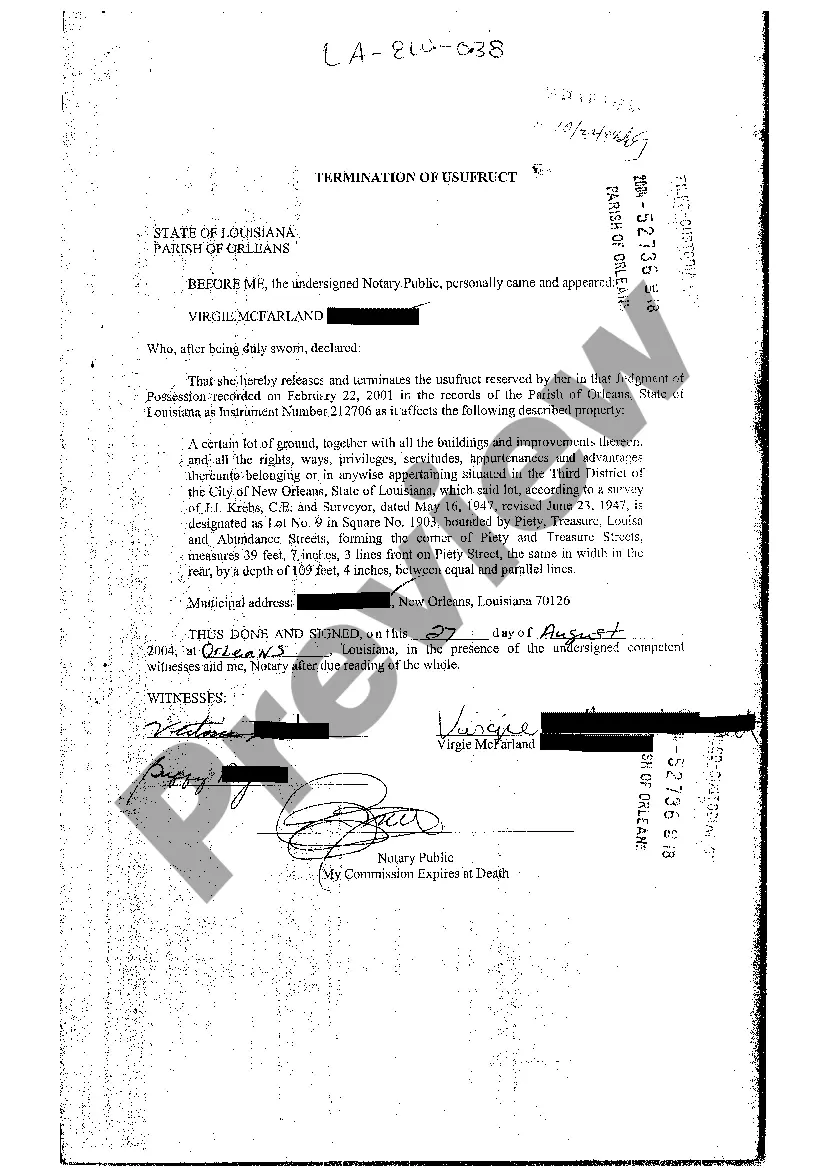

This usufruct that Louisiana Succession Law provides for a surviving spouse is not automatically given for life, but instead, terminates when the surviving spouse dies or remarries, whichever occurs first.

Usufructs and Naked Ownership Under Louisiana Law A usufruct is a right by one person over the property of another. It is similar to a life estate in common law jurisdictions, except that a usufruct can last for a specific period of time other than a lifetime.

If the decedent did not have a testament, his or her property and assets will be distributed ing to state law, but the succession process will proceed in a similar manner to an estate with a testament. The court will appoint an estate administrator, and the state will determine who inherits which assets.

Distribution to surviving descendants. Under Louisiana's intestate succession laws, separate property is distributed first to a deceased person's children. Each child of the deceased person will share equally in the separate property.