Usufruct In Louisiana Without A Will

Description

How to fill out Louisiana Grant Of Usufruct?

It’s clear that you cannot instantly become a legal authority, nor can you understand how to swiftly create Usufruct In Louisiana Without A Will without possessing a specialized skillset.

Assembling legal documents is a lengthy endeavor that necessitates particular education and expertise. So why not entrust the creation of the Usufruct In Louisiana Without A Will to the professionals.

With US Legal Forms, which boasts one of the most extensive libraries of legal templates, you can find everything from court documents to templates for internal office communication.

If you require a different form, start your search over.

Create a free account and choose a subscription option to purchase the form. Click Buy now. Once the payment is processed, you can access the Usufruct In Louisiana Without A Will, fill it out, print it, and send or mail it to the specified individuals or organizations.

- We recognize the importance of compliance and adherence to federal and state legislation and regulations.

- This is why, on our platform, all forms are location-specific and current.

- Let’s begin with our website and obtain the form you need in just a few minutes.

- Locate the form you require using the search bar at the top of the page.

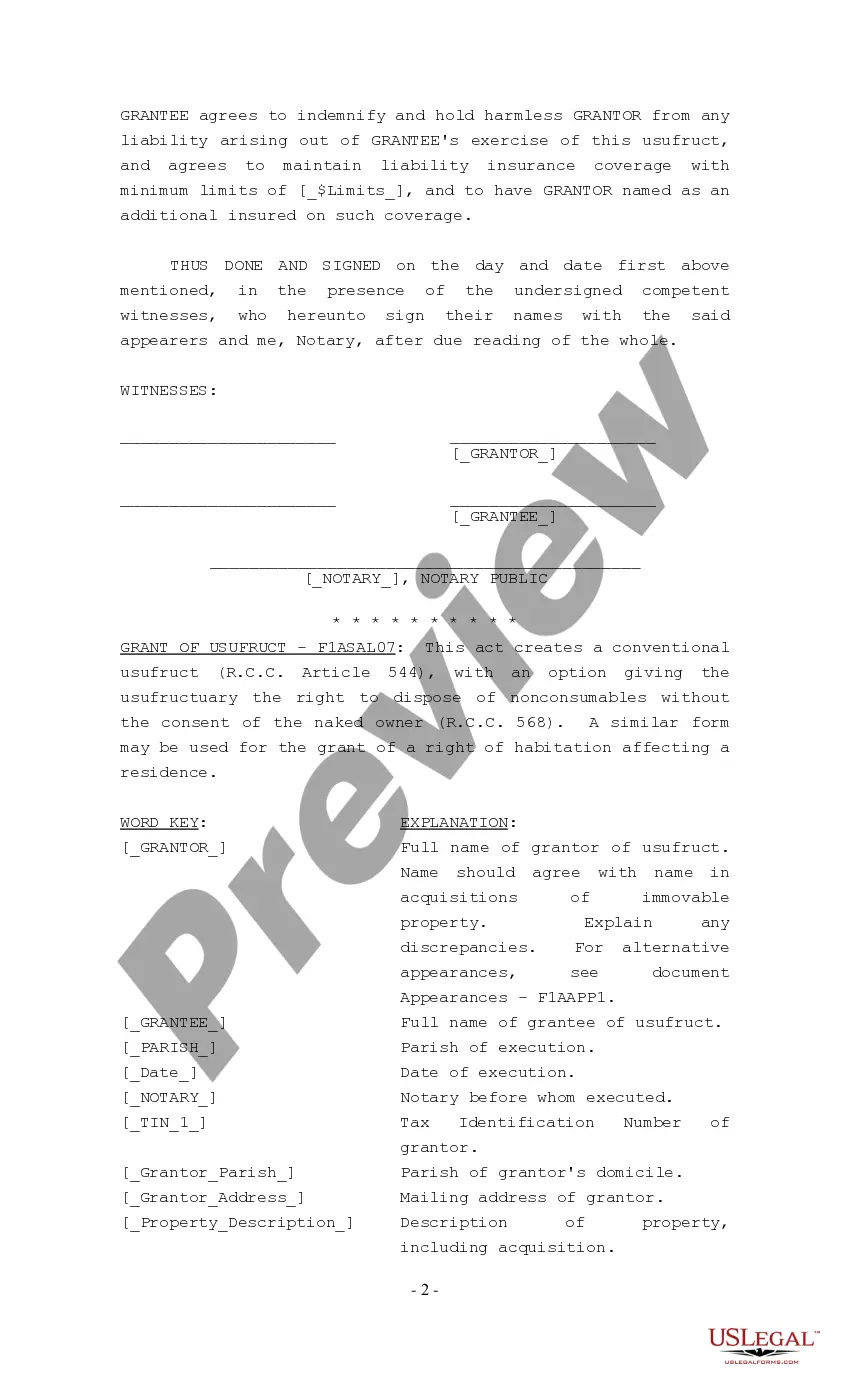

- Preview it (if the option is available) and review the accompanying description to determine if Usufruct In Louisiana Without A Will is what you're seeking.

Form popularity

FAQ

If the decedent did not have a testament, his or her property and assets will be distributed ing to state law, but the succession process will proceed in a similar manner to an estate with a testament. The court will appoint an estate administrator, and the state will determine who inherits which assets.

To summarize Louisiana law on inherited property, community property is inherited in the following order: To the children in naked ownership subject to the usufruct in favor of the spouse, if there are any children. To the spouse in full ownership if there are no children.

If you die without parents, siblings, or descendants -- that is, children, grandchildren, or great grandchildren -- your spouse will inherit all of your property. If you do have descendants, your spouse will share your property with them ing to the rules set out in the chart above.

If an individual dies without a will in Louisiana, their estate becomes subject to intestate succession. During intestate succession, the state will distribute a decedent's assets ing to intestate law. The heirs will receive assets ? starting with children and spouses before moving to other descendants.

Treatment of Separate Property under Louisiana Intestate Law. If a person dies without a will in Louisiana, his or her separate property is distributed among his relatives. The Louisiana Code groups the relatives into categories and gives certain categories priority over others. Distribution to surviving descendants.