Usufruct Formula

Description

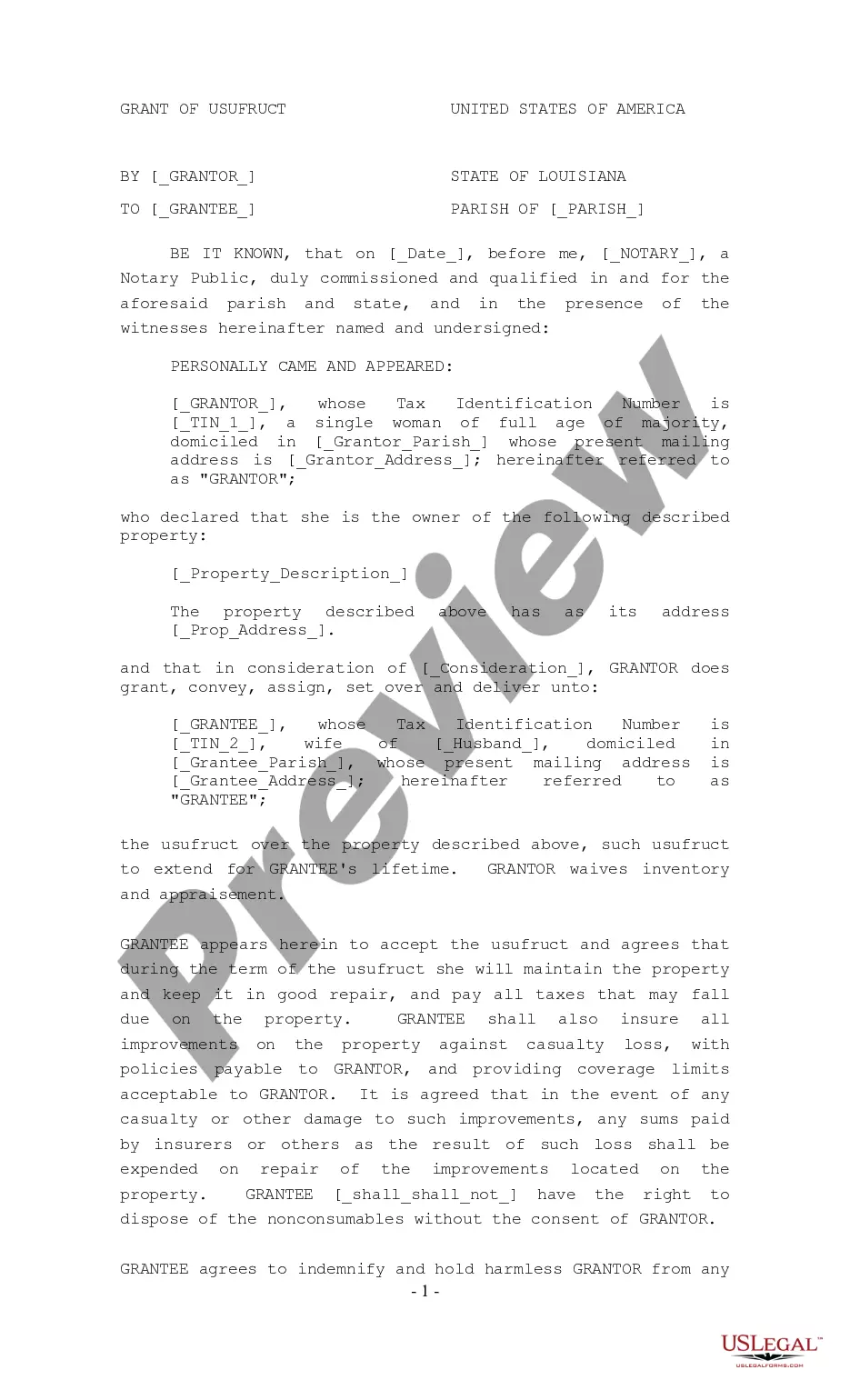

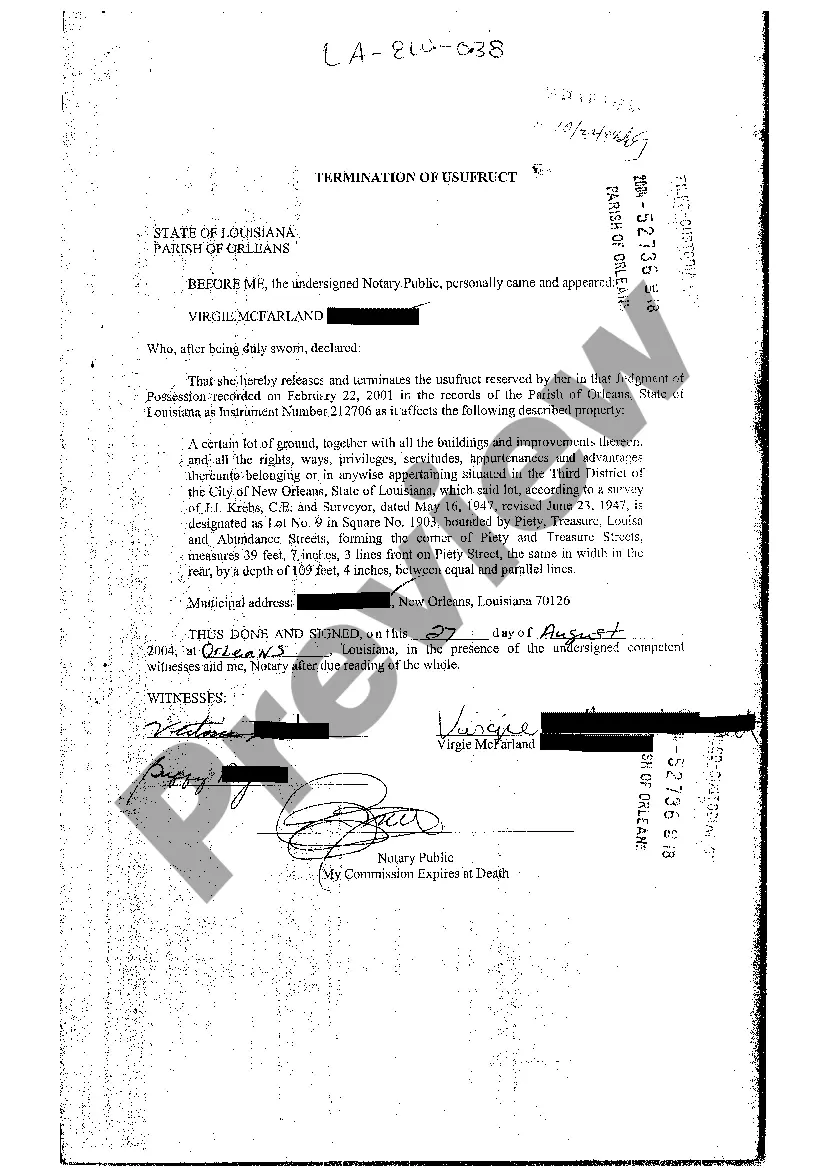

How to fill out Louisiana Grant Of Usufruct?

Handling legal documentation can be daunting, even for the most seasoned experts.

If you are looking for a Usufruct Formula and find yourself lacking the time to search for the correct and latest version, the processes can become anxiety-inducing.

US Legal Forms caters to all your needs, from personal to business documentation, all in one location.

Employ cutting-edge tools to fill out and manage your Usufruct Formula.

Follow these steps after acquiring the form you need: Confirm it is the correct form by previewing it and reviewing its description.

- Access an invaluable resource library of articles, manuals, and materials relevant to your case and needs.

- Save both effort and time when searching for the documents you require, utilizing US Legal Forms' sophisticated search and Preview feature to locate Usufruct Formula and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Visit the My documents tab to review the documents you have previously downloaded and manage your files as desired.

- If it's your first experience with US Legal Forms, establish a complimentary account for unlimited access to the resource library's full benefits.

- A comprehensive online form repository could revolutionize the way anyone tackles these circumstances efficiently.

- US Legal Forms stands out as a frontrunner in online legal documents, offering over 85,000 legal forms tailored to specific states available at your convenience.

- With US Legal Forms, you gain access to a plethora of state-specific or county-specific legal and business forms.

Form popularity

FAQ

The taxation of usufruct can be intricate, as it often depends on various factors, including state laws and the specifics of the usufruct agreement. Generally, the individual holding the usufruct may need to report any income generated from the property as taxable income. Moreover, understanding the usufruct formula can help clarify any deductions related to property maintenance and improvements. For specific guidance, consider using the US Legal Forms platform, which offers resources and templates tailored to your needs.

A common example of usufruct occurs when a parent allows a child to live in the family home while still retaining ownership. The child enjoys the right to use and benefit from the property, while the parent maintains ownership until a specified condition, like the parent's death. This scenario illustrates how the usufruct formula works in real-life situations.

Typically, the usufructuary is responsible for paying the taxes associated with the property while possessing it. This includes property taxes, income taxes from any generated revenue, and other applicable fees. Knowing your obligations through the usufruct formula ensures that both parties understand their financial responsibilities.

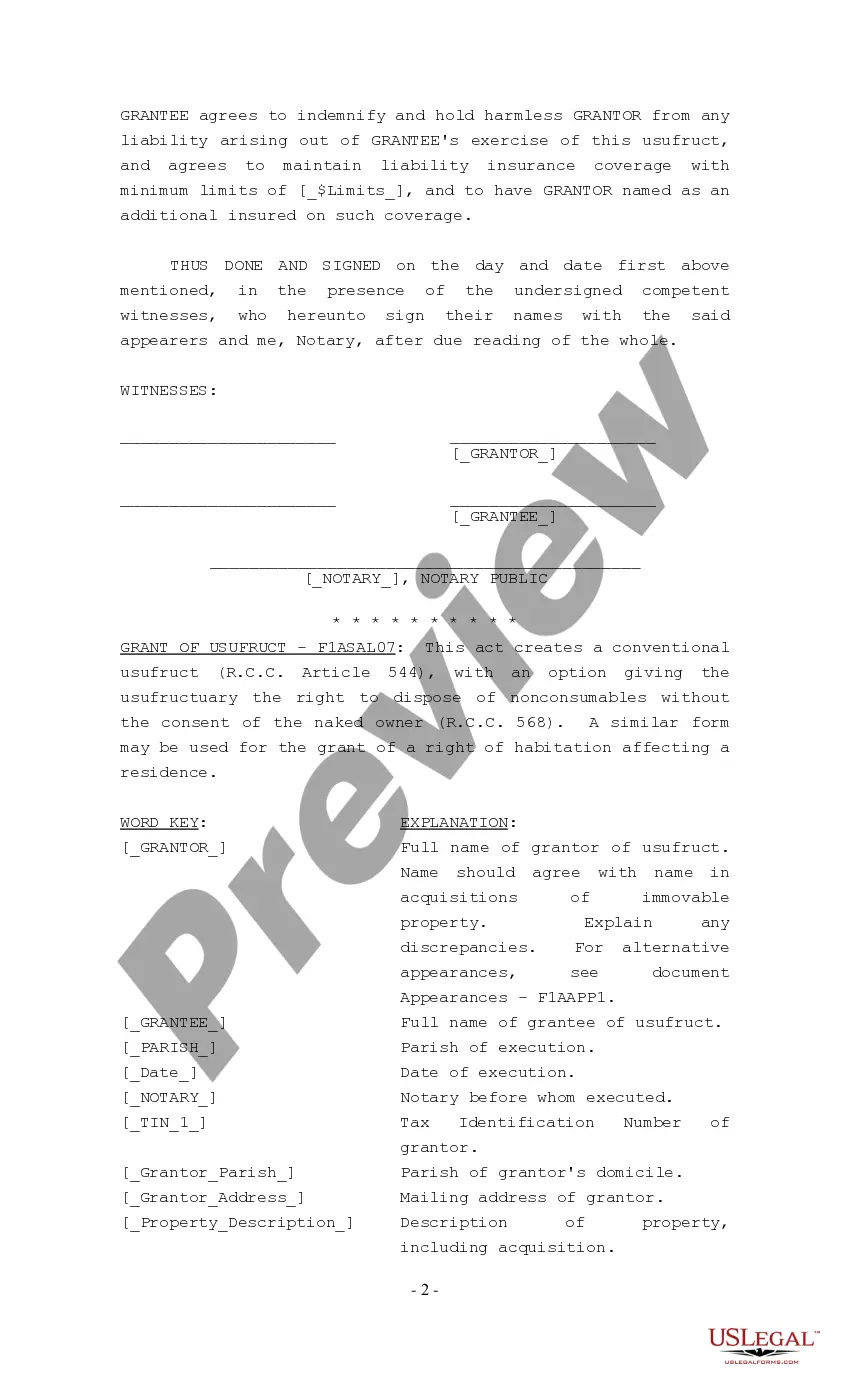

An usufruct can be terminated in several ways, including the expiration of the agreed term, mutual agreement between parties, or the death of the usufructuary. Additionally, if the usufructuary fails to fulfill their obligations regarding the property, it may be terminated through legal action. Always refer to the usufruct formula within your contract for detailed termination procedures.

The primary rule of usufruct is to allow the usufructuary to use the property as if they own it, without altering its essential nature. This concept ensures that the property is preserved for the reversioner while providing enjoyment to the usufructuary. Understanding the rules surrounding usage and maintenance is crucial for anyone considering the usufruct formula.

Valuing an usufruct involves assessing the benefits derived from the property over time. This often includes estimating the income that the property can generate while accounting for the duration of the usufruct. To accurately determine this value, reference to a specific usufruct formula is essential, as it provides a clear framework for valuation.

In general, the term of an usufruct can vary based on the agreement between parties. Typically, an usufruct can last for a specified time, often until the death of the usufructuary or a predetermined duration. However, it is crucial to consult the usufruct formula detailed in your legal documentation to understand the specific terms that apply.

When a usufructuary dies, the rights granted by the usufruct automatically end. The property then reverts back to the owner or their heirs, per the usufruct formula regulations. This transition should be handled carefully to address any outstanding responsibilities or benefits. If you need assistance navigating these changes, US Legal Forms offers resources that can guide you through the legal nuances.

Filing for portability is a process that allows you to transfer property tax benefits to another property. First, ensure you understand the requisite documents, as they may vary by state. You will need to complete specific forms, which often include the usufruct formula in your calculations. US Legal Forms provides the necessary templates to help simplify this process, ensuring you make the right steps.

The derivative of usufruct involves understanding the rights that come with this legal concept. Usufruct allows a person to use and benefit from another's property without owning it. It’s essential to know the usufruct formula that outlines the responsibilities of the usufructuary. For detailed guidance and resources, consider visiting US Legal Forms, where you can find relevant templates and legal advice.