Usufruct Form For Trust

Description

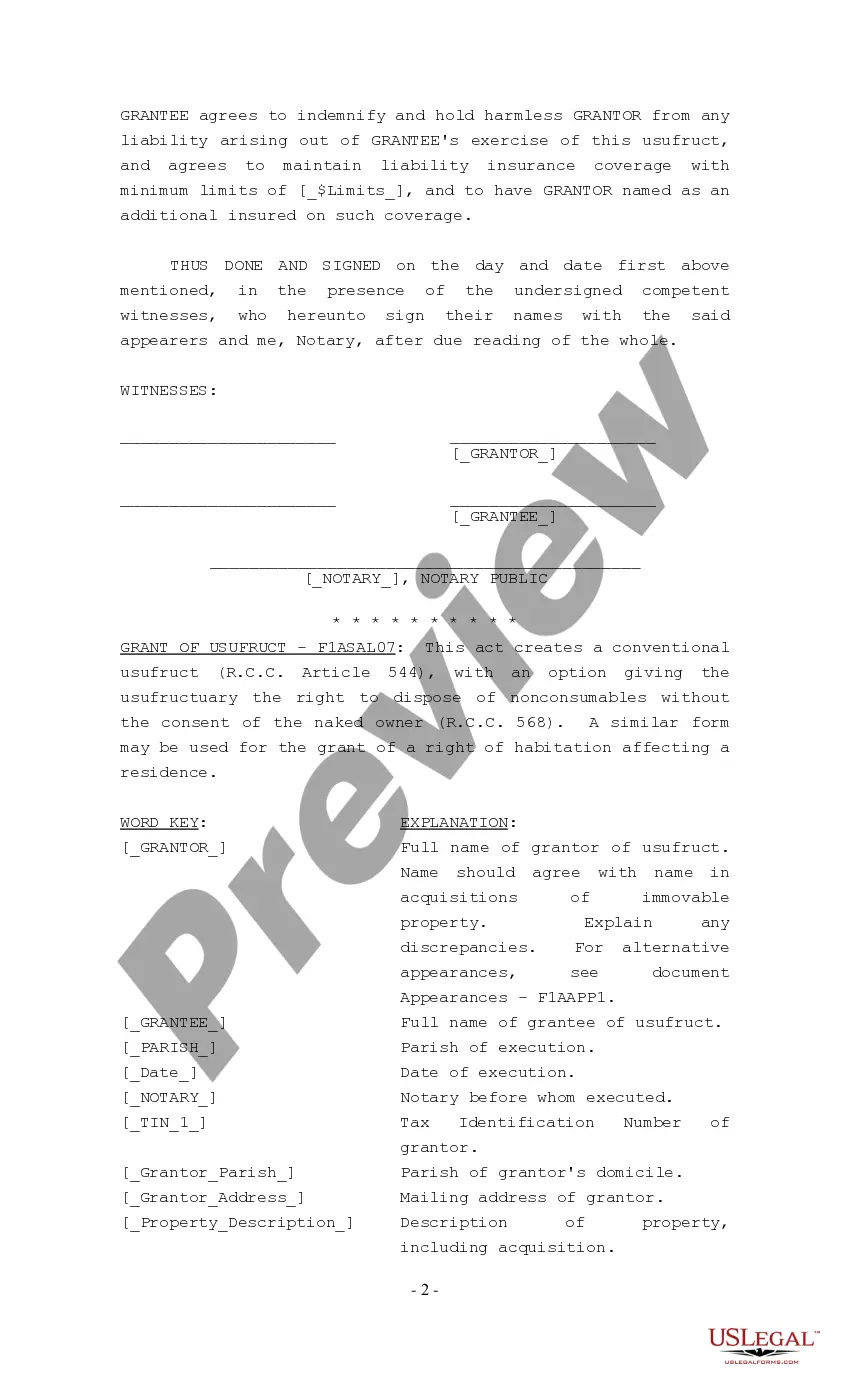

How to fill out Louisiana Grant Of Usufruct?

Legal administration can be overwhelming, even for the most informed professionals.

When you are looking for a Usufruct Form For Trust and do not have the time to invest in finding the correct and updated version, the procedures can be challenging.

US Legal Forms addresses any needs you may have, from personal to business documentation, all in one location.

Use advanced tools to complete and manage your Usufruct Form For Trust.

Below are the steps to follow after obtaining the form you need: Ensure it is the correct document by previewing it and reviewing its description. Confirm that the sample is accepted in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the format you desire, and Download, complete, sign, print, and submit your document. Benefit from the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your everyday document management into a straightforward and user-friendly process today.

- Access a repository of articles, guides, handbooks, and materials related to your situation and needs.

- Save time and effort searching for the documents you require, and utilize US Legal Forms' advanced search and Preview feature to find Usufruct Form For Trust and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents section to see the documents you have previously downloaded and manage your folders as needed.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

- A robust online form library could revolutionize the way everyone manages these scenarios effectively.

- US Legal Forms is a leader in the online legal form industry, providing over 85,000 state-specific legal documents available to you at any time.

- With US Legal Forms, you can access legal and organizational forms specific to your state or county.

Form popularity

FAQ

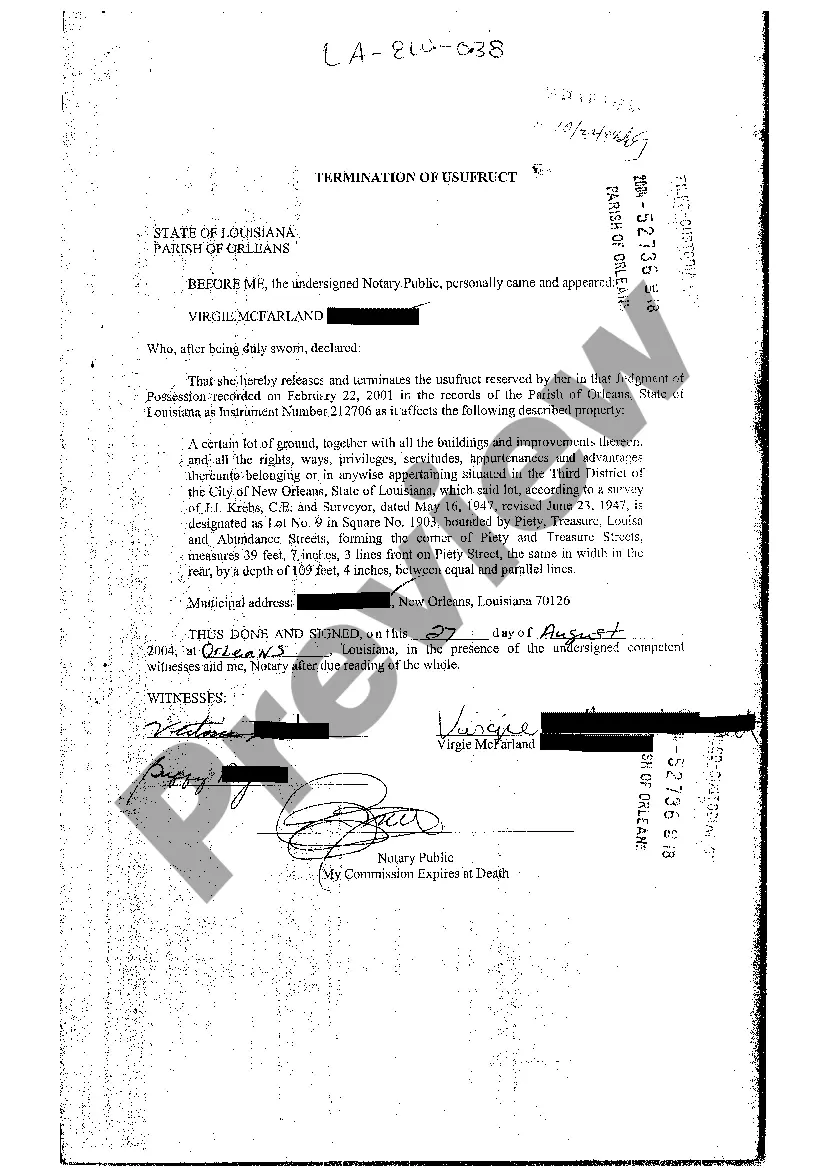

Usufruct is the right to use and benefit from a property, while the ownership of which belongs to another person. The person who enjoys the usufruct is called the usufructuary.

A usufruct is established by law in favor of a surviving spouse when a community property spouse dies intes- tate, whereupon the decedent's children become the ?naked owners? subject to that usufruct. The granting of a usufruct is not constrained to the laws of intes- tacy, however.

A usufruct is a legal right ed to a person or party that confers the temporary right to use and derive income or benefit from someone else's property. It is a limited real right that can be found in many mixed and civil law jurisdictions. A usufructuary is the person holding the property by usufruct.

The perfect usufruct includes only those things that a usufructuary (one who holds property under right of usufruct) can use without changing their substance, such as land, buildings, or movable objects; the substance of the property, however, may be altered naturally over time and by the elements.

U.S. Tax of a Usufruct It is similar to owning an asset as a secondary owner with no right to income. While it may be reportable (FBAR & FATCA), if there is no income attributed to the naked owner, then there is no tax. As to the Usufruct, they would be taxed.