Louisiana Usufruct Of Surviving Spouse

Description

How to fill out Louisiana Grant Of Usufruct?

Managing legal paperwork and processes can be a lengthy addition to your whole day.

Louisiana Usufruct Of Surviving Spouse and similar forms generally necessitate that you look for them and find the optimal way to fill them out accurately.

For this reason, whether you are handling financial, legal, or personal issues, utilizing a comprehensive and straightforward online directory of forms when needed will be very beneficial.

US Legal Forms is the premier online source of legal templates, featuring over 85,000 state-specific documents and a range of resources that facilitate easy completion of your forms.

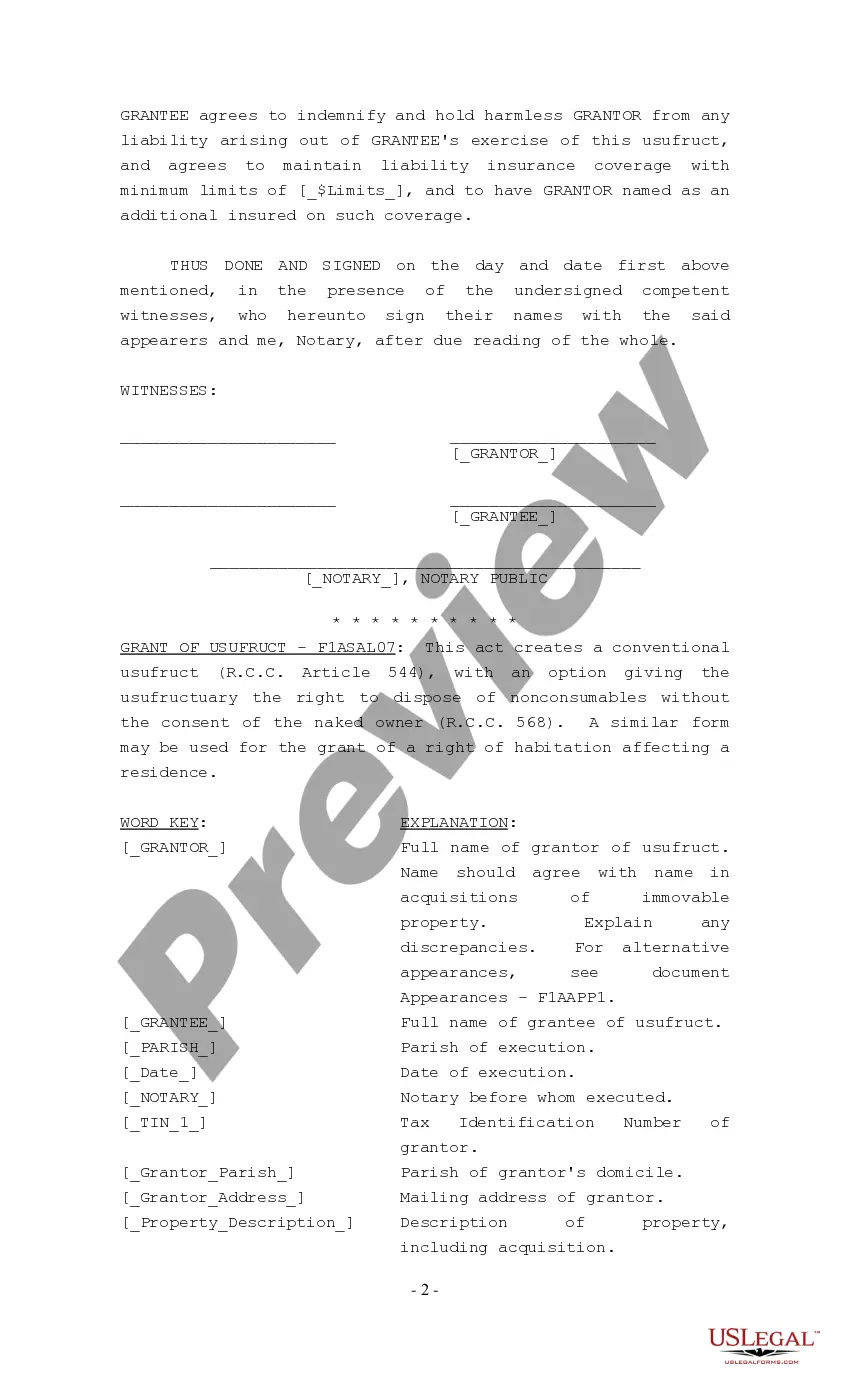

Is it your first time utilizing US Legal Forms? Sign up and establish your account in a few minutes to gain access to the form directory and Louisiana Usufruct Of Surviving Spouse. Then, follow the steps below to complete your document: Make sure you have located the correct form using the Review function and examining the form description. Select Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download then fill out, eSign, and print the form. US Legal Forms has 25 years of expertise assisting users in managing their legal documents. Locate the form you require now and streamline any process with ease.

- Explore the collection of suitable documents available to you with just a single click.

- US Legal Forms offers you state- and county-specific forms accessible at any time for download.

- Safeguard your document management workflows with a reliable service that enables you to create any form within moments without additional or concealed fees.

- Simply Log In to your account, find Louisiana Usufruct Of Surviving Spouse, and download it immediately from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

If you die without parents, siblings, or descendants -- that is, children, grandchildren, or great grandchildren -- your spouse will inherit all of your property. If you do have descendants, your spouse will share your property with them ing to the rules set out in the chart above.

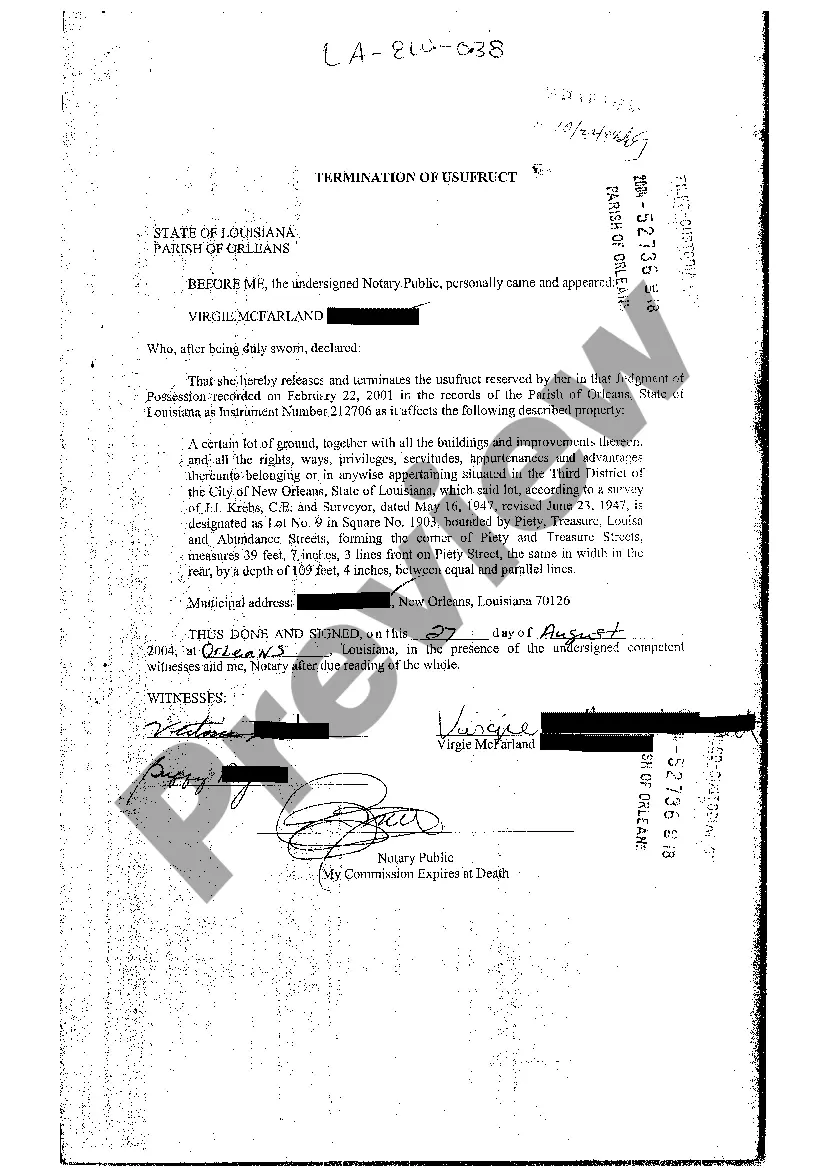

If the deceased spouse is survived by descendants, the surviving spouse shall have a usufruct over the decedent's share of the community property to the extent that the decedent has not disposed of it by testament. This usufruct terminates when the surviving spouse dies or remarries, whichever occurs first.

Joint Tenants With Rights of Survivorship (JTWROS): property ownership where two or more individuals hold an equal and undivided interest in the property, and upon the death of one joint tenant, their interest in the property automatically passes to the surviving joint tenants.

If a married person dies without a will, the surviving spouse inherits a usufruct over the deceased spouse's one-half of the community property until the surviving spouse's death or remarriage.

In the case of joint-ownership, if one of the owners dies, his or her share automatically goes to the other joint owner/s of the property. However, in the tenants in common mode, the shares pass on to the legal heirs.