Promissory Note Template Louisiana With Compound Interest

Description

How to fill out Louisiana Promissory Note - Unsecured - No Interest?

How to obtain certified legal documents that adhere to your state laws and prepare the Promissory Note Template Louisiana With Compound Interest without hiring an attorney.

Numerous online services offer templates to address various legal situations and formal requirements. However, it may require time to identify which of the accessible samples fulfill both practical use and legal standards for you.

US Legal Forms is a reliable platform that assists you in finding official documents created in accordance with the most recent state law revisions and saves you expenses on legal help.

If you do not have a US Legal Forms account, follow the steps below: Visit the webpage you’ve opened and check if the form meets your requirements.

- US Legal Forms is not just a typical online library.

- It is a compilation of over 85,000 validated templates for various business and personal situations.

- All documents are categorized by area and state to streamline your searching experience.

- Moreover, it incorporates robust options for PDF editing and electronic signing, enabling users with a Premium subscription to swiftly complete their paperwork online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already possess an account, sign in and verify that your subscription is active.

- Download the Promissory Note Template Louisiana With Compound Interest by clicking the corresponding button next to the file name.

Form popularity

FAQ

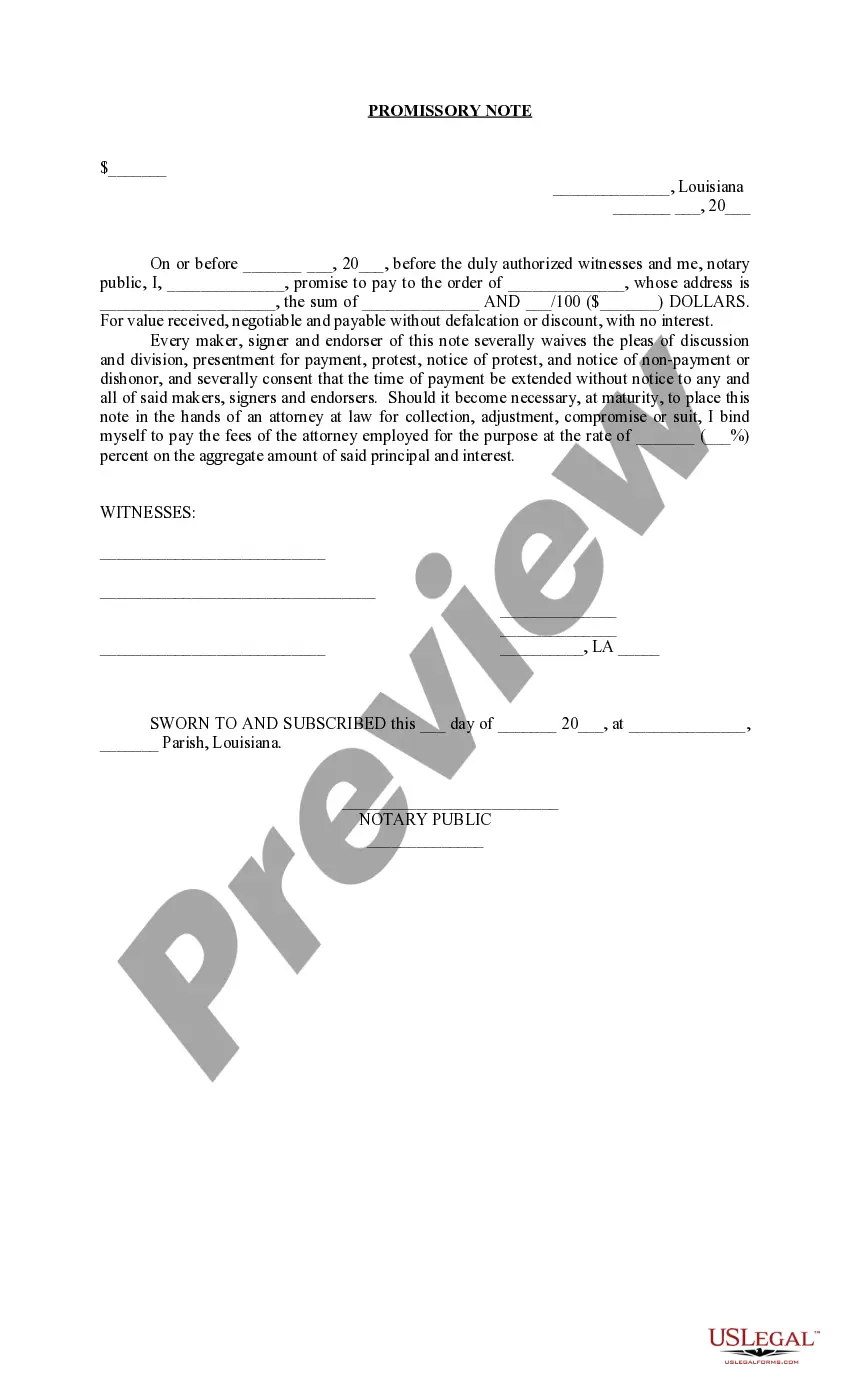

1. INTEREST. Interest shall accrue on the unpaid principal balance of the Promissory Note at the applicable federal rate in effect on , 199 , which was percent ( %) per annum, compounded semiannually.

Find the principal amount of the loan as stated in the promissory note. Use a free online amortization calculator to calculate the amount of monthly interest. Divide the monthly interest amount by the principal loan amount to get the monthly interest rate.

Calculating Compound Interest Compound interest uses a more complicated formula: You must add 1 to the interest rate (for example, a 5 percent interest rate would mean 1 + 0.05 = 1.05) and then raise the total to the power of whatever the number of periods is for repayment.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.