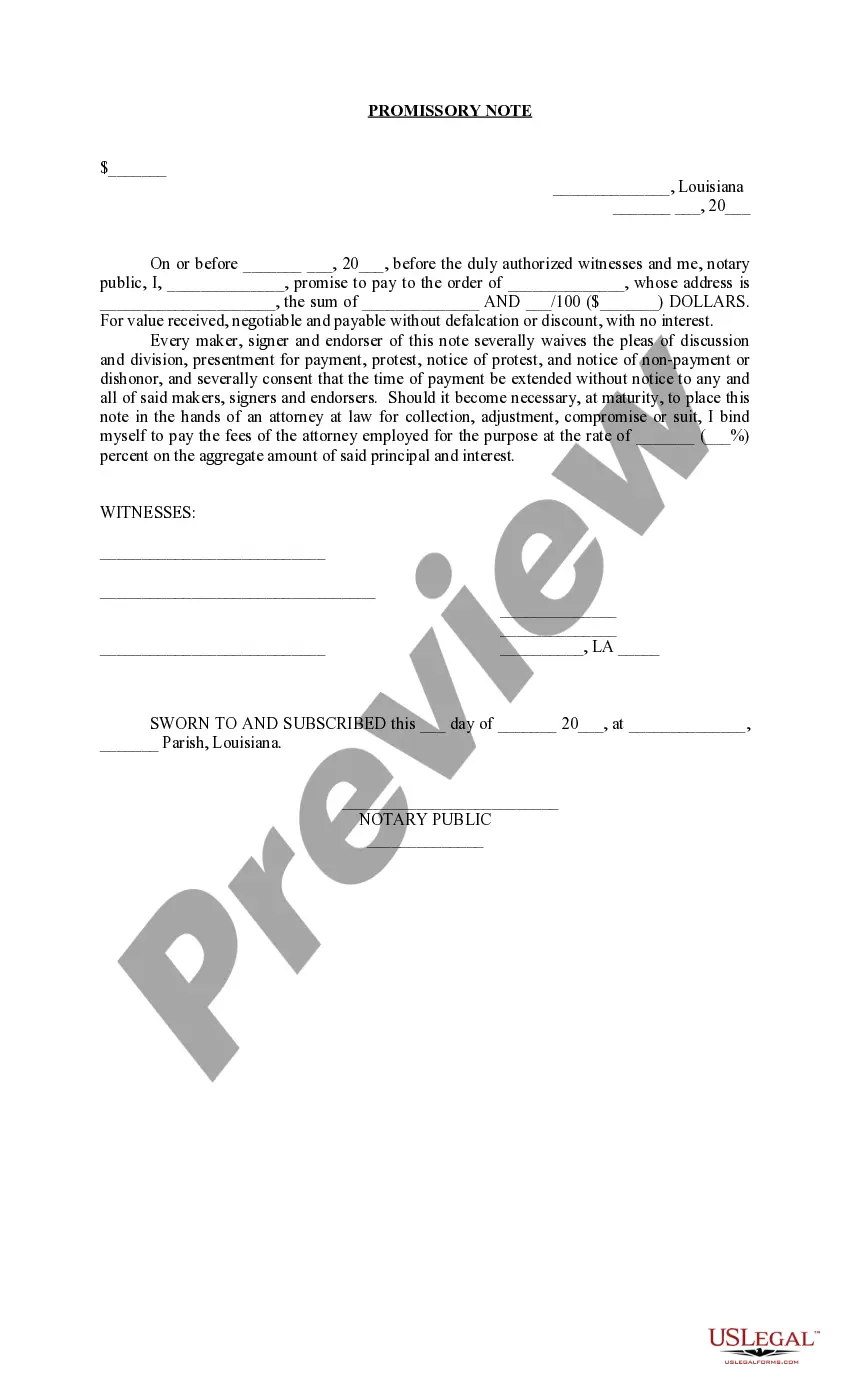

Promissory Note Template Louisiana With Co-maker

Description

How to fill out Louisiana Promissory Note - Unsecured - No Interest?

When you are required to complete the Promissory Note Template Louisiana With Co-maker in accordance with your local jurisdiction's statutes and regulations, there may be various selections to choose from.

There’s no necessity to scrutinize every document to ensure it satisfies all the legal requirements if you are a subscriber to US Legal Forms.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Utilizing US Legal Forms makes obtaining professionally drafted official documents straightforward. Moreover, Premium users can also benefit from the advanced integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms boasts the most extensive online catalog containing over 85,000 ready-to-use documents for both business and personal legal matters.

- All templates are verified to comply with the regulations of each state.

- Therefore, when downloading the Promissory Note Template Louisiana With Co-maker from our platform, you can feel assured that you possess a valid and current document.

- Acquiring the necessary template from our site is remarkably simple.

- If you are an existing member, just Log In to the system, ensure your subscription is active, and save the chosen file.

- Subsequently, you can access the My documents tab in your profile and retain access to the Promissory Note Template Louisiana With Co-maker any time.

- If this is your first time on our website, kindly follow the instructions below.

- Browse the suggested page and verify it for compliance with your needs.

Form popularity

FAQ

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

There is no legal requirement for a promissory note to be notarized in Louisiana. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.