Requesting Mortgage Online With Pay

Description

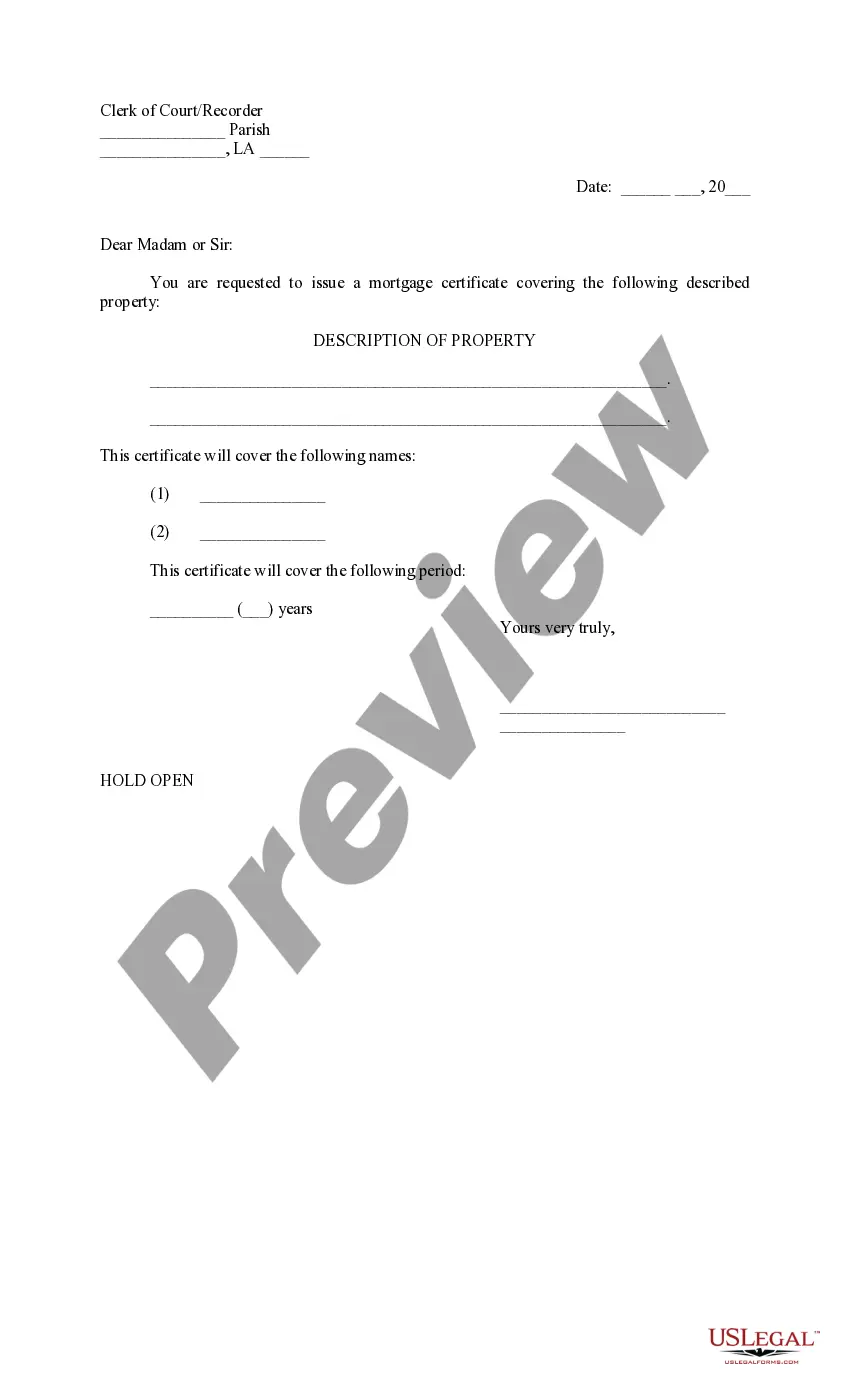

How to fill out Louisiana Letter To Clerk Of Court Requesting Issuance Of Mortgage Certificate?

Drafting legal paperwork from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more affordable way of preparing Requesting Mortgage Online With Pay or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of more than 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific forms diligently prepared for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Requesting Mortgage Online With Pay. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading Requesting Mortgage Online With Pay, follow these recommendations:

- Review the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the form you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Requesting Mortgage Online With Pay.

- Download the file. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and transform document completion into something easy and streamlined!

Form popularity

FAQ

1. Pay your mortgage online. The easiest option for most homeowners is to pay for their mortgage through either their lender or servicer's website. Mortgage online payments are fast, free and efficient.

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

Make sure the following items are included in your coupon: Your name and address. Your contact information (especially a phone number to call if there are any questions about your payment) Your account number with the lender. Your payment due date. The amount of your payment.

You'll likely need to supply some personal information, such as your name, signature, contact information, account number, property address and the date you want the payoff to be effective. Some lenders will also want to know why you're choosing an early payoff.