Requesting Mortgage Online For Mortgage

Description

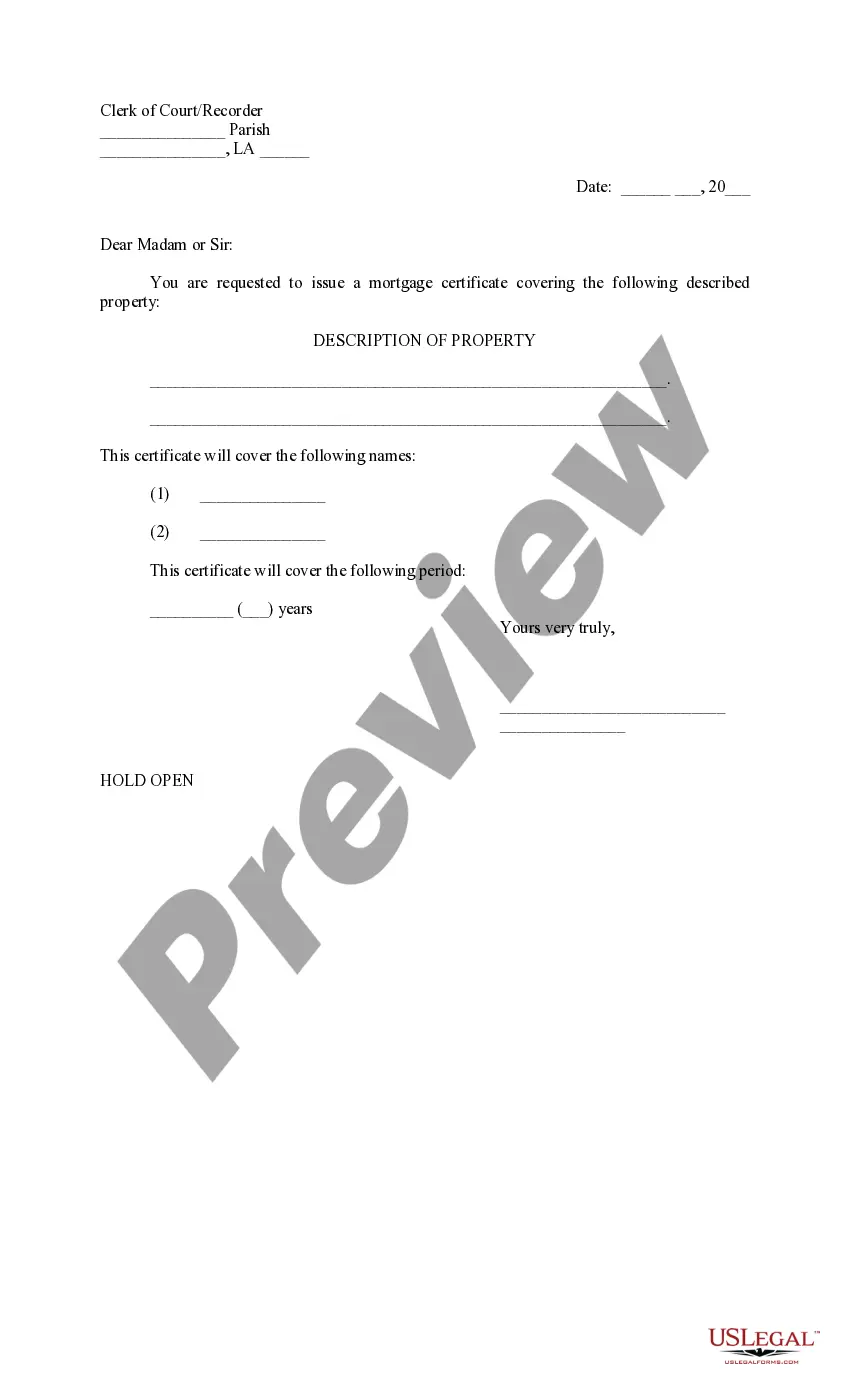

How to fill out Louisiana Letter To Clerk Of Court Requesting Issuance Of Mortgage Certificate?

Finding a go-to place to take the most current and appropriate legal samples is half the struggle of handling bureaucracy. Finding the right legal documents calls for accuracy and attention to detail, which is why it is crucial to take samples of Requesting Mortgage Online For Mortgage only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the information regarding the document’s use and relevance for the situation and in your state or region.

Consider the following steps to complete your Requesting Mortgage Online For Mortgage:

- Make use of the library navigation or search field to find your sample.

- Open the form’s description to ascertain if it fits the requirements of your state and county.

- Open the form preview, if available, to make sure the form is the one you are interested in.

- Get back to the search and look for the right template if the Requesting Mortgage Online For Mortgage does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Pick the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Pick the file format for downloading Requesting Mortgage Online For Mortgage.

- When you have the form on your gadget, you may change it using the editor or print it and finish it manually.

Eliminate the hassle that accompanies your legal paperwork. Explore the comprehensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

It's best when writing a letter of explanation to make it short and to the point. You'll want it to provide the recipient with the information they need, however. Be clear and offer as much relevant detail as possible since the person reading the letter will need to understand your situation.

Learn about the CIBC Home Power Mortgage, CIBC Home Power Plan Borrowing Solution and the CIBC Home Power Plan Line of Credit. How long does a mortgage application take? If you have all your paperwork in order, you can complete a mortgage application and go through the approval process in just a few days.

You can complete a TD Mortgage online application at your convenience, from wherever you are. The Personalized Dashboard makes it easy to track your progress, and you can even apply with a co-borrower.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

Dear [recipient's name], I write to you today in response to a letter I received from you, dated [insert date], about [insert number] of late payments on my loan from [insert date to date]. I am writing this letter today to explain to you the reasons for my delay.