Requesting Mortgage Online For Bank

Description

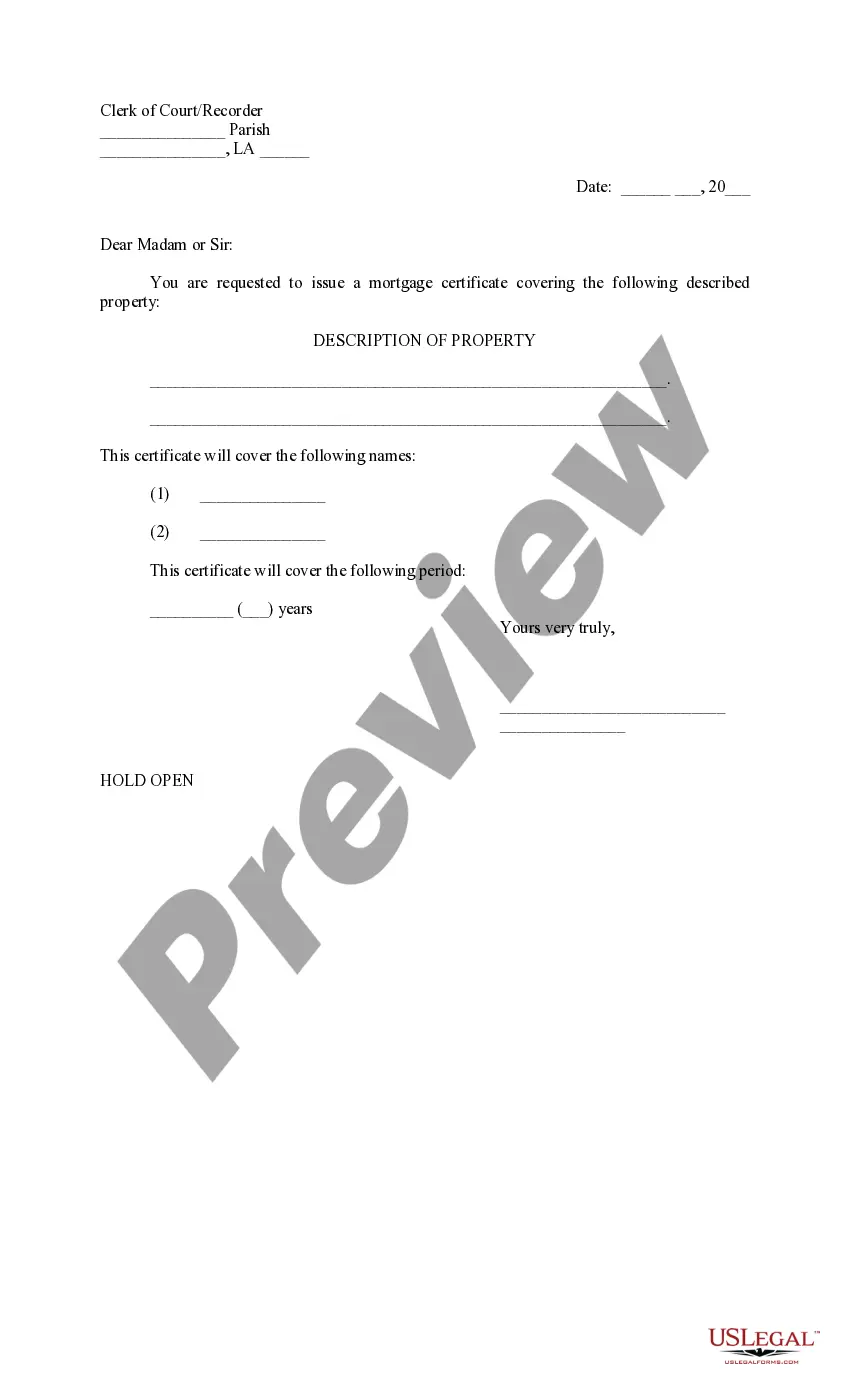

How to fill out Louisiana Letter To Clerk Of Court Requesting Issuance Of Mortgage Certificate?

Whether for business purposes or for individual affairs, everyone has to handle legal situations at some point in their life. Filling out legal paperwork needs careful attention, starting with picking the appropriate form sample. For example, if you pick a wrong edition of a Requesting Mortgage Online For Bank, it will be declined once you submit it. It is therefore important to have a dependable source of legal files like US Legal Forms.

If you have to obtain a Requesting Mortgage Online For Bank sample, follow these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Look through the form’s information to ensure it suits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, get back to the search function to locate the Requesting Mortgage Online For Bank sample you require.

- Download the file if it matches your requirements.

- If you already have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the profile registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Requesting Mortgage Online For Bank.

- When it is downloaded, you can complete the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time searching for the right sample across the web. Take advantage of the library’s straightforward navigation to get the appropriate template for any situation.

Form popularity

FAQ

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. This document is based on certain assumptions and it is not a guaranteed loan offer.

Both pre-qualified and pre-approved mean that a lender has reviewed your financial situation and determined that you meet at least some of their requirements to be approved for a loan. Getting a pre-qualification or pre-approval letter is generally not a guarantee that you will receive a loan from the lender.

Applying for a mortgage usually involves giving the lender your tax returns, bank statements and documents that show your income, such as W-2s and pay stubs. You'll also need documents proving your identity.

Steps for getting a mortgage Step 1: Strengthen your credit. ... Step 2: Know what you can afford. ... Step 3: Build your savings. ... Step 4: Compare mortgage rates and loan types. ... Step 5: Find a mortgage lender. ... Step 6: Get preapproved for a loan. ... Step 7: Begin house-hunting. ... Step 8: Submit your loan application.

How to write a letter of explanation The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.