Louisiana Will Testament Without Probate

Description

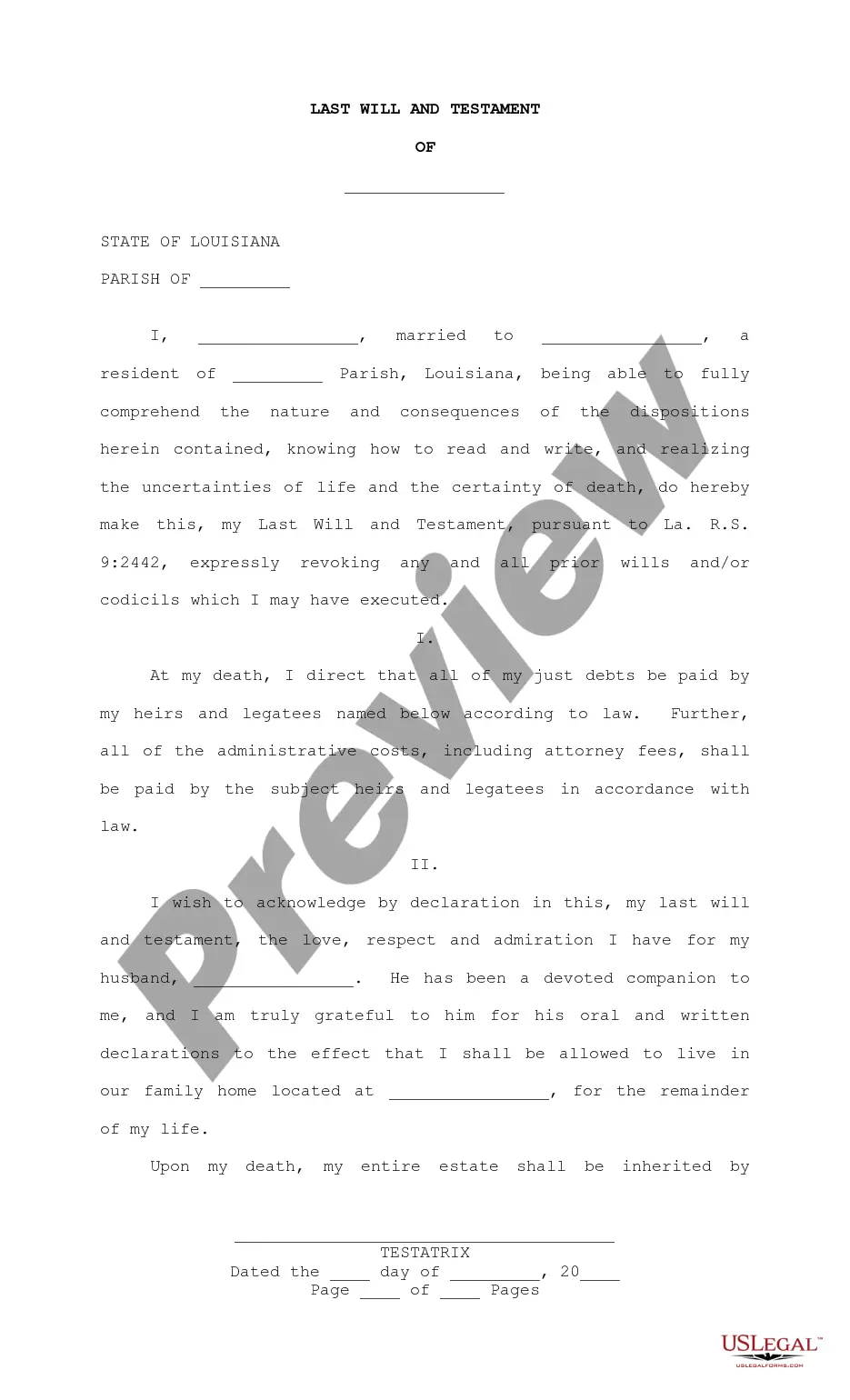

How to fill out Louisiana Last Will And Testament, Spouse, No Children?

Legal document managing may be overpowering, even for the most experienced experts. When you are looking for a Louisiana Will Testament Without Probate and do not have the time to spend looking for the appropriate and up-to-date version, the procedures can be nerve-racking. A strong web form catalogue could be a gamechanger for anybody who wants to handle these situations effectively. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any demands you may have, from individual to organization papers, all-in-one location.

- Use innovative tools to complete and manage your Louisiana Will Testament Without Probate

- Gain access to a resource base of articles, tutorials and handbooks and resources relevant to your situation and needs

Save effort and time looking for the papers you need, and utilize US Legal Forms’ advanced search and Preview tool to discover Louisiana Will Testament Without Probate and get it. In case you have a monthly subscription, log in in your US Legal Forms profile, look for the form, and get it. Review your My Forms tab to view the papers you previously downloaded and to manage your folders as you see fit.

Should it be the first time with US Legal Forms, create an account and get unrestricted access to all benefits of the library. Here are the steps to take after accessing the form you want:

- Confirm this is the proper form by previewing it and reading through its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now once you are ready.

- Select a subscription plan.

- Find the file format you want, and Download, complete, eSign, print out and deliver your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of expertise and trustworthiness. Transform your day-to-day papers management in to a easy and easy-to-use process right now.

Form popularity

FAQ

While this usually makes the will probate process a little more difficult and costly, a handwritten will can be valid in Louisiana. Although you can write your own will, the Louisiana Civil Code is often confusing in this area.

Generally, a decedent's estate goes through succession or probate in Louisiana if the estate is worth $125,000 or more, regardless of whether the decedent died with a will (testate) or without a will (intestate).

In Louisiana, a Petition for Probate of Testament must be filed with the court to request the recognition of the will as valid. If the will is ?notarial,? i.e., executed under Louisiana law pertaining to wills and not handwritten, it is self-proven and, therefore, valid.

Ing to Louisiana inheritance laws, if you die with a will and the estate has a value greater than $125,000, surviving spouses and children must undergo probate. The Louisiana probate process ensures heirs receive their shares of the estate as intended by the decedent ? the person who has died.

If you own real estate located in another state, a revocable trust can help avoid an ancillary probate proceeding in that state. Likewise if you own real estate in Louisiana and move to another state, placing the Louisiana real estate in a revocable trust can avoid going through probate in Louisiana.