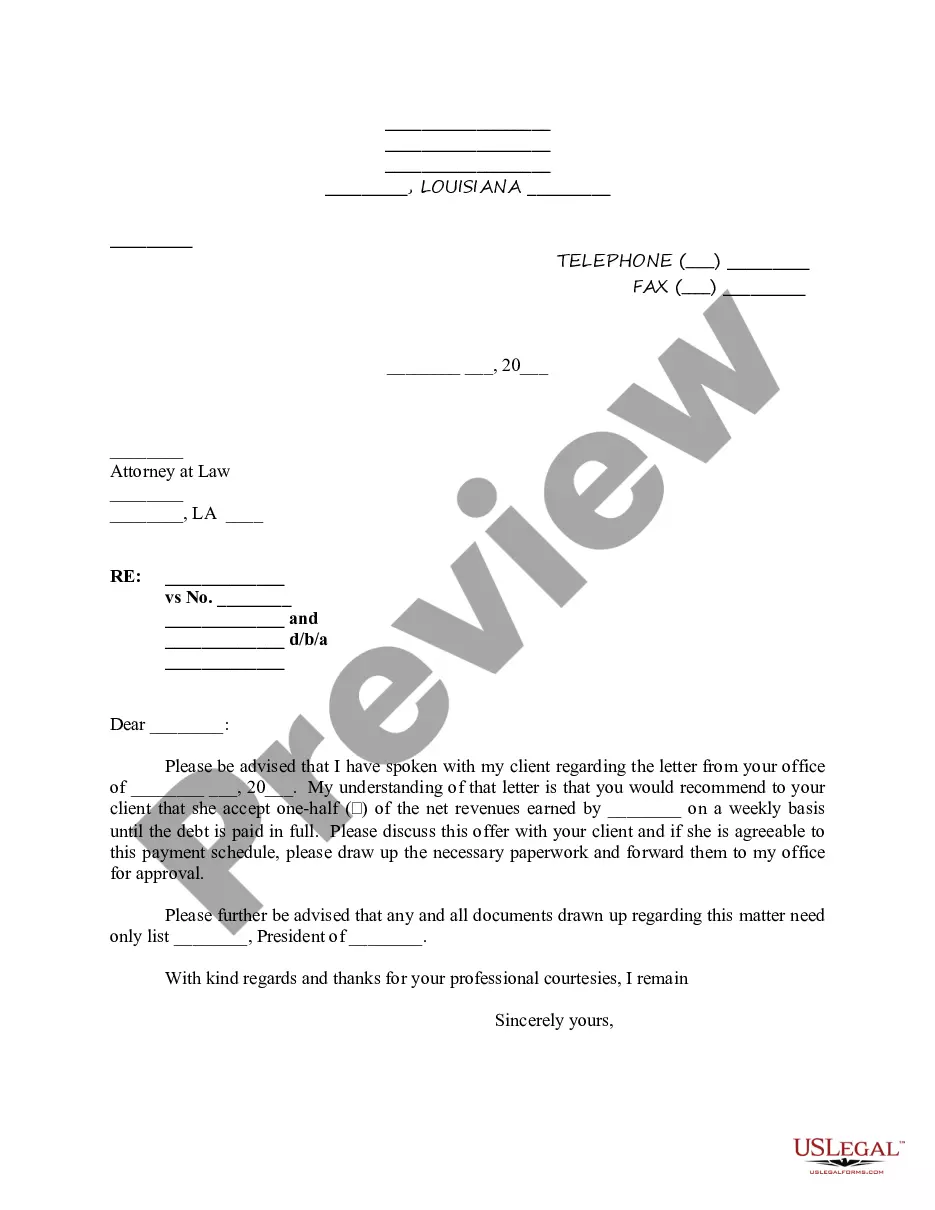

Debt Collection Form Letter

Description

How to fill out Debt Collection Form Letter?

There's no longer a necessity to squander hours searching for legal documents to fulfill your local state obligations. US Legal Forms has assembled all of them in a single location and simplified their access.

Our platform provides over 85k templates for any business and personal legal situations categorized by state and area of application. All forms are expertly crafted and validated for authenticity, so you can trust in receiving a current Debt Collection Form Letter.

If you are accustomed to our service and already possess an account, make sure your subscription is active before downloading any templates. Log In to your account, choose the document, and click Download. You can also revisit all saved documents whenever necessary by accessing the My documents section in your profile.

Print your form to complete it manually or upload the sample if you choose to fill it out using an online editor. Preparing official documentation under federal and state statutes is quick and straightforward with our library. Experience US Legal Forms now to keep your records organized!

- If you haven't previously used our service, the procedure requires a few additional steps to finalize.

- Ensure the page content is examined thoroughly to confirm it includes the sample you require.

- You can utilize the form description and preview options if available.

- Use the Search field above to look for an alternative template if the current one does not meet your needs.

- Click Buy Now next to the template title upon finding the appropriate one.

- Select your preferred pricing plan and either create an account or Log In.

- Complete your payment for the subscription using a credit card or through PayPal to proceed.

- Select the file format for your Debt Collection Form Letter and download it to your device.

Form popularity

FAQ

Debt collectors are not allowed to harass you or use threatening language during their communications. They also cannot call you at unreasonable hours, such as late at night or early in the morning. Understanding your rights can empower you to handle these situations effectively. A debt collection form letter can help document your concerns and protect your interests.

To fill out a debt validation letter, start by including your name, address, and the date. Clearly state that you are requesting validation of the debt, including account numbers and creditor information. Be sure to specify any details that you want verified, such as the original creditor and the amount owed. Using a debt collection form letter can streamline this process and ensure you include all necessary information.

The 7 and 7 rule in debt collection refers to a guideline that states a debt collector should wait at least seven days before contacting you after receiving a debt validation request. This period allows you time to respond and gather necessary information. If they fail to comply, it could be a violation of the Fair Debt Collection Practices Act. Using a debt collection form letter can help you formally request validation.

Creating a debt collection letter involves a clear structure and essential information. Start with your contact details, followed by a polite request for payment or documentation, using a debt collection form letter template if needed. Make sure to include specifics about the debt and any relevant deadlines. This approach helps maintain a respectful tone while ensuring you communicate effectively.

To request proof of debt from a collector, send a formal letter to the agency that contacted you. Use a debt collection form letter to specify your request for documentation of the debt. Make sure to include pertinent details, such as your account number and any previous correspondence. This arrangement makes your inquiry clear and professional.

Yes, debt collectors are required to provide proof of debt if you request it. When you ask for verification through a debt collection form letter, they must respond with documentation that shows you owe the debt. This is your right under the Fair Debt Collection Practices Act. Understanding this can empower you in the collection process.

You can ask a debt collector for proof by sending a written request. Use a debt collection form letter to clearly state that you want verification of the debt. Be sure to include your contact information and details about the account in question. This method ensures that you have a formal record of your request.

Filing a debt validation letter begins with you sending a written request to the collector, asking them to verify that the debt is valid and belongs to you. Include important details such as your name, address, and account number to streamline the process. Keep a copy of the letter for your records and send it via certified mail, which will provide proof of your request. Successfully leveraging a debt collection form letter can help you ensure that all validations are handled appropriately.

Begin a debt collection letter by addressing the debtor by name and including your own contact information. Clearly outline the debt amount, due date, and any previous communications about the matter. Make sure to remain courteous but firm throughout the letter to maintain professionalism, while also guiding them on how to resolve the situation. Utilizing a debt collection form letter template from a trusted resource like US Legal Forms can save you time and ensure you cover all necessary details.

The 7 7 7 rule is a guideline used in debt collection that suggests you should send your collections letters within seven days of the missed payment, follow up again seven days later, and consider additional actions seven days after that. This timeline helps maintain communication with your debtor while also motivating them to settle their debts quickly. By adhering to this rule, you enhance the effectiveness of your debt collection form letter, ensuring timely reminders while showing your commitment to resolving the situation.