Child Support Termination Form Withholding

Description

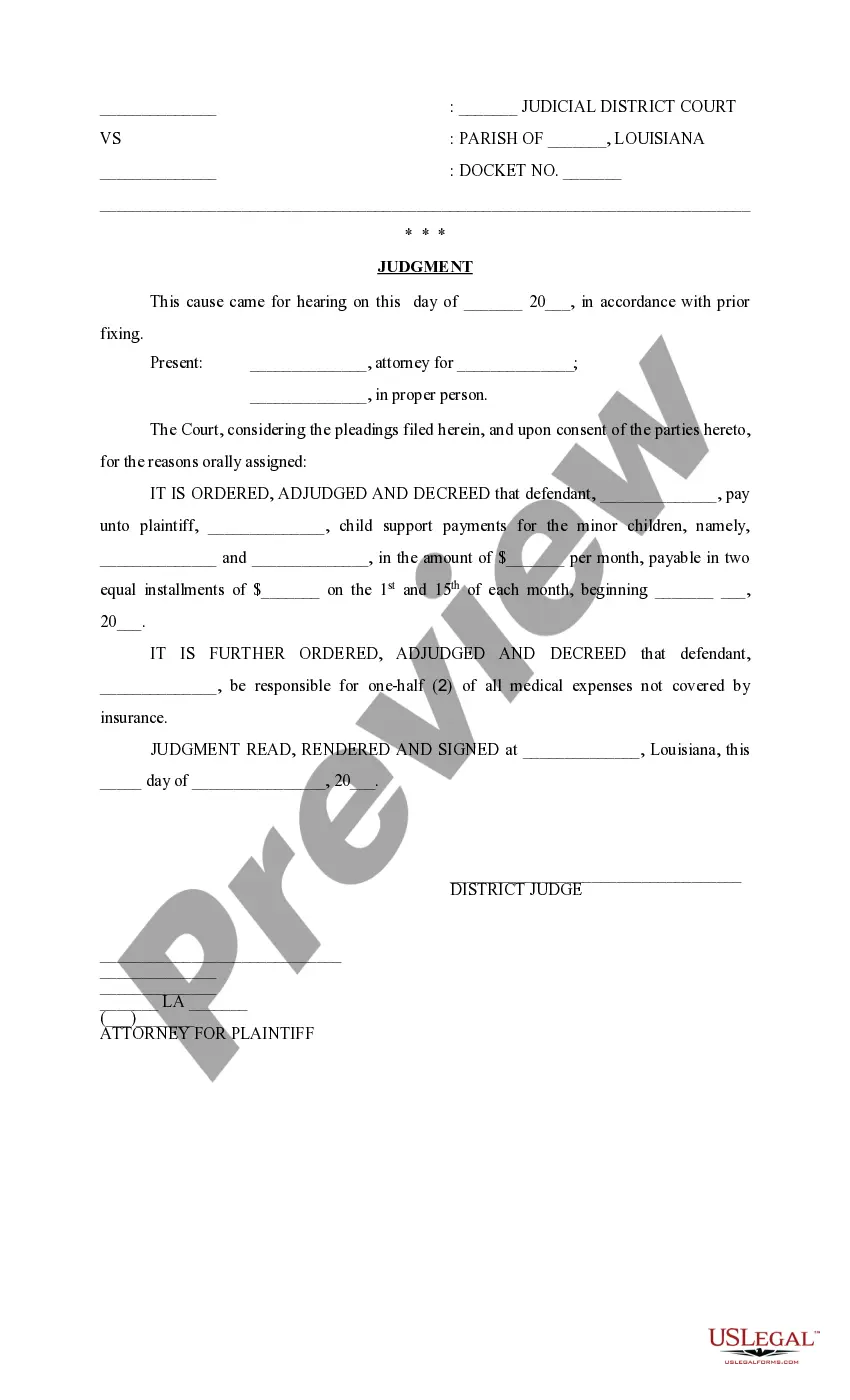

How to fill out Louisiana Consent Judgment For Termination Of Child Support?

Acquiring legal document examples that comply with federal and state regulations is crucial, and the internet provides numerous alternatives to choose from.

However, what’s the advantage of spending time searching for the suitable Child Support Termination Form Withholding example online when the US Legal Forms digital repository already has such templates consolidated in one location.

US Legal Forms is the premier online legal repository with over 85,000 fillable templates created by attorneys for various professional and personal scenarios. They are easy to navigate with all documents categorized by state and intended use. Our experts keep current with legislative changes, ensuring your paperwork is always updated and compliant when obtaining a Child Support Termination Form Withholding from our site.

- View the template using the Preview option or through the text description to ensure it fulfills your requirements.

- Search for another sample using the search tool at the top of the page if needed.

- Click Buy Now once you’ve located the appropriate form and choose a subscription plan.

- Sign up for an account or Log In and complete the payment process with PayPal or a credit card.

- Select your preferred format for the Child Support Termination Form Withholding and download it.

Form popularity

FAQ

The time it takes for an income withholding order to take effect can vary depending on several factors including the employer’s response time. Typically, it can take a few weeks once the Child support termination form withholding is filed. To expedite this process, it’s beneficial to use clear and accurate forms, ensuring all information is provided. This way, all parties can stay aligned with the expectation of payments.

When an order to withhold is terminated, it signifies that the income withholding for child support has ended. This situation often arises when the financial obligations have been fulfilled or modified. For those navigating this process, using a Child support termination form withholding can simplify the necessary steps. It's essential to ensure all parties involved are informed to avoid any miscommunication regarding payment responsibilities.

The maximum amount that can be withheld for child support depends on both state laws and the non-custodial parent's income. Each state has its own guidelines that typically allow for a percentage of disposable income to be withheld. Consulting with a legal expert and using a child support termination form withholding can provide essential guidance on navigating these regulations.

A termination letter for child support formally ends the obligation for payments. It serves as a written record of your request to discontinue support, outlining the reasons why. Using a child support termination form withholding can simplify the process, ensuring that you include all the appropriate elements needed for your case.

Filling out child support paperwork involves providing personal details, income information, and the current custody arrangement. Follow the provided instructions carefully, paying attention to each section to avoid errors. Many find it helpful to use a child support termination form withholding to guide them through the necessary steps.

Yes, there is a letter designed specifically to stop child support payments. This letter should state your request clearly and provide reasoning, such as changes in custody or financial status. Utilizing a child support termination form withholding can help ensure that all details are properly addressed and legally recognized.

In Mississippi, child support laws require both parents to contribute based on their income and the needs of the child. The law also allows for modification or termination of support under specific circumstances, such as when a child reaches adulthood or if there is a significant change in financial conditions. It's essential to use the appropriate child support termination form withholding to comply with these regulations.

A good termination letter for child support should clearly state your intention to discontinue payments. It should include key details such as the reason for termination, your full name, and case number. For your convenience, using a child support termination form withholding can streamline this process and ensure all necessary information is covered.

'Terminated' in a court case signifies the conclusion or end of legal proceedings related to that case. When a case is terminated, it can mean that a judgment has been made, or the parties have reached an agreement. In terms of child support, understanding the termination process is crucial, particularly for filing a child support termination form withholding. If you need assistance, US Legal Forms offers resources that simplify this process for you.

A termination of order to withhold taxes refers to the legal process of ending a court-mandated withholding for child support payments. This often occurs when a parent has fulfilled their obligations or when circumstances have changed, such as a change in employment status. Importantly, filing a child support termination form withholding can help ensure that taxes are no longer withheld unnecessarily. Using a reliable platform like US Legal Forms can guide you through the required paperwork confidently and efficiently.