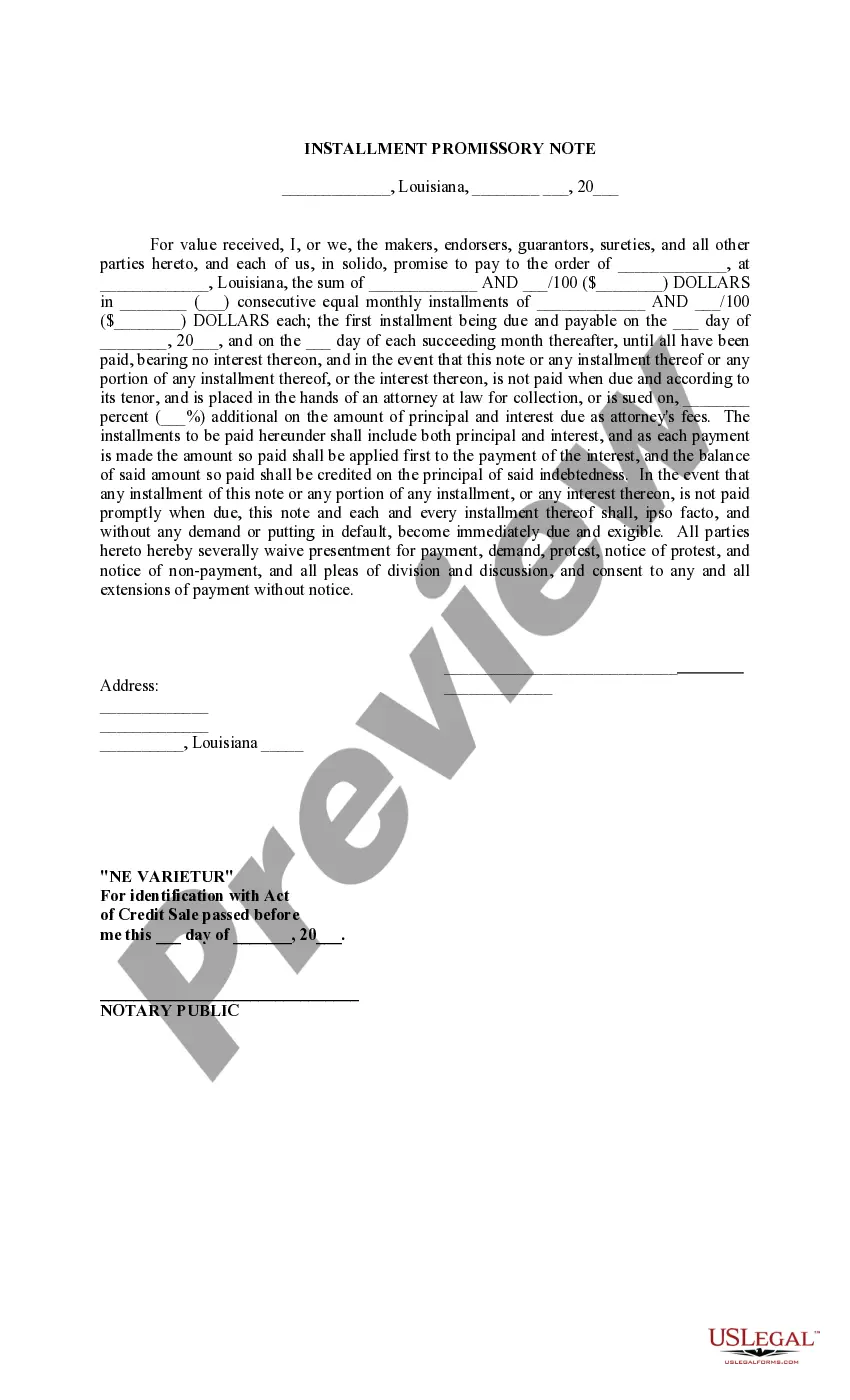

Promissory Note Installment Payments Without Interest

Description

How to fill out Louisiana Installment Promissory Note With Interest Accruing?

How to locate professional legal documents that align with your state regulations and create the Promissory Note for Installment Payments Without Interest without consulting an attorney.

Numerous online services provide templates for various legal occasions and requirements. However, it might take some time to determine which of the available samples meet both your needs and legal obligations.

US Legal Forms is a reliable service that assists you in finding official documents drafted according to the latest state law revisions, helping you save money on legal services.

If you do not have an account with US Legal Forms, please follow the steps below: Review the webpage you have opened to ascertain if the form fits your requirements. Utilize the form description and preview options, if available. Search for another template through the header by providing your state if needed. Once you identify the appropriate document, click the Buy Now button. Choose the most suitable pricing plan, then Log In or create a new account. Select your preferred payment method (credit card or PayPal). Alter the file format for your Promissory Note for Installment Payments Without Interest and click Download. The obtained templates remain in your possession: you can always access them in the My documents section of your account. Register for our library and create legal documents independently like a seasoned legal expert!

- US Legal Forms is not just a typical online directory.

- It comprises over 85,000 verified templates for various business and personal scenarios.

- All documents are organized by field and state to streamline your search experience.

- It also offers integration with advanced tools for PDF editing and e-signature, enabling users with a Premium subscription to conveniently complete their documents online.

- Acquiring the needed paperwork requires minimal time and effort.

- If you already possess an account, Log In to confirm your subscription is active.

- Download the Promissory Note for Installment Payments Without Interest using the button next to the document name.

Form popularity

FAQ

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

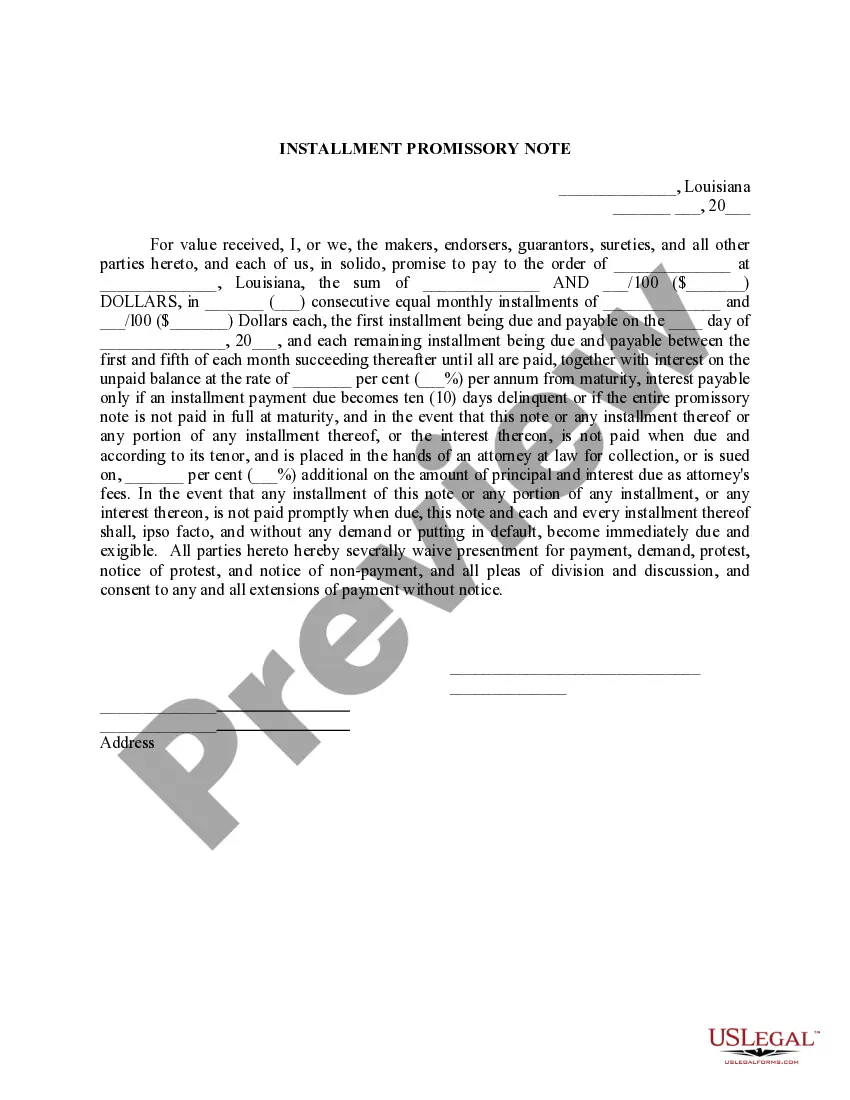

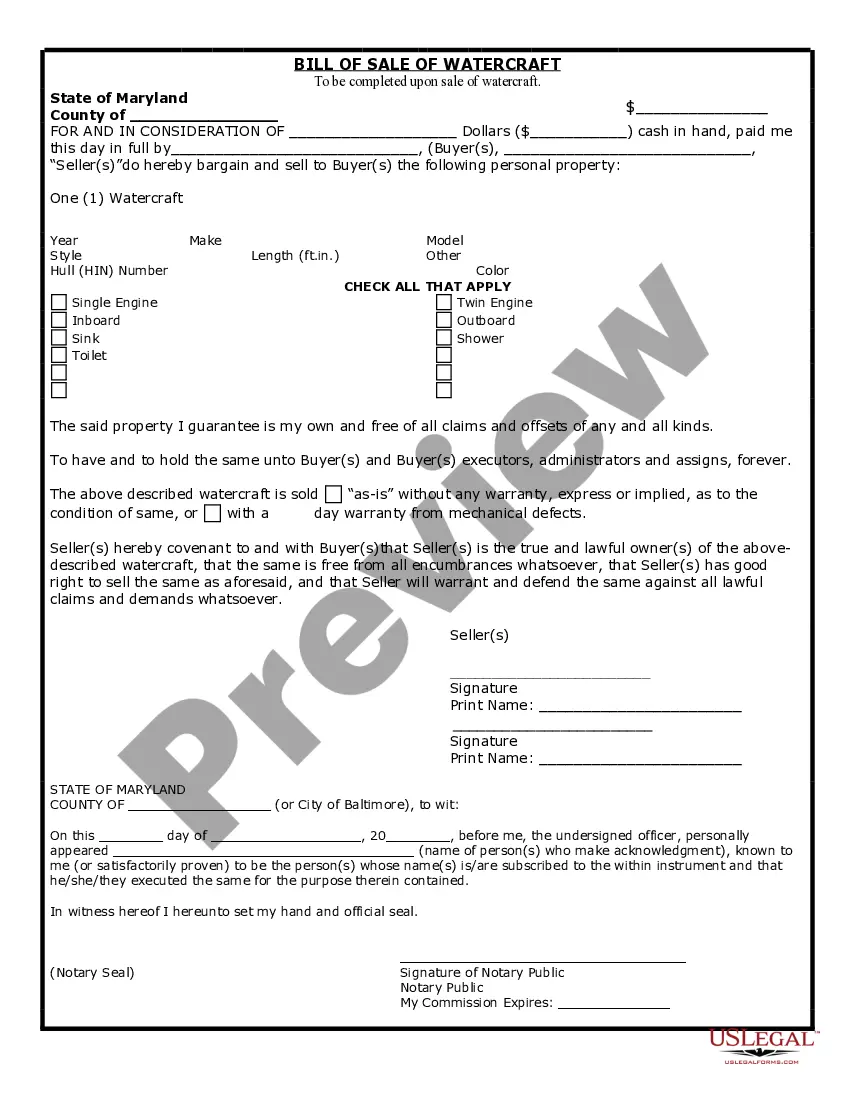

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A Promissory Note with Installment Payments is a lending contract that sets terms for a loan to be repaid in installments. This Promissory Note specifies that the loan will be paid back with consistent, equal, payments. Whether you're the lender or the borrower, you know exactly what each payment will be.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.