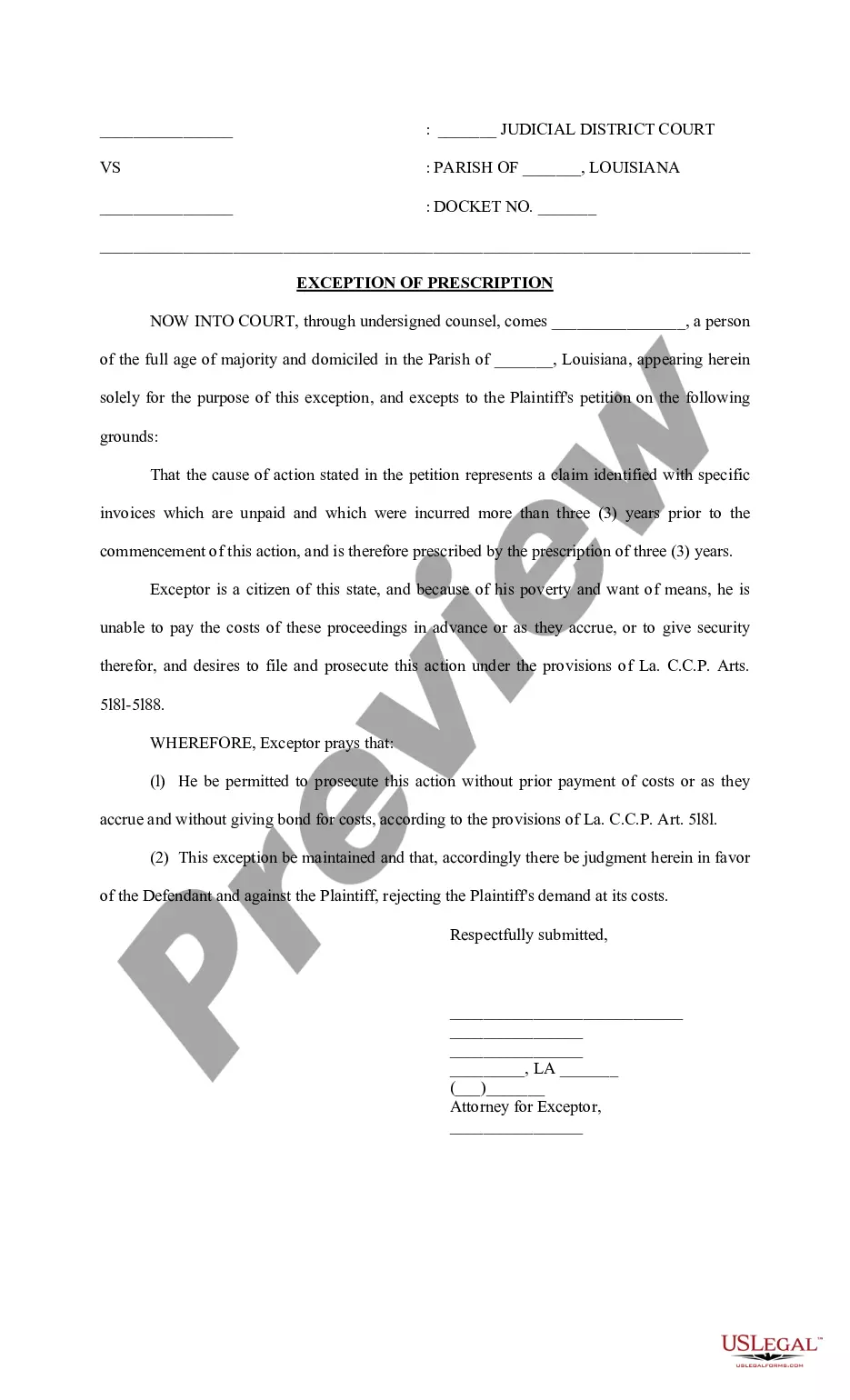

Exception Of Prescription Louisiana Withholding

Description

How to fill out Louisiana Exception Of Prescription?

Securing a reliable location to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the correct legal documents requires precision and careful consideration, which highlights the necessity of obtaining samples of Exception Of Prescription Louisiana Withholding exclusively from reputable sources, such as US Legal Forms. An incorrect template can drain your time and delay your circumstances. With US Legal Forms, you can feel reassured. You can access and review all the pertinent information about the document’s applicability and significance for your case and within your state or county.

Once you have the form saved on your device, you can edit it using the editor or print it to fill it out manually. Eliminate the hassle that accompanies your legal paperwork. Explore the extensive US Legal Forms library where you can locate legal templates, evaluate their applicability to your situation, and download them instantly.

- Use the library navigation or search feature to find your template.

- Access the form’s details to verify if it aligns with the stipulations of your state and locality.

- View the form preview, if available, to confirm that it is indeed the document you seek.

- Return to the search and find the correct document if the Exception Of Prescription Louisiana Withholding does not meet your requirements.

- Once you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Select the pricing option that best fits your needs.

- Continue with the registration to finalize your transaction.

- Conclude your purchase by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Exception Of Prescription Louisiana Withholding.

Form popularity

FAQ

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

If you are employed by more than one employer, you may claim the exemption from withholding with each employer, provided that the total of your anticipated income will not cause you to incur any liability for Louisiana income tax for the current year and you incurred no liability for Louisiana income tax for the ...

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

Common consumer-related exemptions include: Food for home consumption; Utilities such as electricity, natural gas and water; Drugs prescribed by a physician or dentists; and.

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.