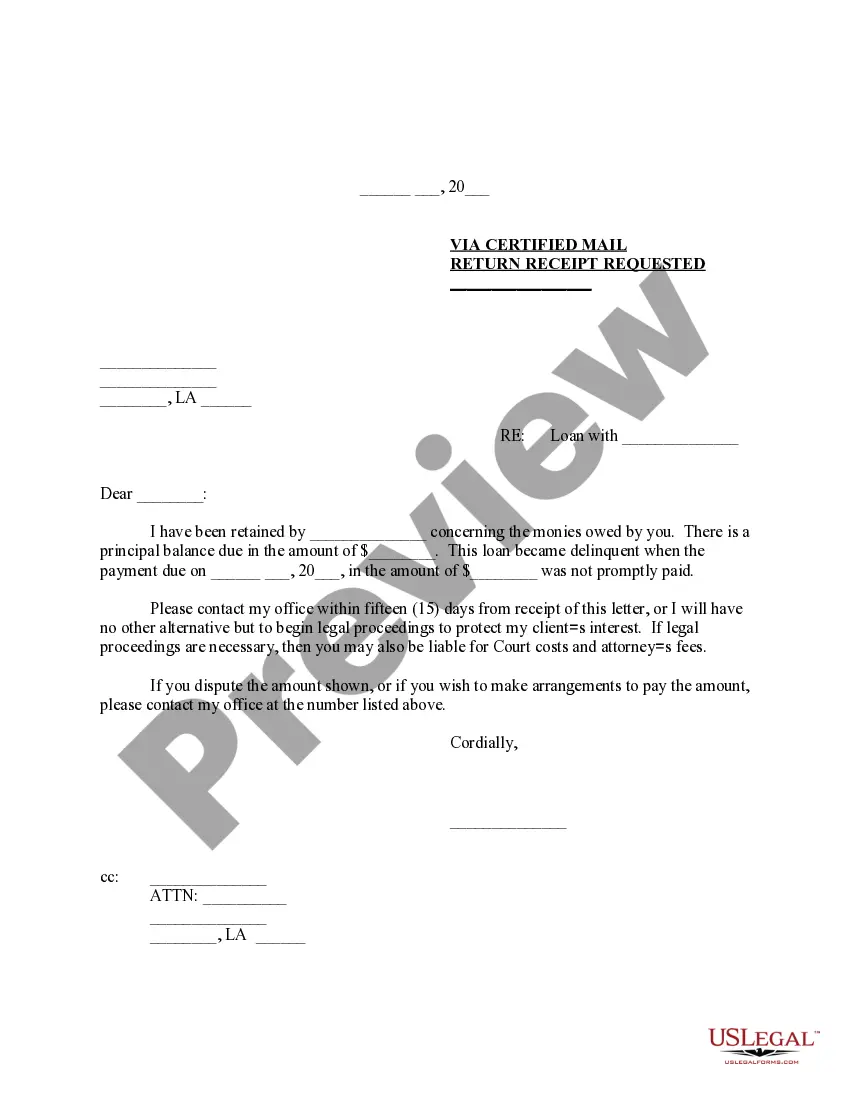

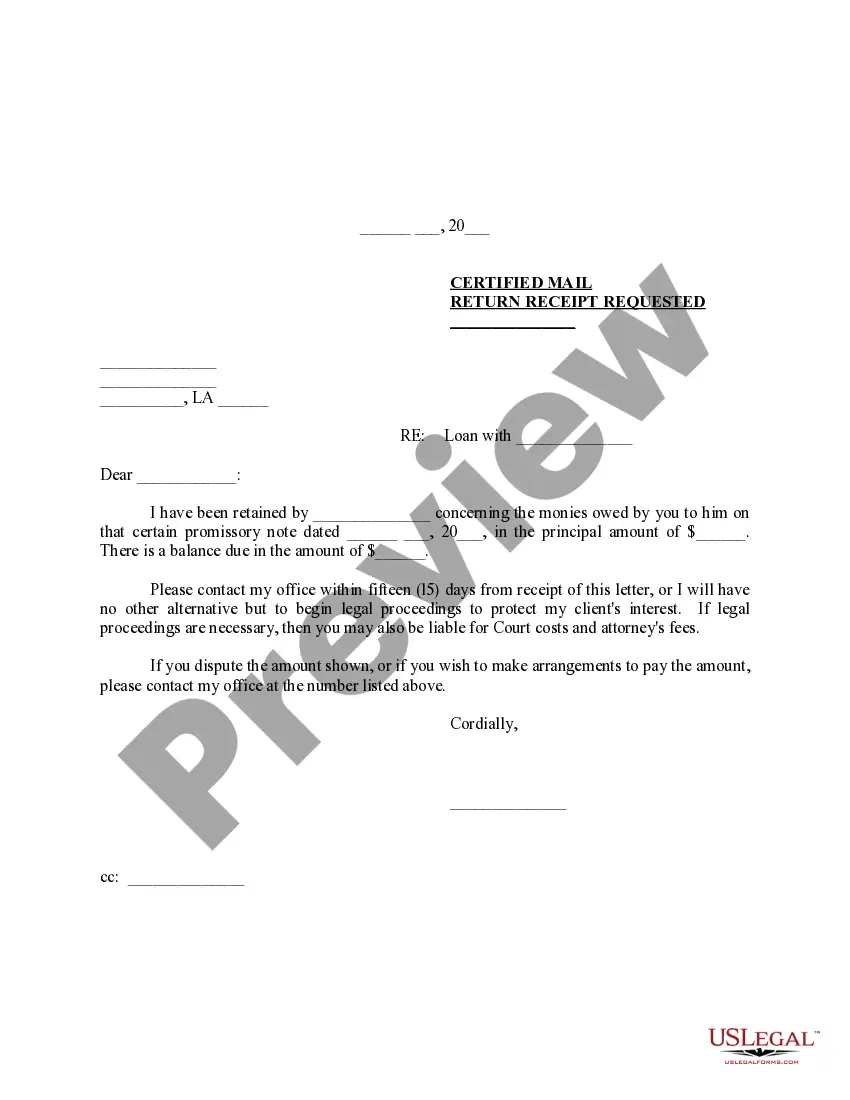

Sample Demand Letter For Promissory Note

Description

How to fill out Louisiana Demand Letter - Repayment Of Promissory Note?

Bureaucracy necessitates exactness and precision.

If you do not manage the completion of documents like Sample Demand Letter For Promissory Note on a daily basis, it may lead to some misunderstandings.

Selecting the correct template from the outset will guarantee that your submission of documents proceeds smoothly and avoids any hassles of re-submitting a document or repeating the same task entirely from scratch.

If you are not a subscribed user, finding the needed template will involve a few additional steps.

- You can always find the suitable template for your documentation at US Legal Forms.

- US Legal Forms is the largest online collection of forms that contains over 85 thousand templates for various fields.

- You can discover the most current and appropriate version of the Sample Demand Letter For Promissory Note simply by searching it on the site.

- Identify, save, and download templates in your account or consult the description to verify you have the correct one accessible.

- With an account at US Legal Forms, it is feasible to obtain, organize in one spot, and navigate the templates you save to reach them with just a few clicks.

- When on the webpage, click the Log In button to authenticate.

- Next, proceed to the My documents page, where your forms are retained.

- Study the description of the templates and download the ones you require at any time.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

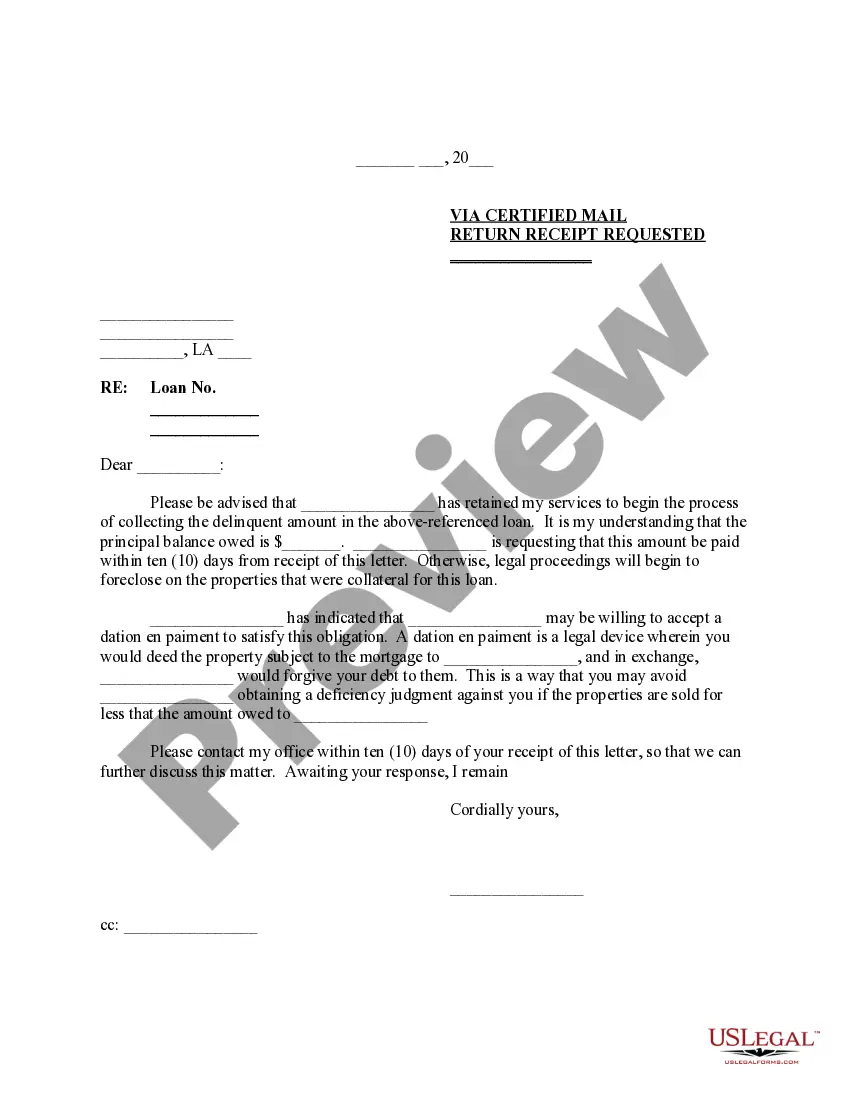

When payment is requested, a time period will be given for repayment. A promissory note, in contrast, can have the option for payment to be 'on demand' or at a specified date. A demand note is not required to show cause notice to be given to a borrower who is delinquent, unlike a mortgage loan.

This demand letter should include the following:The date of the letter.The names of the borrower and lender.The original amount of the loan.The date of the promissory note and any reference number or account number it contains.The payment schedule that was agreed upon.More items...?

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.