Motion To Dismiss Louisiana Withholding

Description

How to fill out Louisiana Motion And Order To Dismiss By Defendant?

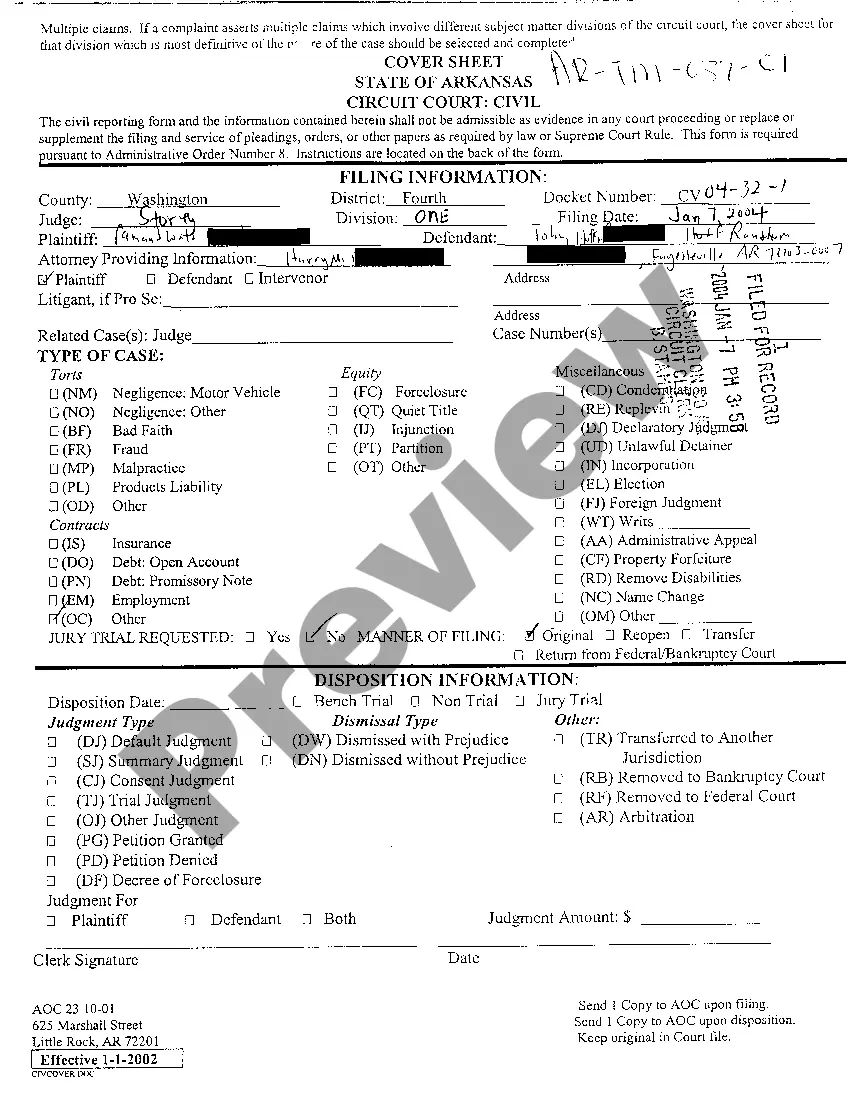

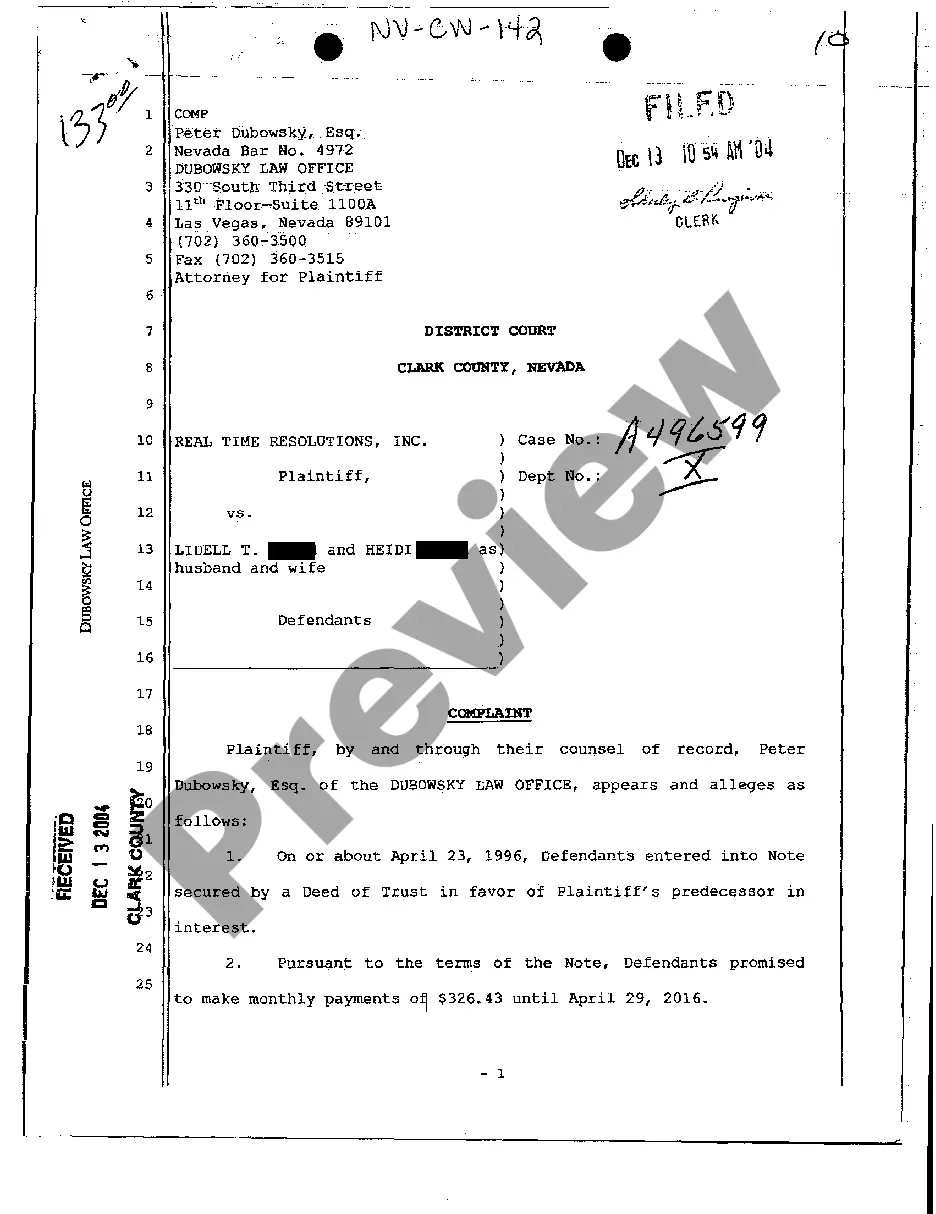

The Motion To Dismiss Louisiana Withholding you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and local regulations. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Motion To Dismiss Louisiana Withholding will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your requirements. If it does not, make use of the search option to get the appropriate one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your Motion To Dismiss Louisiana Withholding (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

The Tax Division also pursues criminal investigations and prosecutions against those individuals and entities who willfully fail to comply with their employment tax responsibilities, as well as those who aid and assist them in failing to meet those responsibilities.

Employers are required to withhold income tax on all wages that are subject to Louisiana income tax as follows: Employers located in Louisiana?income tax must be withheld on all employee wages earned in Louisiana regardless of whether the employee is a resident or not.

How to claim exempt status on a W-4. To claim an exemption, you must complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. (In Box 7, write ?EXEMPT?. Writing this will guarantee that withholdings are not taken from your future paychecks.)

To change their tax withholding, employees can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit to their employer. Don't file with the IRS.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.