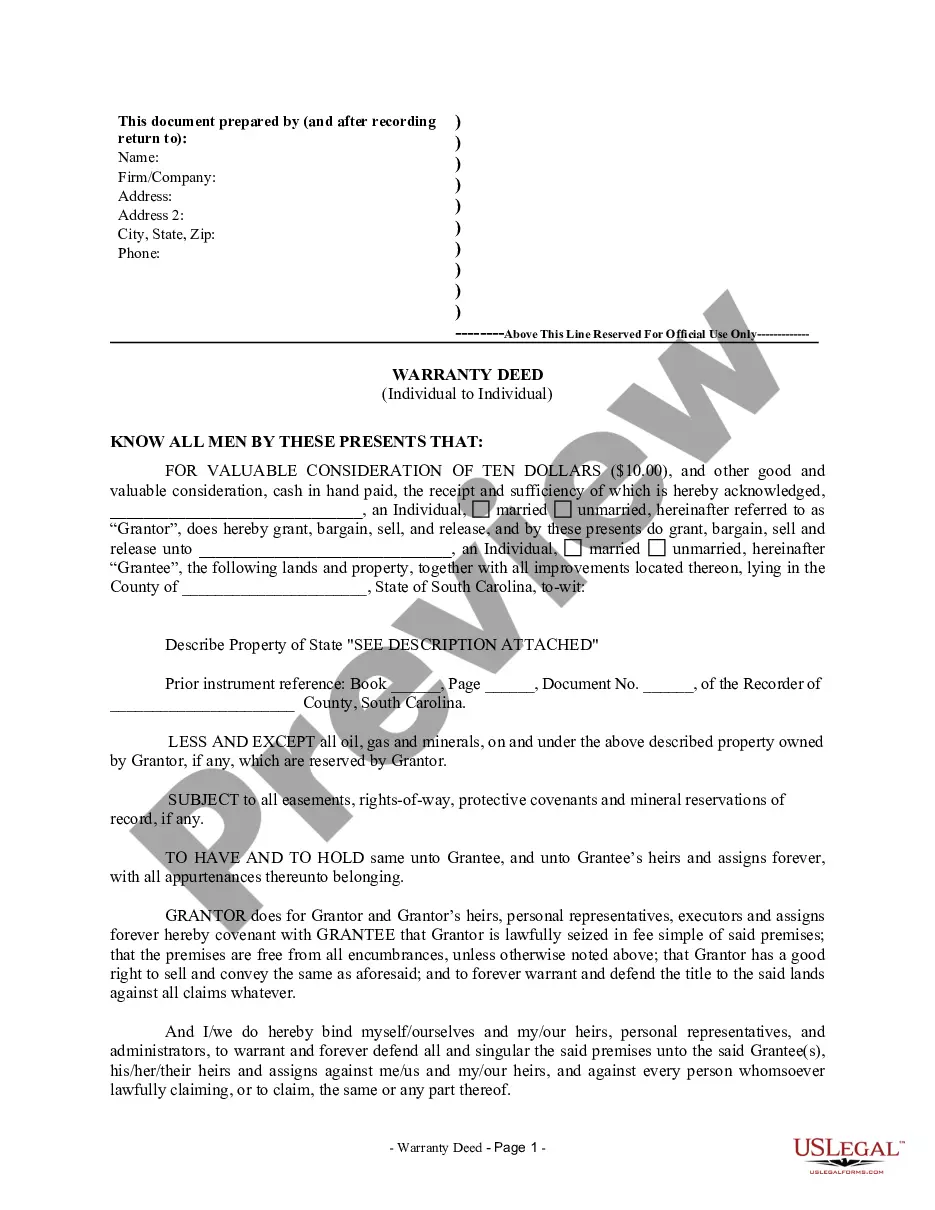

South Carolina Warranty Deed from Individual to Individual

Description

How to fill out South Carolina Warranty Deed From Individual To Individual?

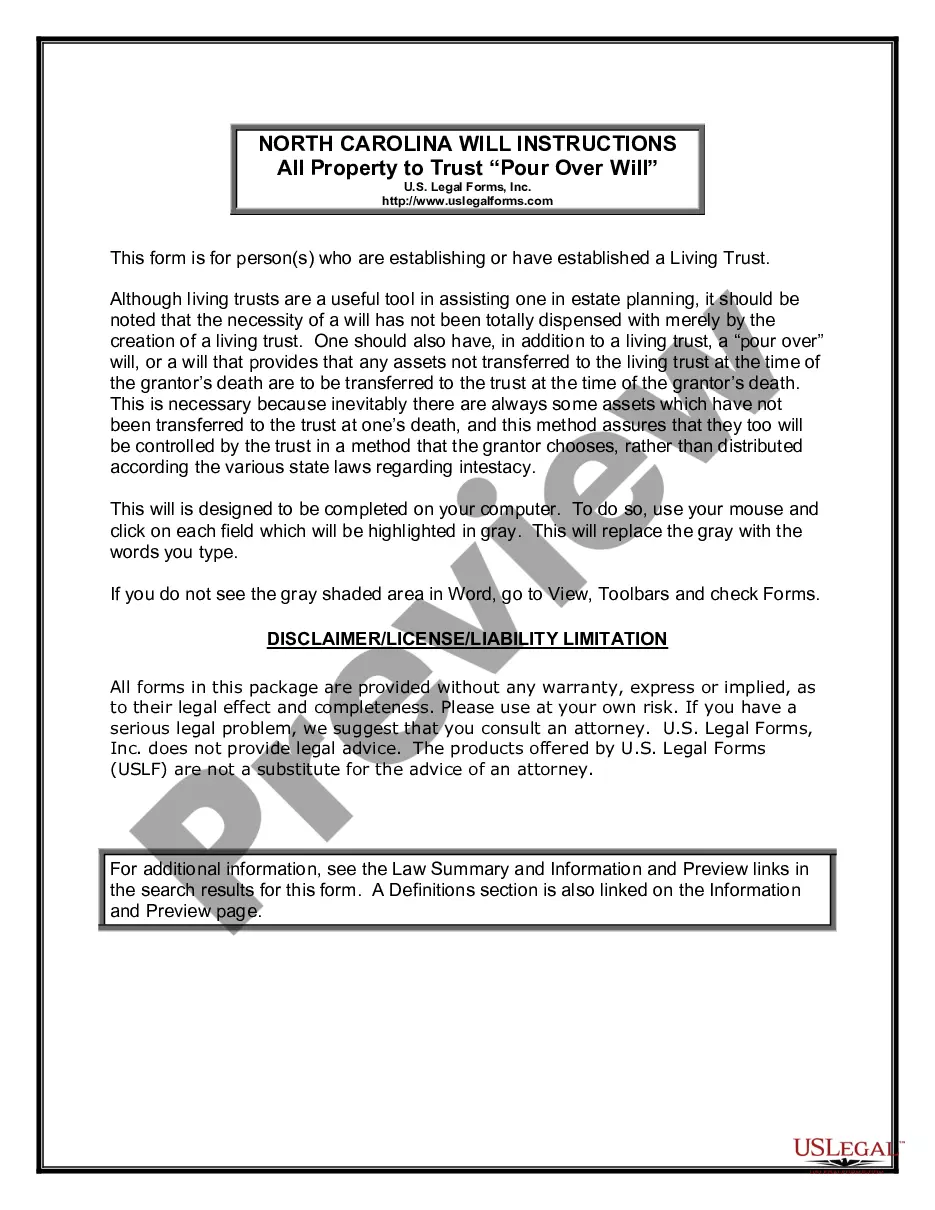

Creating papers isn't the most straightforward process, especially for people who rarely work with legal papers. That's why we recommend making use of correct South Carolina Warranty Deed from Individual to Individual templates created by skilled attorneys. It gives you the ability to stay away from problems when in court or working with official institutions. Find the documents you require on our website for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the file webpage. Soon after getting the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can easily create an account. Use this simple step-by-step guide to get your South Carolina Warranty Deed from Individual to Individual:

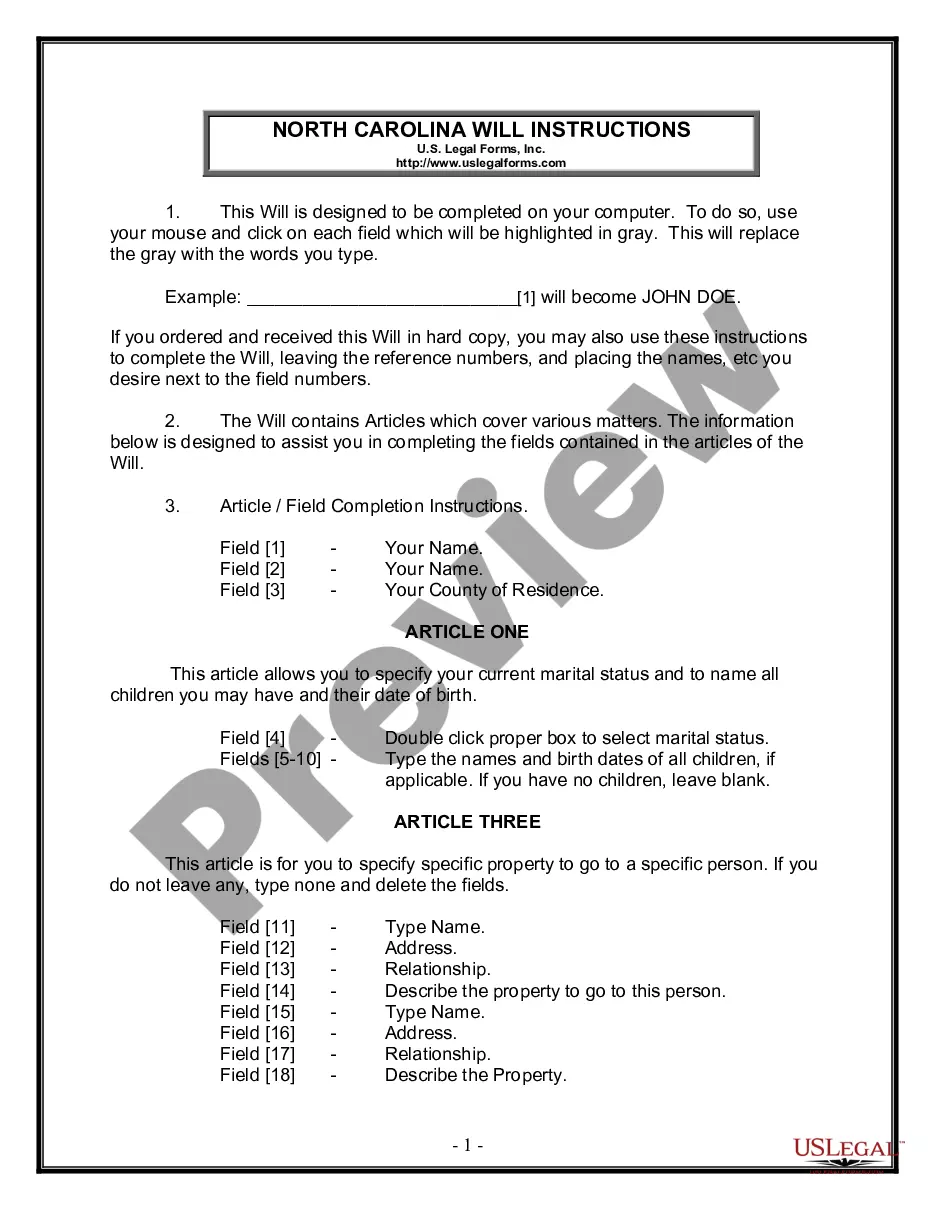

- Be sure that the form you found is eligible for use in the state it is needed in.

- Confirm the file. Utilize the Preview option or read its description (if offered).

- Buy Now if this template is what you need or utilize the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after finishing these simple actions, it is possible to complete the sample in a preferred editor. Recheck filled in information and consider requesting a legal professional to review your South Carolina Warranty Deed from Individual to Individual for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

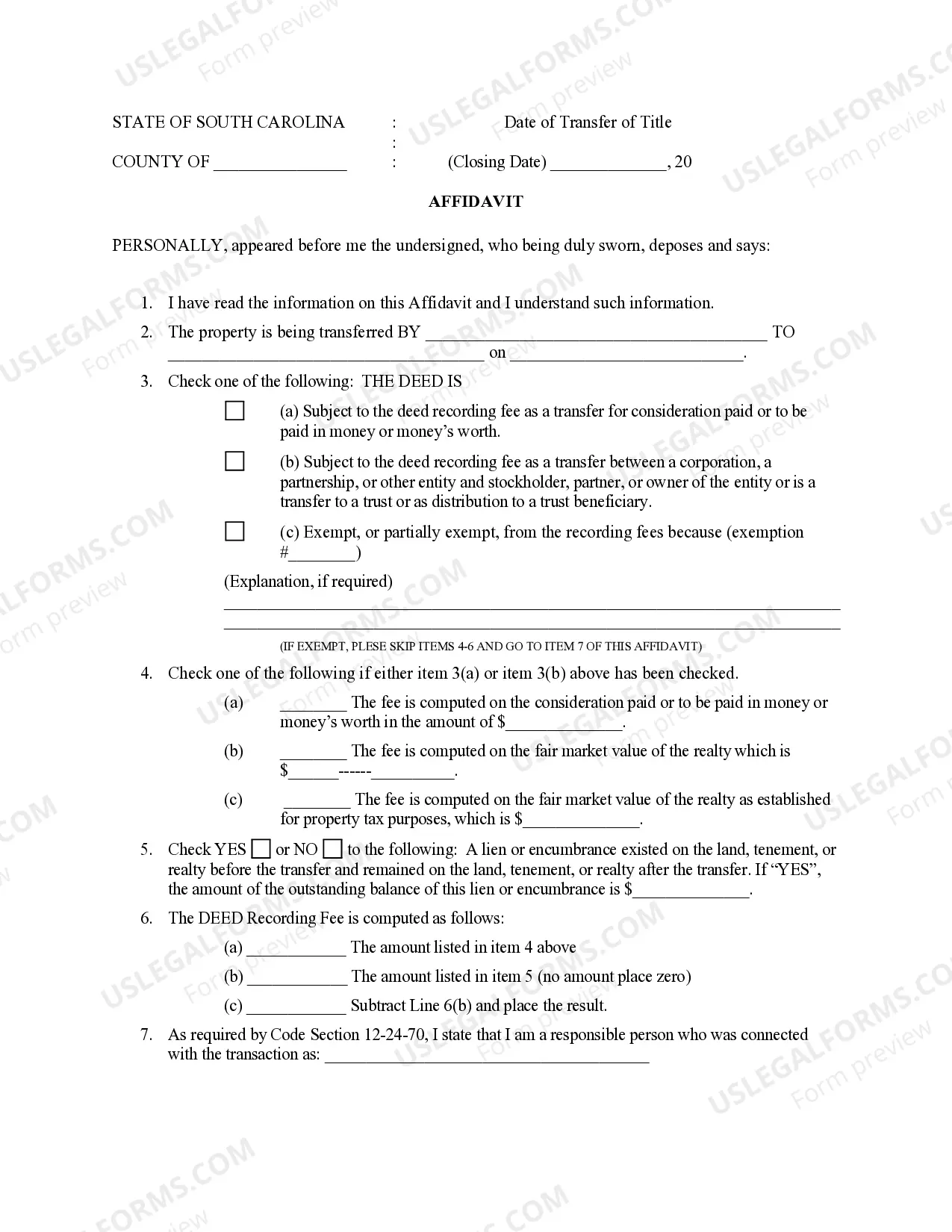

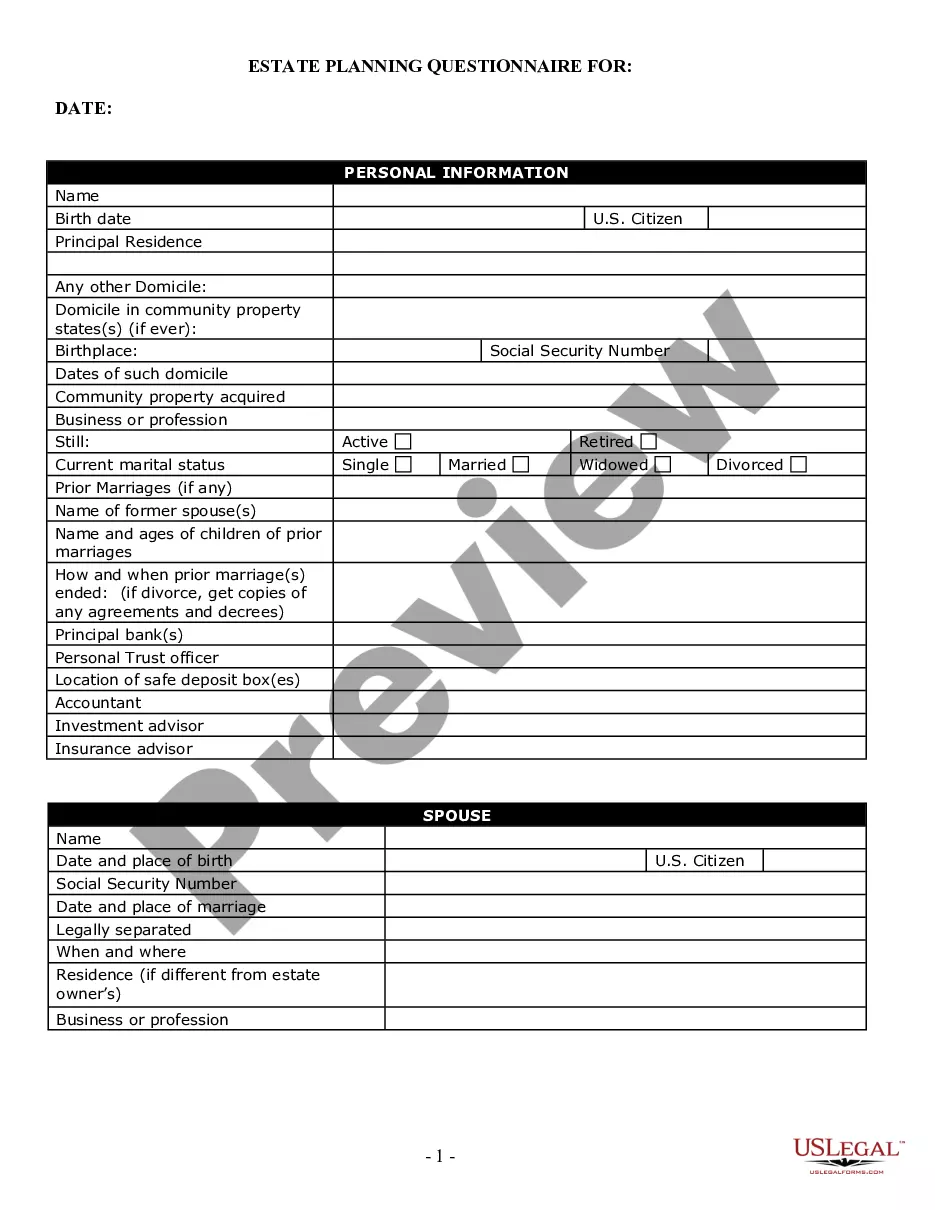

Review the property title to see who is officially listed on it. Sign the title over to the new owner in the place that is noted. Complete a general warranty deed to show the transfer of ownership from you to another. Pay the real estate transfer tax as levied in South Carolina.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

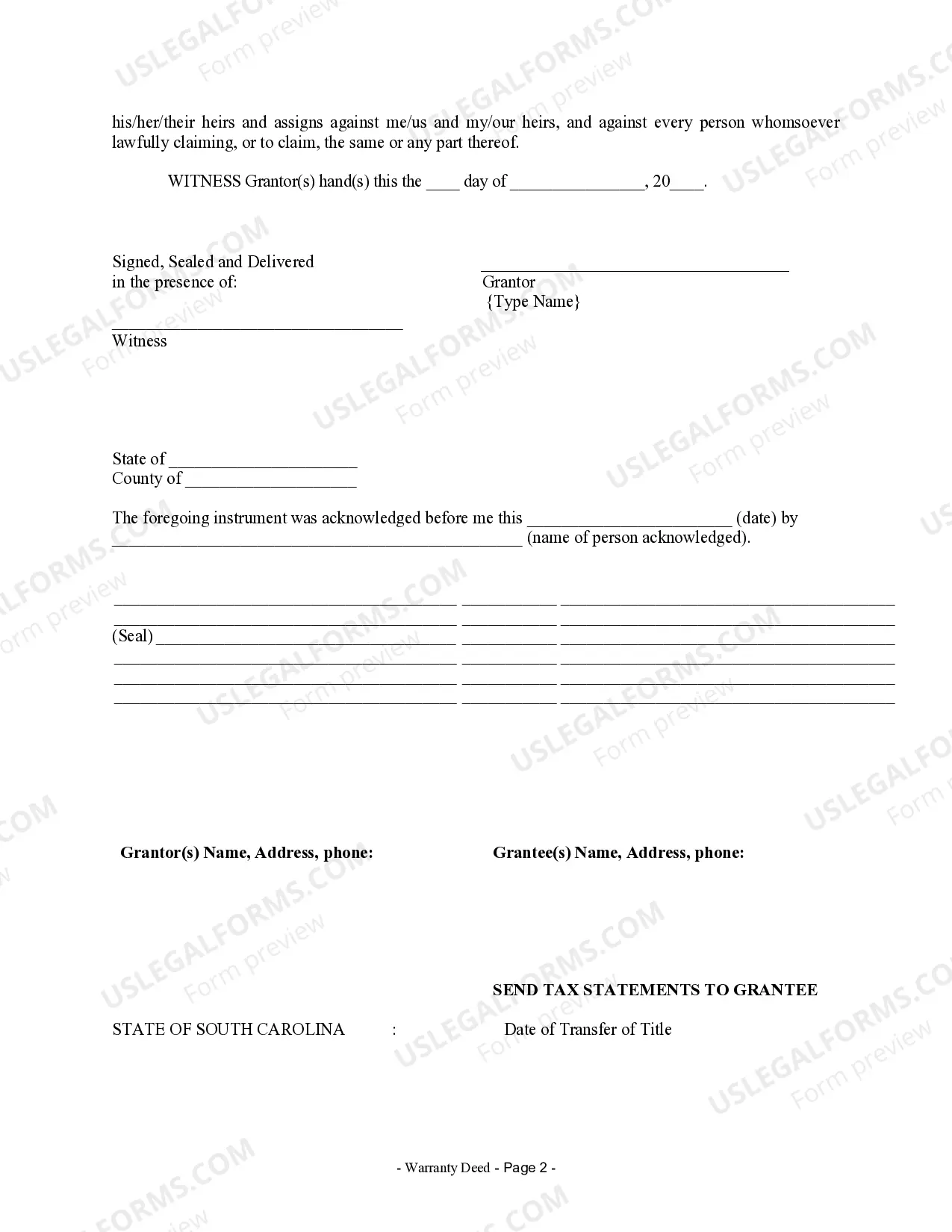

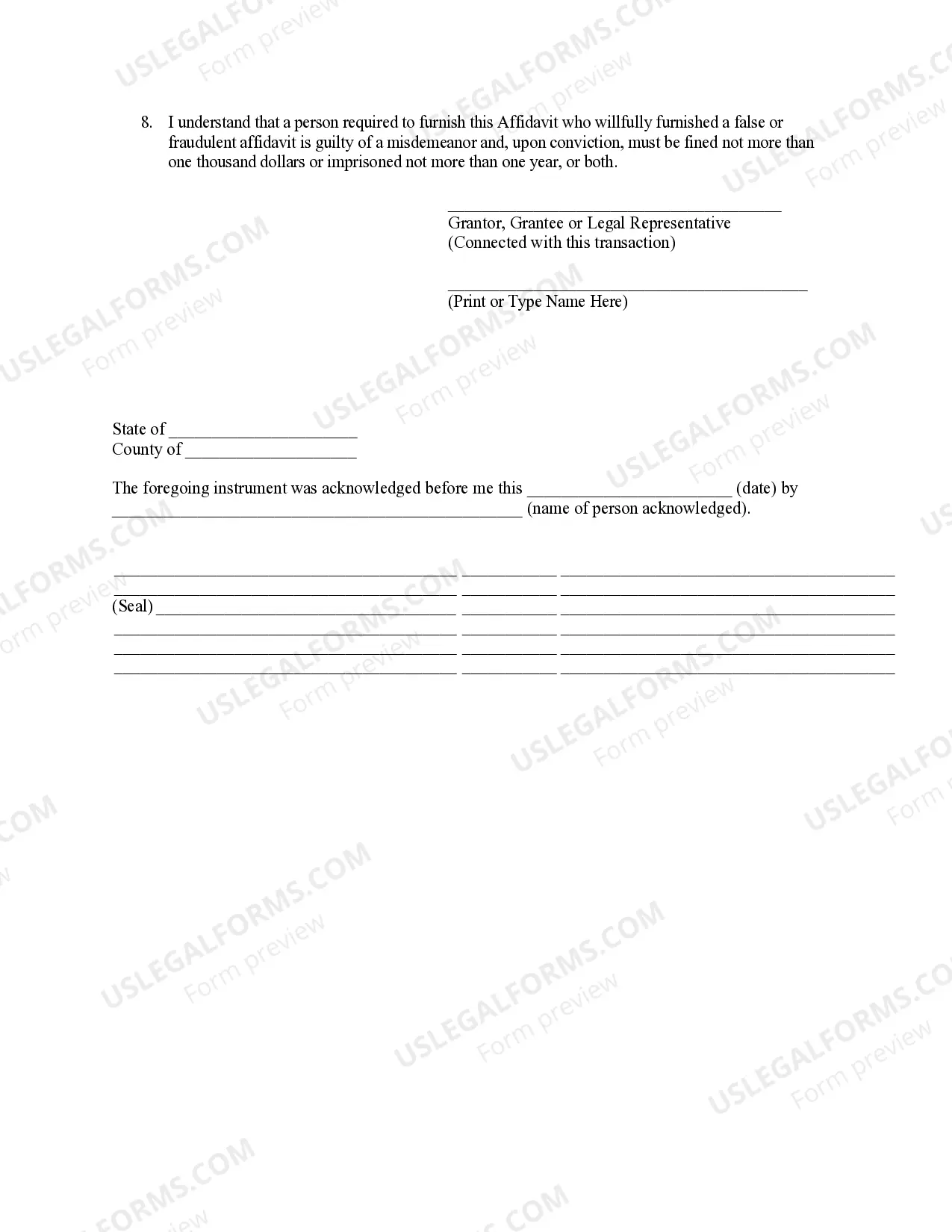

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

It will not protect against title issues that arose prior to the time the seller took occupancy. Consequently, it offers less protection to buyers, and more protection to sellers, than a general warranty deed, which is the most common option for selling or buying a property.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.