Louisiana Heirship Withholding Tax

Description

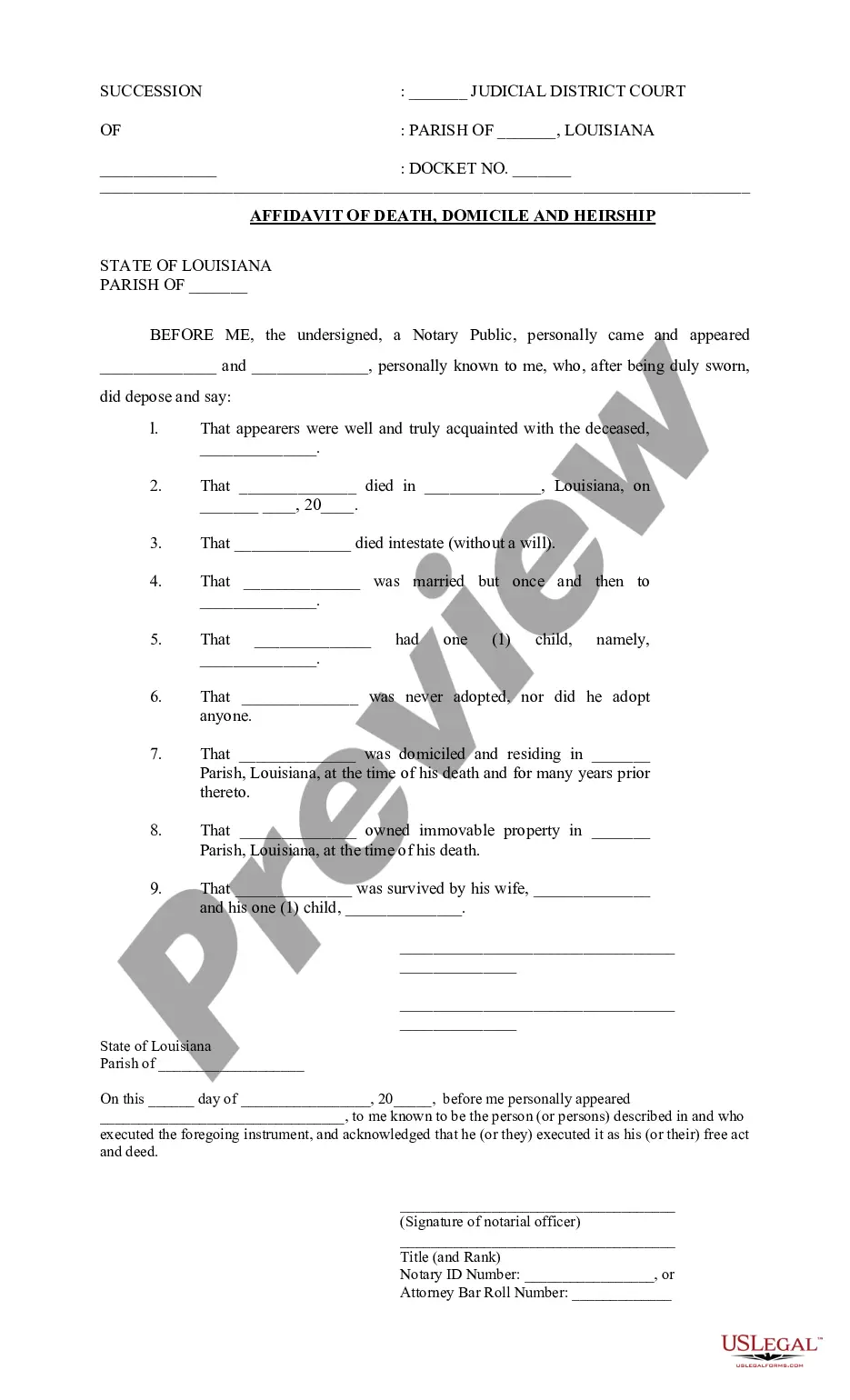

How to fill out Louisiana Affidavit Of Death, Domicile And Heirship Or Descent?

It's well-known that you cannot instantly become a legal authority, nor can you quickly learn how to draft Louisiana Heirship Withholding Tax without a specialized background.

Drafting legal documents is a lengthy process that demands specific education and expertise. So why not entrust the creation of the Louisiana Heirship Withholding Tax to the experts.

With US Legal Forms, which boasts one of the largest libraries of legal templates, you can find everything from court paperwork to templates for internal business communication.

If you require any other template, you can restart your search.

Create a free account and select a subscription plan to buy the document. Click Buy now. Once the transaction is completed, you can obtain the Louisiana Heirship Withholding Tax, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

- We recognize the significance of compliance and adherence to federal and local regulations.

- That's why, on our platform, all templates are specific to your location and current.

- To get started, visit our website and obtain the document you need in just a few minutes.

- Use the search bar at the top of the page to find the document you require.

- Preview it (if this feature is available) and read the accompanying description to see if Louisiana Heirship Withholding Tax is what you seek.

Form popularity

FAQ

Louisiana Department of Revenue. Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary.

Louisiana does not have an inheritance tax. Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $12,5001.85%Over $12,500 but not over $50,000$231.25 plus 3.50% of excess over $12,500Over $50,000$1,543.75 plus 4.25% of excess over $50,000

An inheritance tax is another type of death tax and is paid by the beneficiary, not the estate. It's charged at the state level and is assessed by the state a person resides at the time of their death. Currently, just six states levy an inheritance tax.

New hires and existing employees making changes to their withholdings must submit both the Form W-4 and the Form DE 4. If a new employee does not submit state DE 4, the employer must withhold state income tax as if the employee were single and claiming zero withholding allowances.