Tenant Ti

Description

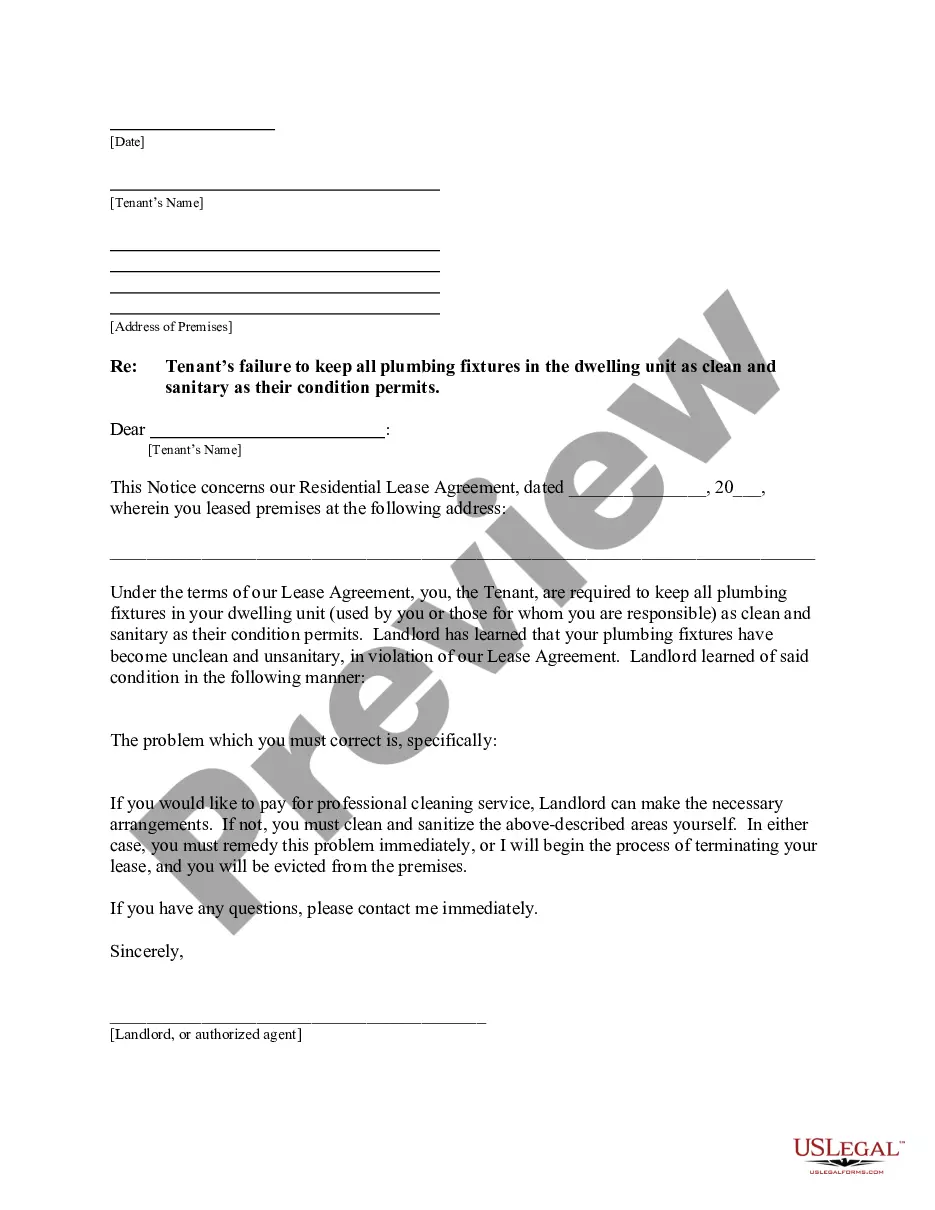

How to fill out Louisiana Letter From Landlord To Tenant For Failure To Keep All Plumbing Fixtures In The Dwelling Unit As Clean As Their Condition Permits - Remedy Or Lease Terminates?

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active; if not, consider renewing it before proceeding.

- For new users, start by previewing the form descriptions. Make sure to select the correct tenant ti form that aligns with your local jurisdiction.

- If adjustments are needed, utilize the Search function to find another suitable template.

- Purchase the document by clicking on the Buy Now option and select your desired subscription plan. You'll need to create an account for full access.

- Complete your transaction by entering your payment details, either through credit card or PayPal, to finalize your subscription.

- After payment, download the form directly to your device. You can also access this document later in the My Forms section of your account.

In conclusion, US Legal Forms not only simplifies the process of acquiring tenant ti documents but also ensures you have access to expert guidance if required. With a user-friendly experience and a vast array of forms, you can confidently fulfill your legal needs.

Start your journey with US Legal Forms today to effortlessly obtain and manage your legal documents.

Form popularity

FAQ

To account for the TI allowance, first, clearly define the total amount available for improvements in your lease agreement. Track all expenses related to the renovations and ensure they align with what’s specified in the TI allowance. Regularly review your budget to manage expenditures and make adjustments if necessary. Utilizing the US Legal Forms platform can streamline this process, helping you create formal agreements and maintain organization.

TI stands for Tenant Improvement, referring to the modifications made to rental space to meet the needs of the tenant. These improvements can include anything from painting walls to constructing new spaces. Understanding TI helps you negotiate lease terms more effectively, as it clarifies who is responsible for these enhancements. Be sure to discuss TI allowances with your landlord, as this can influence your rental decision.

To secure a tenant quickly, start by marketing your rental property effectively. Use online platforms and social media to reach a broader audience. Consider offering incentives, such as reduced rent or a flexible lease term, which may attract prospective renters faster. Additionally, ensure your property is in good condition and priced competitively to draw interest.

Creating a quit notice for a tenant should involve specifying the reason for the notice and the required action. Clearly outline the timeline for rectifying the issue, citing your tenant ti rights as needed. This notice establishes a formal record of your communication. Utilizing uslegalforms can help you format this notice correctly and ensure compliance.

Writing a letter to quit a rental property requires a straightforward approach. Clearly state your desire to end the lease, include your address, and specify your last day in the property. Referencing your tenant ti details can clarify any obligations you need to meet before leaving. Make sure to send this letter according to the notice period outlined in your lease.

Recording a tenant improvement allowance involves documenting the agreement and all related expenditures. Retain all invoices and agreements as proof of the improvements made. Proper record-keeping is essential for tax reporting and for future references. If you're uncertain, using the uslegalforms platform can provide templates and guidance.

When crafting a notice to vacate as a tenant, clearly state your intention to leave the property. Include your name, address, and the date you plan to vacate. Make sure to reference any terms from your lease agreement regarding notice periods. This will help ensure you fulfill your obligations while also addressing your tenant ti responsibilities.

To report your tenant improvement allowance, start by collecting all relevant documentation. This includes lease agreements and invoices related to the improvements made. You may need to report this on your tax return as income, depending on how the tenant ti is structured. Consulting with a tax professional can help you navigate the specifics.

TI refers to Tenant Improvements, while LC stands for Letter of Credit. Together, these concepts are vital in commercial leasing agreements. Tenant TI ensures the space meets the tenant's needs, while a Letter of Credit provides security for the landlord, fostering a solid relationship between both parties.

TI in a lease denotes the improvements made to a commercial space that a tenant requires to operate effectively. These can range from simple cosmetic updates to extensive renovations and are often outlined in the lease agreement. Understanding Tenant TI is essential to ensure both parties are satisfied and clear about their expectations.