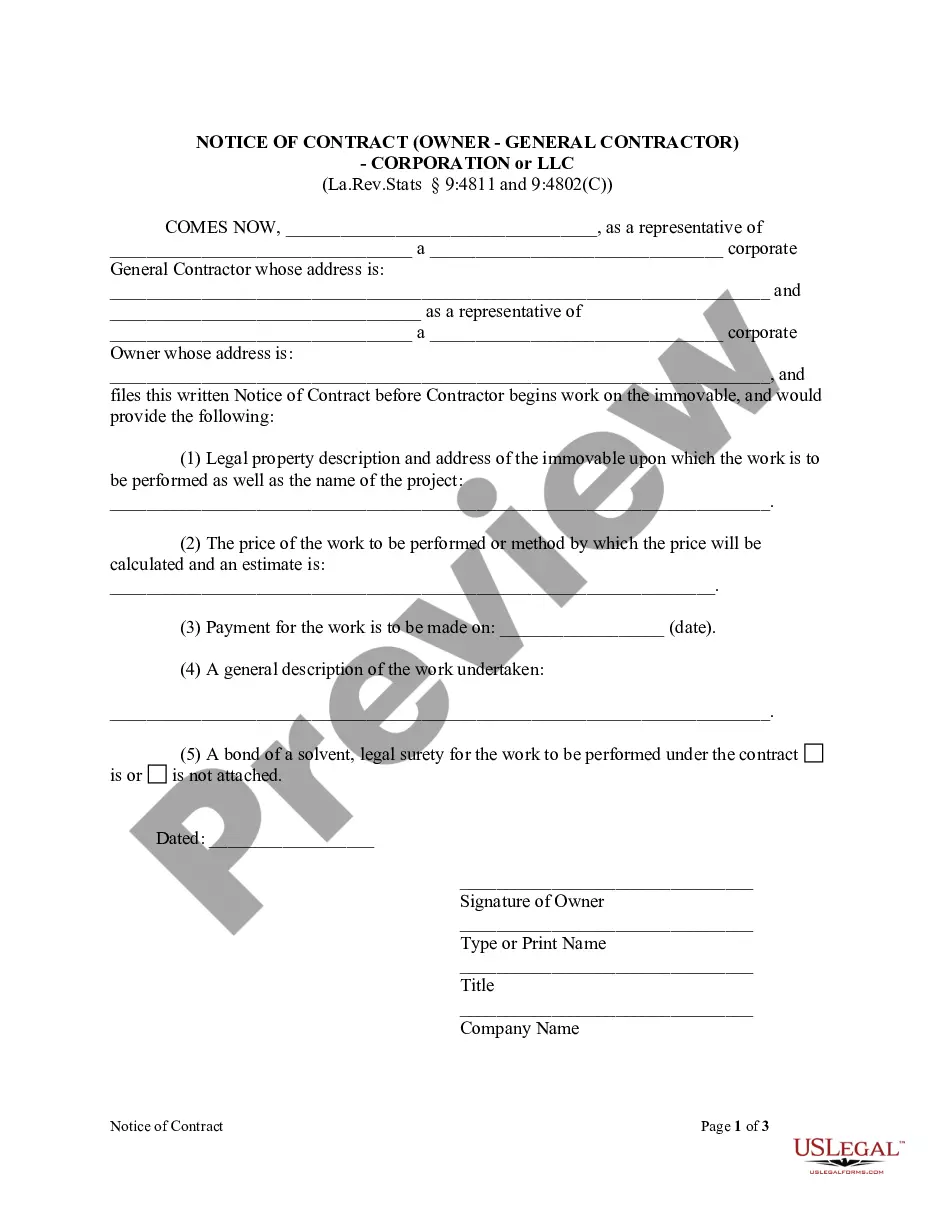

This Notice of Contract form is for use by a corporate or LLC contractor and owner to provide notice of a contract before the contractor begins work on the immovable, and includes the legal property description of the immovable upon which the work is to be performed and the name of the project, the price of the work to be performed or method by which the price will be calculated and an estimate, the date payment for the work is to be made, a general description of the work undertaken and whether a bond of a solvent, legal surety for the work to be performed under the contract is attached.

Louisiana Filing Requirements For Llc

Description

Form popularity

FAQ

The fastest way to get an LLC in Louisiana is to complete your filing online through the state’s Secretary of State website. This method typically provides quicker processing times compared to submitting paper forms. Be sure to follow all Louisiana filing requirements for LLC to ensure your application is successful. Additionally, services like US Legal Forms can assist you in preparing your documentation accurately, helping you save time.

The time it takes to form an LLC in Louisiana can vary, but generally, you can expect to receive your approval within a few business days when you file online. However, if you choose to submit by mail, processing may take longer. It's essential to ensure you meet all Louisiana filing requirements for LLC to avoid delays. Using a platform like US Legal Forms can help streamline the process and keep you informed about the necessary steps.

Yes, an LLC in Louisiana generally must file a tax return, depending on its tax classification. Single-member LLCs often file as sole proprietorships, while multi-member LLCs usually file as partnerships. Understanding the Louisiana filing requirements for LLC, including tax responsibilities, is crucial for effective financial management. Utilizing platforms like USLegalForms can simplify this process and help you stay compliant with state regulations.

In Louisiana, you must file an annual report to keep your LLC active. This filing is part of the Louisiana filing requirements for LLC to maintain good standing. It's vital to complete this renewal process by the specified deadline each year to avoid penalties. Staying on top of these requirements ensures your LLC remains compliant and operational.

Getting your LLC in Louisiana can take about 1 to 3 weeks from submission to receipt of your approval. This timeframe includes the processing of your application by the Secretary of State. To ensure a smoother experience, consider using US Legal Forms, which can provide clarity on Louisiana filing requirements for LLC and help you minimize delays.

In Louisiana, the approval process for an LLC typically takes about 7 to 14 business days. However, this timeframe can vary based on factors such as the current workload of the Secretary of State's office. To expedite the process, consider submitting your application online through platforms like US Legal Forms, which can streamline your submission and help you meet Louisiana filing requirements for LLC quickly.

To start an LLC in Louisiana, you will need a unique business name, a registered agent, and completed Articles of Organization. Additionally, drafting an operating agreement is a smart move. Following these steps will set you on the right path and ensure you adhere to Louisiana filing requirements for LLC.

Yes, LLCs in Louisiana are required to file an annual report. This report typically includes basic information about your LLC and helps keep your business in good standing. Meeting this obligation is part of the Louisiana filing requirements for LLC.

In most cases, you will need an EIN for your LLC in Louisiana if you hire employees or if you choose to be taxed as a corporation. Even if you are a single-member LLC, obtaining an EIN may simplify your tax filings and interactions with banking institutions. This aligns with the Louisiana filing requirements for LLC.

Filing taxes for an LLC in Louisiana can vary based on how your business is taxed, either as a sole proprietorship or corporation. Usually, LLCs report their income on their personal tax returns. However, understanding your tax obligations is vital to comply with Louisiana filing requirements for LLC.