Llc Company In Oman

Description

Form popularity

FAQ

Registering an LLC company in Oman involves several steps. First, you need to draft your company’s Memorandum of Association and appoint a local service agent if required. Once you complete these documents, you can submit them to the relevant authorities along with any necessary permits, such as from Oman’s Special Economic Zones. US Legal Forms can guide you through the registration process, ensuring that your LLC company in Oman meets all legal requirements efficiently.

The primary difference between an SPC and an LLC in Oman lies in their structure and purpose. An SPC focuses on specific projects, often requiring lower capital and regulatory obligations. In contrast, an LLC typically demands a higher capital requirement and offers a wider operational scope. When deciding between the two, consider your business goals and how each serves your venture, particularly if you’re planning to establish an LLC company in Oman.

An SPC is not an LLC, although both offer limited liability features. The SPC is generally a more flexible structure tailored for specific projects, while an LLC is a broader business entity allowing for varied operations. Investors may choose between these structures based on their business goals and risks involved. Understanding these differences helps you make informed decisions for your LLC company in Oman.

Yes, it is possible to convert an SPC to an LLC in Oman. This process involves fulfilling specific legal requirements and ensuring all obligations of both company structures are met. Transitioning to an LLC can offer added benefits, such as increased liability protection and a broader scope for business activities. If you need assistance with the conversion, uslegalforms can provide the guidance necessary for a smooth transition.

An SPC, or Special Purpose Company, in Oman serves as a limited liability entity focused on specific investment projects. This structure promotes flexibility, making it easier to manage investments without the full regulatory burden of a traditional LLC. Many entrepreneurs choose SPCs for expedited processes and fewer compliance requirements. However, if you're considering an LLC company in Oman, SPCs can also serve as a preliminary step for your business endeavors.

The minimum capital requirement for an LLC company in Oman is generally 20,000 Omani Rials. This amount is necessary for registration and helps ensure the company’s financial stability. It's important to note that this capital must be deposited in a local bank before incorporating the LLC. Meeting this requirement positions your LLC company in Oman for long-term success.

The full form of LLC is Limited Liability Company. This structure provides essential legal protection for its shareholders, ensuring their personal assets are separate from business liabilities. In Oman, forming an LLC company in Oman is an excellent choice for entrepreneurs seeking to mitigate risks while enjoying the benefits of a collective business venture.

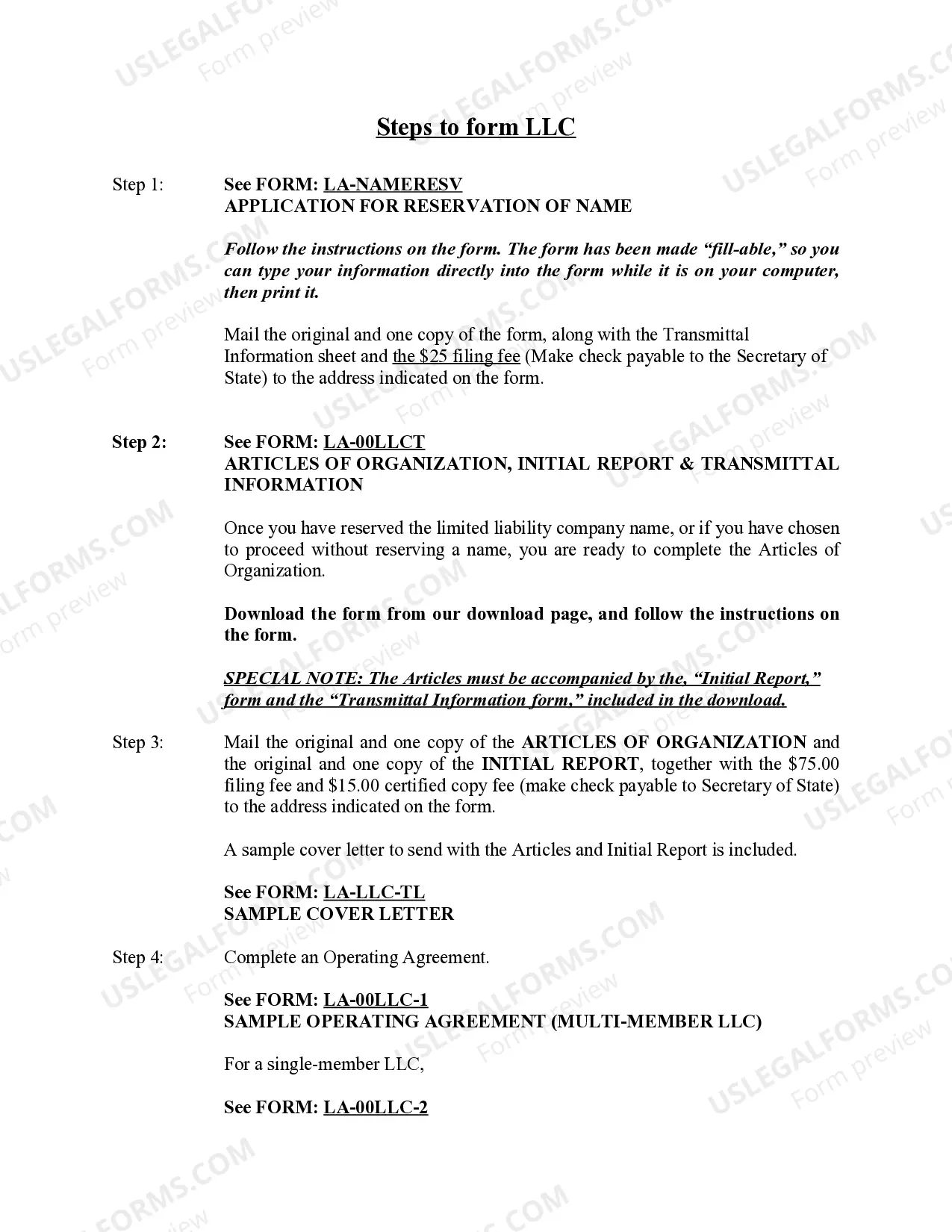

Opening an LLC company in Oman involves several steps, starting with choosing a unique company name and securing a local sponsor if needed. You must also prepare the necessary documents and submit them to the Ministry of Commerce, along with your capital requirement. Once your approvals are in place, you can proceed with obtaining a commercial registration and a business license, paving the way for your company's successful operation.

To establish an LLC company in Oman, the minimum capital requirement is OMR 20,000. This is crucial for ensuring that your business can sustain its operations and obligations. Higher capital can provide more leverage in financial decision-making and attract investors. Therefore, assess your financial capability before setting up your LLC.

An LLC company in Oman allows for multiple shareholders, making it ideal for collaborative businesses, while an SPC, or sole proprietorship company, is owned by a single individual. The LLC offers limited liability protection, shielding personal assets from business debts, unlike the SPC. Choosing between the two depends on your business goals, so consider your needs carefully before deciding.