Limited Liability Company For Dummies

Description

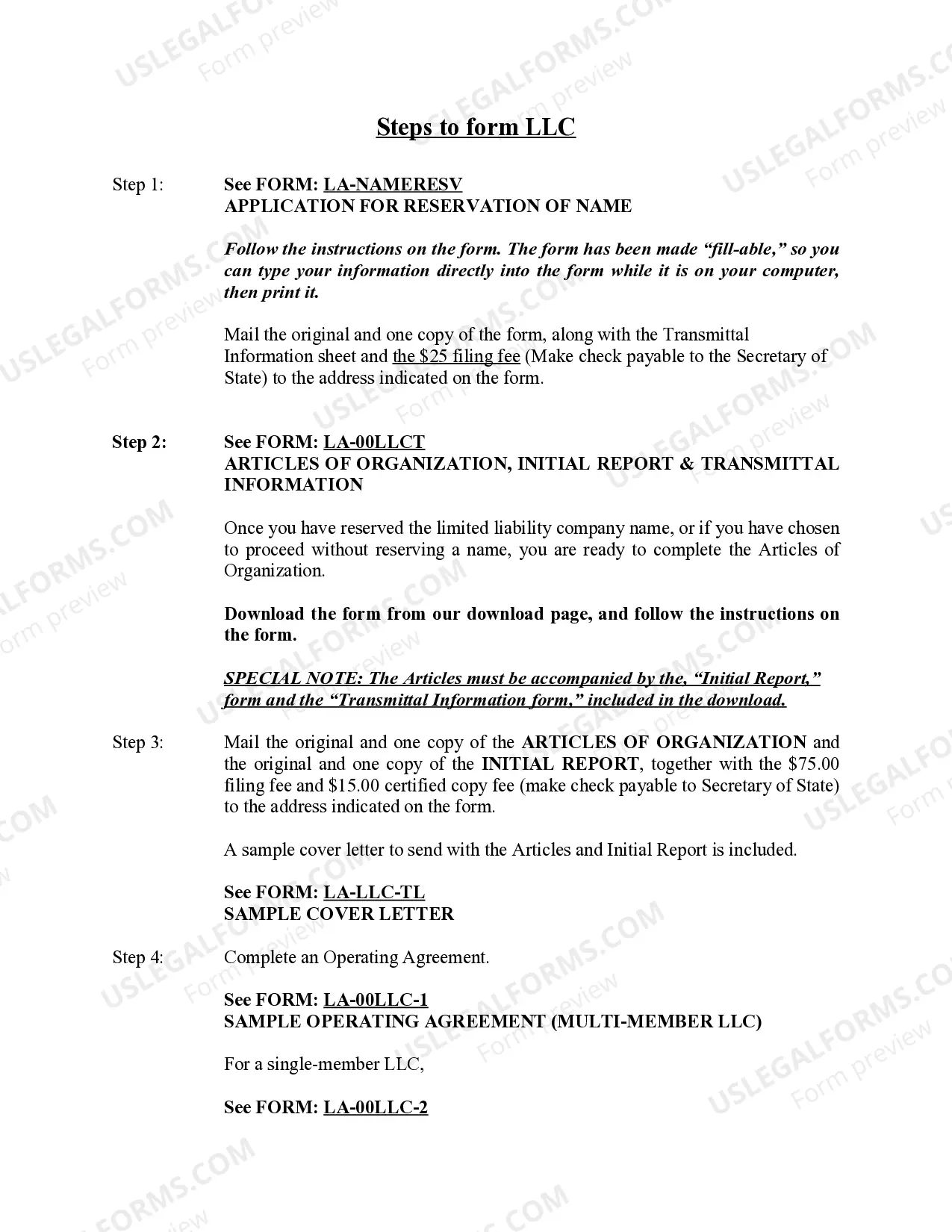

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- Log in to your US Legal Forms account if you've used our service before and download the necessary form template by clicking the Download button. Ensure your subscription is current; if not, renew it according to your payment plan.

- If you are new to our platform, start by reviewing the Preview mode and form description to select the correct template that meets your jurisdiction's requirements.

- Should you need a different template, utilize the Search tab to find the right one that fits your needs.

- Purchase the document by clicking the Buy Now button, choosing your preferred subscription plan, and registering for an account for full access.

- Complete your purchase by entering your credit card information or using PayPal to pay for your subscription.

- Download your selected form and save it to your device. You can access it anytime from the My Forms menu in your profile.

By leveraging the extensive resources provided by US Legal Forms, you can ensure that your LLC formation process is both smooth and efficient.

Don't hesitate—start forming your LLC today with US Legal Forms and make the most of our legal expertise!

Form popularity

FAQ

The primary point of having an LLC is to shield your personal assets from business liabilities. This structure also offers tax flexibility and can enhance your business’s credibility. For anyone trying to understand how to create a limited liability company for dummies, it can provide peace of mind while operating a business.

LLC stands for limited liability company, and it describes a legal entity that combines elements of a corporation and a partnership. In simple terms, it provides a flexible business structure while protecting personal assets from business debts. This means you can run your venture with less worry about losing personal property.

To write your LLC correctly, always use the abbreviation 'LLC' after your business name. Ensure to follow your state’s regulations about naming and registration. If you need assistance, you can find step-by-step guides and sample formats on US Legal Forms to make this process even smoother.

Writing an LLC example begins with creating a fictitious company name and providing its purpose. For instance, 'ABC Consulting LLC' might describe a company that offers business advice. It can help to look at templates and examples available on resources like US Legal Forms to see how to format your own.

Filling out an LLC involves completing the necessary forms required by your state. You typically need to provide basic information like your business name, address, and the names of the members. Platforms like US Legal Forms can guide you through this process and ensure you have the right documents ready.

A limited liability company, or LLC, is a type of business structure that protects its owners from personal liability. This means that if the business faces debts or legal issues, your personal assets are usually safe. For dummies, think of it as a safety net that lets you run a business while keeping your personal life separate.

The best way to file taxes as a limited liability company for dummies is to keep organized records of all income and expenses throughout the year. Then, determine your tax classification to decide on the correct form for filing. Utilizing services like US Legal Forms can further aid in navigating the required forms and deadlines for your specific situation.

Generally, if you are the sole owner of a limited liability company, you will file your LLC and personal taxes together using a specific form, like Schedule C. This approach simplifies your tax reporting. However, if your LLC has multiple members, separate tax returns might be necessary; thus, it's wise to check your state requirements or seek help from US Legal Forms.

LLCs can be taxed as partnerships, corporations, or sole proprietorships, depending on the structure chosen by the owners. This flexibility allows members to select the tax arrangement that best suits their needs. An essential step in understanding taxes for a limited liability company for dummies is to consult the IRS guidelines and perhaps use services like US Legal Forms for detailed explanations.

Yes, you can file your limited liability company by yourself, but it requires careful attention to state rules and requirements. This process can be time-consuming and may lead to mistakes without proper guidance. For a straightforward approach, consider using services like US Legal Forms that streamline the filing process and help you avoid potential pitfalls.